The Solana price analysis is negative, given that the price of SOL/USD is now falling. The price levels have dropped to the $23 zone; the SOL price was seeing a continuous slide as of February 6, 2023. Yesterday, bulls attempted to stage a comeback, but today bears have reclaimed the initiative, and the downturn has once again resumed. In the ensuing hours, it is also anticipated that price levels would continue to drop.

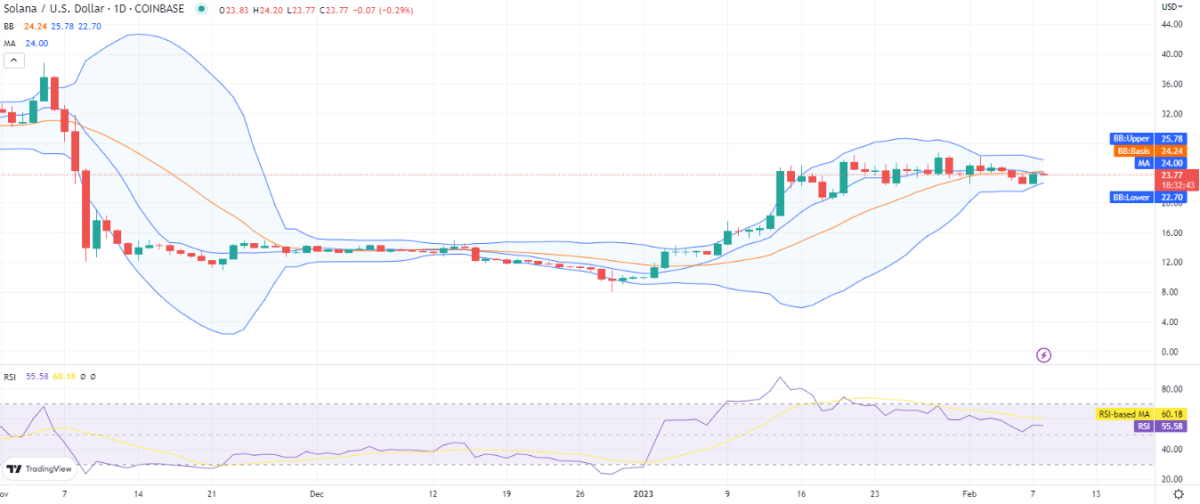

SOL/USD 1-day price chart: Selling pressure forms again

After only one day of bullish activity, the cryptocurrency is once again following the decline, according to the 1-day Solana price analysis. The value of the coin has started to tumble once more; it is now at $23.77 after losing 0.64 percent of its value in the previous hour. The cryptocurrency exhibits a 0.82 percent loss over the past seven days as the trend has been bearish for the past week. On the other side, over the past 24 hours, the trade volume has surged by 56%.

The lower limit of the volatility indicator is showing more upward convergence and has reached the $22.70 level, which is still below the price level indicating support for SOL’s price function. As the Bollinger bands get smaller, volatility is decreasing, which is a promising sign for the future of cryptocurrency. The Bollinger bands’ upper limit, at $25.78, indicates resistance for the coin’s price. The Bollinger bands collectively signify minimal volatility.

The moving average (MA), which is somewhat above the present price level, is at $24. Since the beginning of the consolidation, the relative strength index (RSI) has been trading in the upper half of the neutral range and has reached index 55, the curve of the indicator is downwards which indicates the bearish nature.

Solana price analysis: Recent developments and further technical indications

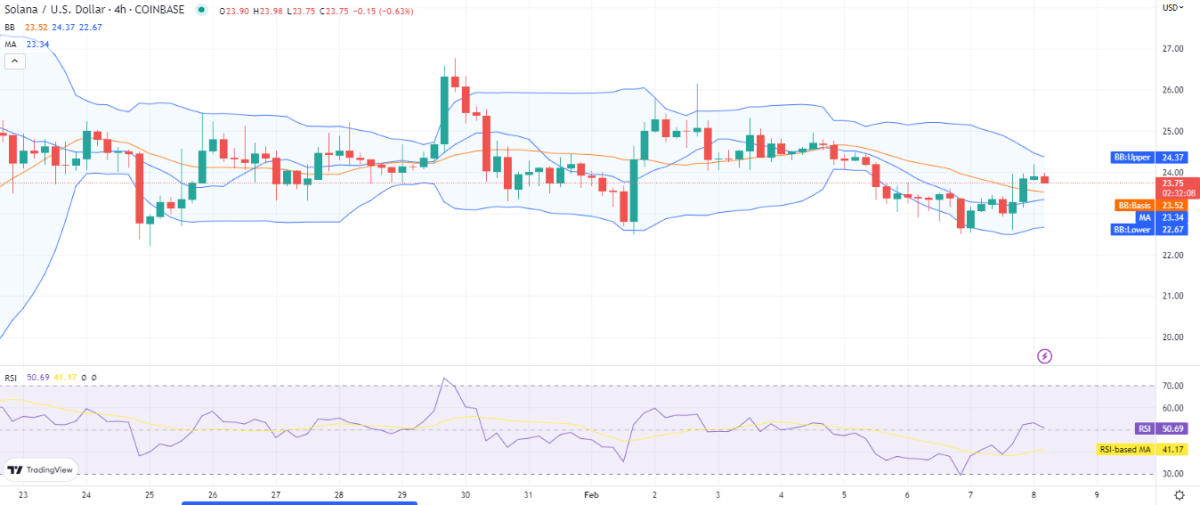

According to the 4-hour Solana price analysis, the price value has continued to drop because of the bearish momentum. The trend remained bearish for today following the final bullish action noted at the beginning of the current trading session, but bears were able to make a comeback over the past four hours, bringing the price down to $23.75.

Given that the moving average (MA) is also at a lower level in comparison to the present price, which is $23.34, the negative momentum appears to be accelerating in the hours to come. The upper Bollinger band is at $24.37, while the lower Bollinger band is at $22.67, according to the 4-hours price chart’s Bollinger band values. Following the return of the negative trend today on the 4-hour chart, the RSI has dropped to index 50.

Solana price analysis conclusion

According to the Solana price analysis, the bearish pressure persisted for the last week, causing the price to drop to its most recent level of $23.75. On February 6, it was anticipated that the consolidation would end with a break lower, but bulls made significant headway yesterday, keeping the consolidation from ending. Today, selling pressure has returned, but it is unlikely that the consolidation will yet see a break higher or lower.