Crypto investors using Gemini Earn are now much closer to reclaiming their finances with the newly announced agreement between US-based crypto exchange Gemini, Genesis Global Capital LLC (Genesis), and Digital Currency Group.

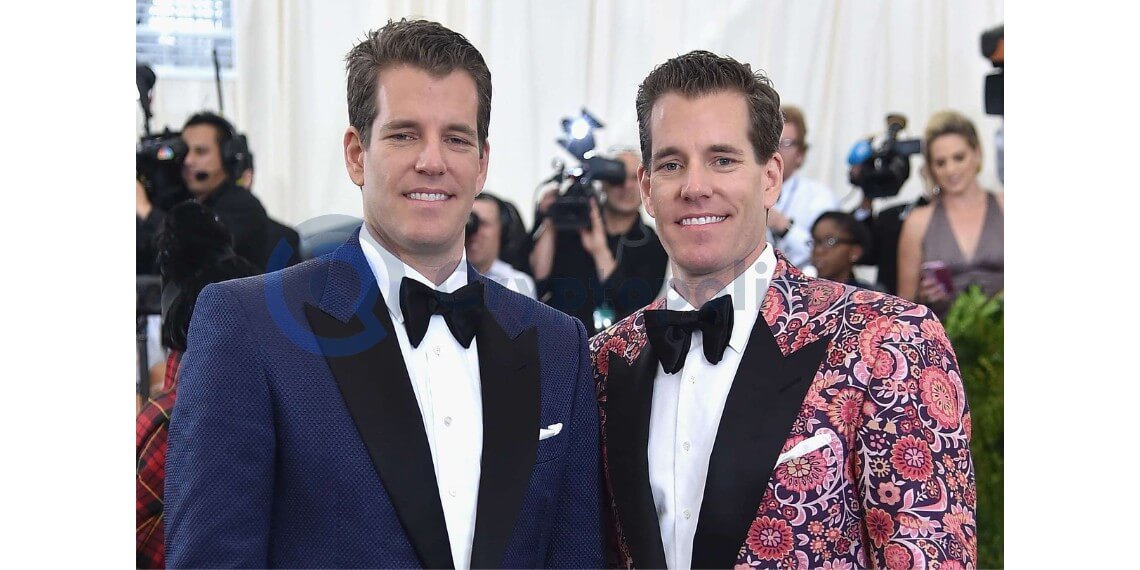

The co-founder of Gemini, Cameron Winklevoss, declared on Twitter that there was an agreement in principle between Gemini and Genesis Global Capital LLC, DCGco, as well as other creditors, to provide a solution for Earn users to recover their assets. He also tweeted about the announcement made in Bankruptcy Court today. To ensure the recovery of its user’s funds, Gemini will contribute up to $100 million, which includes selling off some parts from Genesis Global Trading.

Additionally, DCG will be exchanging its current $1.1 billion note that is due in 2032 for convertible preferred stock and refinancing the existing 2023 term loans into two tranches with approximately $500 million to be given out as payments to creditors.

In November 2022, a heated public dispute erupted between Gemini and Genesis when the latter abruptly halted user withdrawals. Gemini had provided $900 million as a loan to now-bankrupt Genesis Global in exchange for their participation in the Gemini Earn program, which granted users yields of up to 8% interest on cryptocurrency deposits. After withdrawal suspensions were enforced, tensions boiled over, and Winklevoss threatened legal action against both Barry Silbert’s Digital Currency Group (DCG) and its primary partner company, demanding they put forth plans for reimbursing their loan.

On January 19, the crypto brokerage firm tragically filed for Chapter 11 bankruptcy—joining a bevy of other companies that have failed since spring 2022. Gemini cited Three Arrow Capital and FTX’s collapse as catalysts to their filing. The United States Federal regulators then opened an investigation into the Gemini Earn program, with accusations from the Securities Exchange Commission regarding violations of securities laws.

The Winklevoss twins emphasized that today’s agreement is a step toward recovering assets for all Genesis creditors.

3/ In addition, Gemini will be contributing up to $100 million more for Earn users as part of the plan, further demonstrating Gemini’s continued commitment to helping Earn users achieve a full recovery.

— Cameron Winklevoss (@cameron) February 6, 2023

Expressing his appreciation for the Genesis team’s commitment to client service, Interim CEO Derar Islim expressed his heartfelt gratitude to all of their customers for being continuously loyal and understanding throughout this challenging period. Winklevoss further stated that there is still much work ahead, but a system has been established to help them move forward.