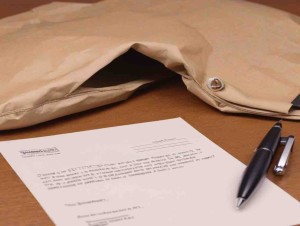

US senators Elizabeth Warren, Chris Van Hollen, and Catherine Cortez Masto have accused Binance, one of the world’s largest cryptocurrency exchanges, of facilitating illegal activity. In a letter addressed to Binance CEO Changpeng Zhao, the senators alleged that the exchange has allowed criminals to move and launder illicit funds through its platform.

The letter comes amid growing concerns about the role of cryptocurrency exchanges in facilitating money laundering and other illegal activities. The crypto service provider has faced scrutiny from regulators in several countries, including the United States, and has been forced to shut down operations in some jurisdictions.

Allegations of Facilitating Illegal Activity

In the letter, the senators accused Binance of “lax regulatory and legal standards” and allowing “bad actors to conduct transactions on its platform.” The senators cited several examples of criminal activity that they claim were facilitated by Binance, including the recent hack of a major cryptocurrency exchange and the use of Binance by a known terrorist group.

The senators also questioned Binance’s compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, stating that “Binance has not taken sufficient steps to verify its users’ identities and prevent money laundering on its platform.”

Response from Binance

Binance has responded to the allegations, stating that it takes compliance with AML and KYC regulations “very seriously” and has “invested heavily” in building a robust compliance program. The exchange also stated that it works closely with law enforcement agencies around the world to prevent and detect criminal activity on its platform.

The crypto platform has faced regulatory action in several countries, including the United States, where it has been forced to shut down operations in some states due to a lack of regulatory compliance. The exchange has also faced criticism from industry experts for its lack of transparency and failure to disclose key information about its operations.

Scrutiny of Cryptocurrency Exchanges

The allegations against Binance come amid growing scrutiny of cryptocurrency exchanges by regulators and law enforcement agencies around the world. In recent years, exchanges have faced increasing pressure to improve their compliance with AML and KYC regulations and prevent the use of cryptocurrencies for illegal activities.

The US Financial Crimes Enforcement Network (FinCEN) has proposed new regulations that would require exchanges to collect more information about their users and report certain transactions to law enforcement agencies. The proposed regulations have faced criticism from industry groups, who argue that they could harm the development of the crypto industry.

Binance’s Future in the US

The allegations against Binance could have significant implications for the exchange’s future in the United States. The exchange has already been forced to shut down operations in some states, and the recent allegations could lead to further regulatory action.

The exchange has stated that it is committed to compliance with US regulations and has taken steps to improve its compliance program. However, the exchange’s history of regulatory issues and lack of transparency could make it difficult for Binance to gain a foothold in the US market.

Conclusion

The allegations against Binance by US senators highlight the challenges facing cryptocurrency exchanges in the current regulatory environment. While the crypto exchange has stated that it takes compliance with AML and KYC regulations seriously, the exchange’s history of regulatory issues and lack of transparency could make it difficult for it to operate in the United States and other jurisdictions. As regulators continue to tighten their oversight of the crypto industry, exchanges will need to take steps to improve their compliance programs and prevent the use of cryptocurrencies for illegal activities.