TL;DR Breakdown

- Polkadot price analysis shows bearish signs as price declined 6 percent over 24 hours

- Current trend approaches the $15.66 demand zone where buyers may come in

- Trading volume up 4 percent with market capitalisation falling 6 percent

Polkadot price analysis is bearish today, as price receded more than 6 percent to reach as low as $17. After consolidating up to the $19 resistance on February 28, it was expected that DOT will set a new monthly high above $20 before profit taking action overtaking the market. However, price has been in steady downtrend since then and after today’s stark decline it lowers further towards the $15.66 demand zone where buyers are expected to come in and push price back towards the $19 resistance. Over the past 24 hours, trading volume fell more than 4 percent whereas market capitalisation rose 6 percent, exhibiting further bearish signs for the token.

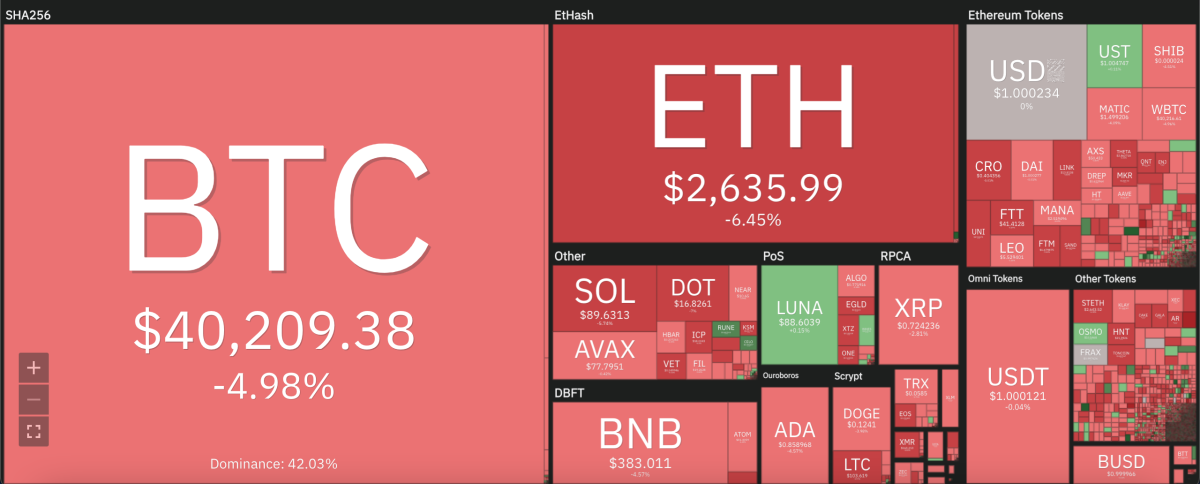

The larger cryptocurrency market faced further declines, as Bitcoin fell down to around $40,500 with a 5 percent drop. Ethereum receded 6 percent down to reach $2,600, while Altcoins also remained in the red zone. Ripple dropped 3 percent to sit at $0.72, Cardano 4 percent at $0.86, and Dogecoin 4 percent at $0.12. Solana declined 6 percent to move down to $90.07, whereas the only positive movement across the market was seen with Terra that rose up by 1 percent to reach $88.48.

Polkadot price analysis: 24-hour chart indicates further decline for DOT

The 24-hour candlestick chart for Polkadot price analysis justifies the bearish pattern and indicates the trend to continue further. Price shipped as low as $16.24 before buyers came in late in the day to push price upwards. However, the decline has put DOT near the support region at $15.66 which is also the demand zone where buyers may be expected to enter the market. Price fell below the 50-day exponential moving average (EMA) at $17.54 during the day.

Since December, DOT price has consistently failed to breach its respective 50-day simple moving average (SMA). The most recent rally failed to test the SMA at $17.87 on March 1 and the current retracement will potentially push DOT into the demand region. Market valuation shown by the relative strength index (RSI) provides an encouraging sight at 39.63 as the graph shows slight stagnancy instead of decline. The moving average convergence divergence (MACD) shows a bullish crossover above its neutral zone, also presenting an encouraging indicator as DOT moves towards buyer interest.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.