Dogecoin Price Prediction 2024-2033

- Dogecoin Price Prediction 2024 – up to $0.2314

- Dogecoin Price Prediction 2027 – up to $0.6708

- Dogecoin Price Prediction 2030 – up to $2.0460

- Dogecoin Price Prediction 2033- up to $4.407

Dogecoin used to be the best-performing in crypto market within the top 10 and the 3rd best-performing within the 100 behind FTM and LINK. Our Dogecoin Price Prediction 2024-2033 is shaping up beautifully, and that’s something to be grateful for. We need more of these price spikes, not just for DOGE!

How much is DOGE worth?

Today, Dogecoin is priced at $0.1536, with a 24-hour trading volume of $57.19 billion and a market capitalization of $21.91 billion, holding a market dominance of 0.93%. Over the past 24 hours, DOGE has seen a 1.70% increase in price. Sentiment analysis suggests a bearish outlook for Dogecoin’s price prediction, despite the Fear & Greed Index indicating a level of 66 (Greed). With a circulating supply of 143.95 billion DOGE, the current yearly supply inflation rate stands at 3.60%, resulting in the creation of 5.00 billion DOGE in the past year. In terms of market cap ranking, Dogecoin holds the #2 position in the Proof-of-Work Coins sector, #1 in the Meme Coins sector, and #7 in the Layer 1 sector.

Dogecoin price analysis: DOGE shows incredible bullish resilience at $0.1536

- Dogecoin price analysis shows a bullish trend today

- Support for DOGE/USD is present at $0.1440

- Resistance for DOGE is present at $0.2192

On April 19, 2024, the price analysis of Dogecoin indicates a notable trend in the meme cryptocurrency’s performance over the past 48 hours. Initially, there was an upward trajectory, with the price climbing from $0.1391 to $0.1544 on April 18, 2023. However, today, the cryptocurrency has experienced a significant decline in value. Presently, Dogecoin stands at $0.0782 at the time of this writing, continuing its bearish movement. Despite this recent downturn, Dogecoin has exhibited resilience and strong performance throughout the day. The cryptocurrency’s trajectory suggests potential for further growth, contingent upon the continued bullish sentiment in the market. The fluctuating nature of the cryptocurrency market underscores the importance of closely monitoring trends and market dynamics to make informed decisions regarding investment strategies.

Dogecoin price analysis reflects a noteworthy pattern in the meme cryptocurrency’s behavior over the preceding 48 hours. Initially, there was an upward trend, marked by Dogecoin’s ascent from $0.1391 to $0.1544 on April 18, 2023. However, today, the cryptocurrency has undergone a substantial decrease in value, currently resting at $0.0782, indicating a continuation of its bearish trajectory. Despite this recent downturn, Dogecoin price prediction has demonstrated resilience and maintained a robust performance throughout the day. This suggests the potential for further expansion, provided that the prevailing bullish sentiment in the market persists. The ever-changing landscape of the cryptocurrency market emphasizes the necessity of closely monitoring trends and market dynamics to formulate well-informed decisions concerning investment strategies.

DOGE/USD 1-day price chart: DOGE increases rapidly

The analysis of Dogecoin’s price indicates a market trend leaning towards positivity, characterized by increased volatility that initiates a widening movement in market fluctuations. This heightened volatility suggests a greater likelihood of significant price shifts towards either extreme. Within this context, the upper limit of the cryptocurrency’s Bollinger Bands is identified at $0.2192, serving as the resistance level for DOGE. Conversely, the lower price boundary of Dogecoin’s Bollinger Bands rests at $0.1378, representing a 2.5% variance and functioning as the support level for DOGE. This delineation underscores the dynamic nature of Dogecoin’s pricing dynamics, emphasizing the importance of closely monitoring these indicators to gauge potential market movements effectively.

The DOGE/USD pair shows a notable crossing below the Moving Average curve, signaling a bearish trajectory. However, there are indications of upward movement towards the resistance band, suggesting a potential reversal of the prevailing trend. With volatility nearing closure, there’s a possibility that this development favors the bulls. A breakout from this consolidation phase could trigger increased volatility, creating more opportunities for bullish activity to unfold. This scenario highlights the importance of closely monitoring market dynamics and key technical indicators to navigate potential shifts in momentum effectively.

