The stock and cryptocurrency markets have both been a nightmare for investors so far in 2022. The Federal Reserve System of the United States of America is getting ready to convene a meeting of its Federal Open Market Committee (FOMC) on November 1st and 2nd, where officials will deliberate on whether or not to hike the benchmark interest rate for the month of November.

The market expects a rate hike of 0.75 percent (75 basis points). According to the FedWatch Tool from CME Group, the likelihood of a rate hike of less than 0.75% is 19%.

Expert gives opinion on what FOMC meeting might mean for the market

As is customary, there has been a great deal of discussion among cryptocurrency industry professionals about the potential impact that the impending FOMC meeting will have on the cryptocurrency market.

The well-known cryptocurrency expert TedTalksMacro posted a thread on Twitter describing what he believes the potential outcome may be.

1/ FOMC this week (Wednesday 18:00 UTC)

— tedtalksmacro (@tedtalksmacro) October 30, 2022

There’s lots of talk about a ‘pivot’ or that ‘the Fed are breaking things and need to stop hiking.’

But, the data says otherwise and points to nothing other than hawkishness again this week.

I’ll explain 👇 pic.twitter.com/lYpCUXKPr1

There’s lots of talk about a ‘pivot’ or that ‘the Fed is breaking things and need to stop hiking.’ But, the data says otherwise and points to nothing other than hawkishness again this week. I’ll explain.

TedTalksMacro

The expert began his explanation by stating that since the last meeting of the Federal Reserve in September, Core Inflation has continued to run hot, and the job market has remained robust.

When we look at the pattern in the statistics, inflation continues to be persistent, and employment levels continue to be high, as TedTalksMacro pointed out. In spite of a spate of positive news on inflation and the employment sector, the cryptocurrency market has become more risk-tolerant.

The market expert believes that this is because speculators at the lows factored in or overestimated the degree to which bearishness would prevail owing to the Fed’s announced terminal rate.

I think the important point here is that the market is very prepared for a hawkish Fed.

TedTalksMacro

Lastly, he said that the market would go down if there is more hawkish sentiment or higher terminal rates, but he doesn’t think that will happen anytime soon.

In his opinion, the Federal Open Market Committee meeting is positioned favorably for bulls for the first time in a very long time. The analyst anticipates hawkishness, but other than that, he doesn’t foresee anything new.

How the crypto market is doing right now?

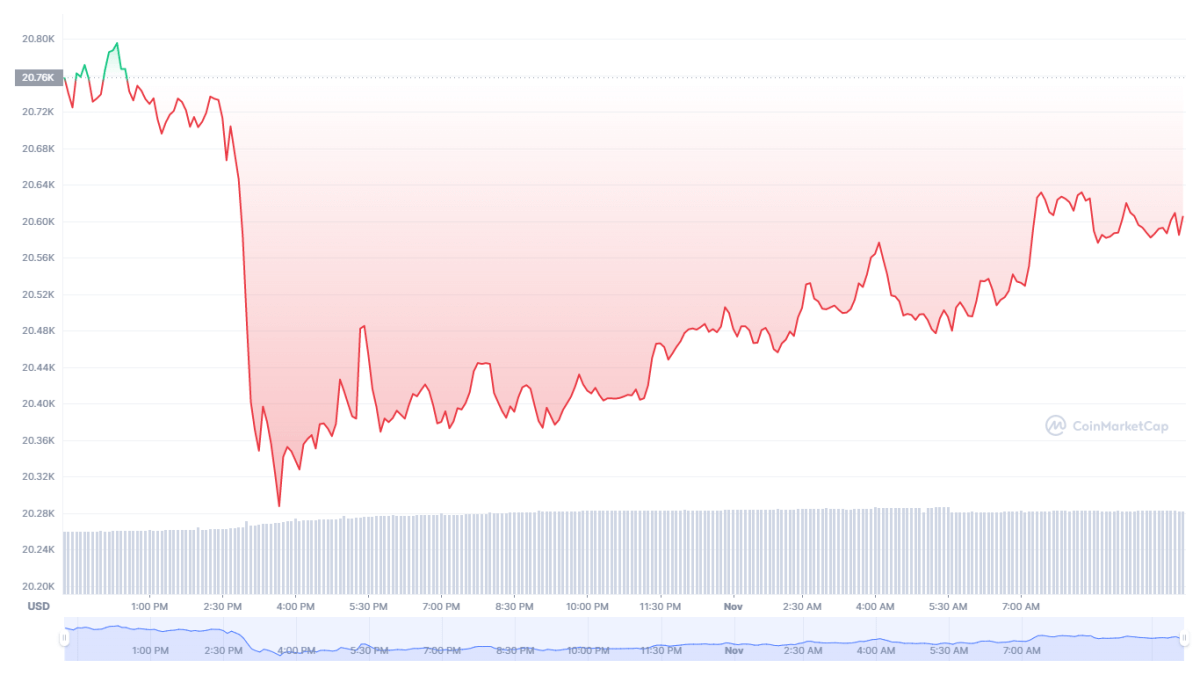

Bitcoin (BTC), the most popular cryptocurrency in the world, started the most important week of the year, which was filled with important domestic and global economic events, still trading at over $20,000. As of the time, this article was written, one bitcoin is now worth $20,414, representing a weekly increase of 7%.

Additionally, Ethereum (ETH) started the week in the green, as the token continued to trade at a price that was higher than $1,600. The current price is somewhat below the mark at $1598 and has increased by 19% over the course of the last week.

At the time of this writing, the value of the crypto market as a whole was slightly more than one trillion dollars. In spite of the fact that there is a diversity of views on Bitcoin’s ability to weather the storm, the market has been caught off guard as recent liquidations have set records for the year 2022.

In the same way that the FOMC meetings have resulted in quick price responses from the cryptocurrency market, the CPI date (which is coming up on November 10th) has also had this effect. In the past, we saw that a deviation from the projected percentages by as little as 0.2 percentage points might result in a move of $1,000 for BTC.