- Overbought technical indicators are signaling a U-turn for the current Bitcoin trend

- Bitcoin price is close to the all-time high of $19,531 due to the broader crypto market rally

- Psychological $20,000 level is fast approaching on the hourly charts

Bitcoin trend in no mood to back down – Technical indicators signal a correction

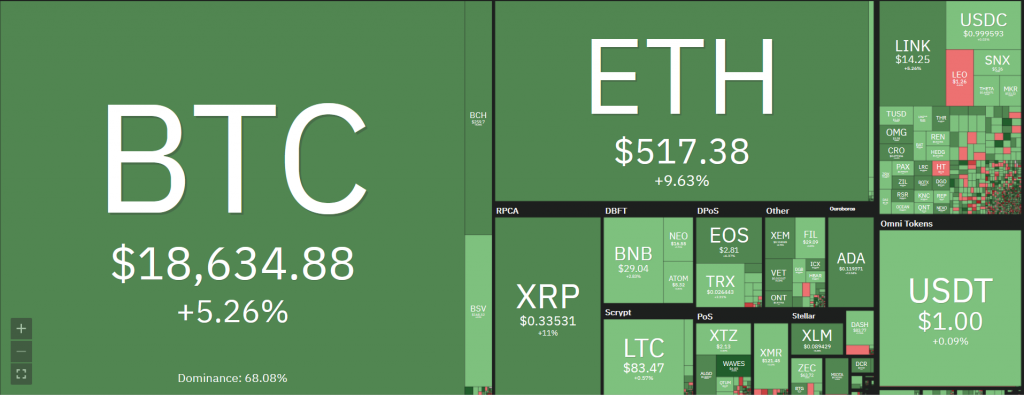

Bitcoin trend is consolidating above $18,000 as supports move higher underneath the pair. After posting a fresh 2020 high of $18,824, BTC/USD is all set to close above the $18K mark in a bid to show the underlying bullish resolve. With a new annual high printed every day, the pair will soon cross its all-time high of $20,000 and chart its journey onwards.

Altcoins are following suit as both Ethereum and Ripple are close to their annual highs. BTC whales back the current Bitcoin trend besides institutional investors, and large financial companies, all of whom have developed a new found love for the cryptocurrency. Bitcointreasuries says that companies own 4.54 percent of the present BTC supply. That is a huge step forward in helping BTC reach mainstream finance.

As more financial firms tone down their anti-crypto stand, a higher influx of money into the crypto realm will further bolster the Bitcoin tther. No wonder BTC/USD is riding on a long-term bull wave that will see prices cross $20K soon.

BTC/USD 4-hour chart – Still challenging the upper limits

There is no stopping the current Bitcoin trend, refusing to come down from the upper end of the price channel. Bitcoin price has retreated from the $18,800 mark now trades near the upper Bollinger Band at the $18,680 level. Despite the minor correction, the price is still printing green candles on the hourly charts.

Buy wall built by whales well fortify the $17,200 support. If the price corrects towards $17K support, it will turn into a buying opportunity to arrest any further downfall. Any correction that cracks $17,000 can see the price slide towards $14,000 support. On the other end, bulls will face resistance near $19,531, which also happens to be the all-time high for the cryptocurrency. Of course, the next mountain is the psychological $20,000 price level, which beckons bulls since 2017.

A blow-off top’s chances are highly likely, considering the current Bitcoin trend is built upon massive volumes and liquidity. Whales and institutional investors will be looking to push BTC/USD past the $20,000 level using vertical rallies and waterfall retracement pattern.

Bitcoin price movement in the last 24 hours – Overbought yet resilient

In extended bull rallies, the price is known to defy technical indicators and remain perched at elevated levels. The relative strength index (RSI) is currently highly overbought on the hourly charts, and MACD is also signaling a correction. Therefore, a pullback may occur anytime.

However, the Bitcoin trend has not followed set technical protocols in recent weeks. Its ability to stay near the top with minimal to nil correction has surprised investors and traders alike. Traders should not assume a top until suitable price corrections take down multiple support underneath. Trailing stops must be used judiciously to avoid burning cash.

Bitcoin price deserves a much higher pedestal based on macro data and fundamentals

Mike McGlone of Bloomberg Intelligence says that Bitcoin price can touch $1,70,000 by 2022. He makes such a stark Bitcoin price prediction based on fundamental factors and macro data at hand. Bitcoin’s volatility vis-à-vis gold has been receding amid a growing global appetite for risky assets. The decline in BTC’s volatility shows its safe-haven credentials and a precursor to significantly higher prices.

#Bitcoin Exchange Whale Ratio has a history of topping here.

— Cole Garner (@ColeGarnersTake) November 19, 2020

Still, it's likely there's one more blow off leg left in the tank.

On-chain data courtesy of @cryptoquant_com pic.twitter.com/UtHgbzj2pF

Alex Saunders of Nugget News also believes that the BTC price is set to touch $1,00,000 in the coming five years. Additionally, if BTC achieves a global currency tag, the price can zoom further to reach $1 million in the next 15 years. All these lofty predictions come courtesy of a relentlessly bullish Bitcoin trend that refuses to back down.

Despite the over-exuberance and recent parabolic rise of BTC in the last few weeks, markets are poised to correct after lofty bull runs. Every mature asset undergoes periods of correction before starting the next bull rally. Thus, traders should remain cautious and avoid taking excessive long positions when markets are overheated.

What is the upper ceiling for Bitcoin?

The current Bitcoin trend is certainly overstretched by all means. However, there is still steam left in the current rally. If BTC/USD goes past $20,000, the rally can extend further towards $25,000 in the next few weeks. A ceiling becomes irrelevant in such a scenario as BTC will be in a whole new territory.

There is little evidence in terms of historical data to suggest that BTC/USD blow-off top is near the $20,000 level. The buying euphoria is high. But the rising popularity graph of BTC is still bringing new investors every day. Any negative news on the geopolitical front can prove a catalyst for Bitcoin to touch fresh all-time highs. There is no end to retail investor purchase once the price crosses $20,000 since ‘Fear-Of-Missing-Out’ can play on a whole new level.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.