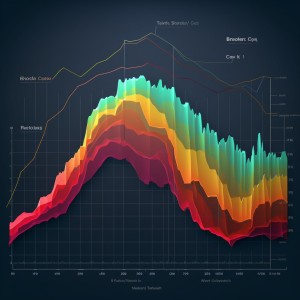

The Solana blockchain has witnessed an unprecedented surge in stablecoin transfer volume, exceeding $300 billion in January alone, according to data from the blockchain analytics platform.

This remarkable milestone not only eclipses the previous month’s total of $297 billion but also represents a staggering 2,520% increase compared to January 2023, when the transfer volume stood at $11.56 billion.

Solana’s remarkable ascent in the stablecoin arena

Solana’s rapid ascent in the stablecoin space is underscored by its growing market share, which currently stands at almost 32%, marking a substantial increase from the 1.2% share it held just a year ago.

The blockchain’s journey toward prominence began in October when stablecoin activity on Solana started gaining traction, leading to a remarkable 650% increase in transfer volume.

While Ethereum maintains its position as the industry leader with $317 billion in stablecoin transfer volume for January, representing a market share of more than 33%, Solana is rapidly closing the gap. Tron holds the third position with a notable $240 billion in stablecoin transfers this month.

Driving factors behind Solana’s surge

A prominent player in blockchain analytics noted that the growth in weekly stablecoin volumes across all networks recently reached a yearly high. This surge is attributed, in large part, to the increasing USDC (USD Coin) transfer volumes on the Solana blockchain.

Paxos announced the launch of its regulated stablecoin, USDP, on the Solana blockchain, further fueling the blockchain’s rise in the stablecoin ecosystem.

Over the past year, the combined transfer volume of stablecoins across all blockchains has exceeded an astounding $1.18 trillion.

This significant increase underscores the growing popularity and adoption of stablecoins as a reliable and efficient means of transferring value within the cryptocurrency ecosystem.

Decentralized Finance (DeFi) flourishing on Solana

In addition to the surge in stablecoin transfers, Solana has witnessed a notable uptick in decentralized finance (DeFi) activity. This surge in DeFi participation has driven the total value locked (TVL) on the Solana blockchain to its highest level since September 2022, with TVL reaching $1.36 billion, according to DeFiLlama.

This demonstrates the blockchain’s growing role as a hub for DeFi applications and projects.

Solana’s price performance

While Solana’s blockchain has been experiencing substantial growth in stablecoin transfers and DeFi activity, its native cryptocurrency, SOL, has faced price fluctuations. As of the latest data available, SOL is trading at $93, having experienced a 2% decline over the past weekend.

This price level represents a 25% retracement from its December 2023 peak of $123 and a 64% decrease from its all-time high of $260 in November 2021.