The examination of Dogecoin’s price unveils a Relative Strength Index (RSI) reading of 43, reflecting a state of high stability for DOGE and placing it within the dormant region. However, there is notable movement in the RSI score, trending upward, signifying a burgeoning market with prevalent buying activities. This uptick in RSI not only suggests an increase in market activity but also hints at the dominance of buying sentiment. Such indicators point towards the potential emergence of an upward trend in the Dogecoin market, highlighting opportunities for further growth and positive price movements.

Dogecoin price analysis on a 1-hour price chart: Recent Updates

The analysis of Dogecoin’s price demonstrates an upward trajectory in the market, accompanied by a rise in volatility. Moreover, there are indications of an opening movement occurring, suggesting the likelihood of future volatility surges. This heightened volatility increases the susceptibility of DOGE’s price to significant fluctuations in either direction. At present, the upper boundary of the Bollinger Bands is identified at $0.1561, representing a robust resistance level for DOGE. Conversely, the lower boundary of the Bollinger Bands is observed at $0.1440, serving as a strong support level for DOGE.

Dogecoin is currently exhibiting a bullish trend, as evidenced by the DOGE/USD price crossing above the Moving Average curve. This upward movement signals a growing market sentiment for the meme cryptocurrency. The price is striving to reach the resistance band in the near future. Should they converge, it could result in a breakthrough, leading to a reversal in the market dynamics.

The current Relative Strength Index (RSI) score for Dogecoin stands at 58, implying a stable condition for the meme cryptocurrency. Positioned within the stable region of the RSI chart, DOGE demonstrates a steady linear movement. The uptick in the RSI score indicates a prevailing trend where buying activities surpass selling activities, steering the market towards a more pronounced bullish stance. This suggests a growing confidence among investors in Dogecoin’s potential for upward movement.

What to expect from Dogecoin price analysis?

To sum up, the price analysis of Dogecoin recently indicates a changing and dynamic market environment. There are encouraging indications of resilience and growth potential notwithstanding oscillations and sporadic pessimistic trends. Technical indicators that offer important insights into market mood and possible price moves are the Moving Average curve, Bollinger Bands, and the Relative Strength Index (RSI). In the always shifting realm of cryptocurrency trading, investors must keep a careful eye on trends and critical indicators in order to make well-informed decisions and take advantage of opportunities as they navigate these swings.

Is Dogecoin a Good Investment?

Based on our price analysis, Dogecoin exhibits both promising signs of resilience and growth potential, alongside periods of volatility and bearish movements. While the market has shown instances of bullish activity and the presence of support levels, there are also significant price declines and fluctuations to consider. Whether Dogecoin represents a good investment depends on individual risk tolerance, investment objectives, and the ability to navigate the inherent volatility of the cryptocurrency market. Investors should conduct thorough research, seek professional advice, and stay informed about market developments before making any investment decisions in Dogecoin or any other cryptocurrency.

Dogecoin Recent News

DOGE surges to two-year high amidst on-chain milestones

Dogecoin being one of the listed major cryptos, has recently faced the pressure of the price fall affected by other major cryptos such as Ethereum and Bitcoin ETFs valuations. The rely of crypto asset trends by most investors has affected the price curve of Dogecoin to hold the price surge as of year 2024. However, for how long this will last is unpresented as the investors are still comprehending the market trend. This comes as a positive sentiment has dogecoin still maintains its resistance level of 0.1514 since March 5th 2024.

It is anticipated that the price of Dogecoin will increase to reach the projected level and break through the 0.2192 resistance level. This is going to be the outcome of the market correction that other major cryptocurrencies are experiencing as they alter the market. Investors are keeping a close eye on the incoming economic data and use ETF inflows as a barometer to see how the market for digital assets is changing. This is a result of price corrections in significant cryptocurrency assets, including Dogecoin.

A remarkable 739% increase in transaction fees at the start of 2024 was indicative of the bull run pattern of 2021. Amidst conflicting on-chain signals, market watchers continue to be on the lookout for any indications of sustainability as the DOGE rally picks up steam. As a result, DOGE’s price has increased dramatically by 25% over the last day to hit a new all-time high of $0.50.

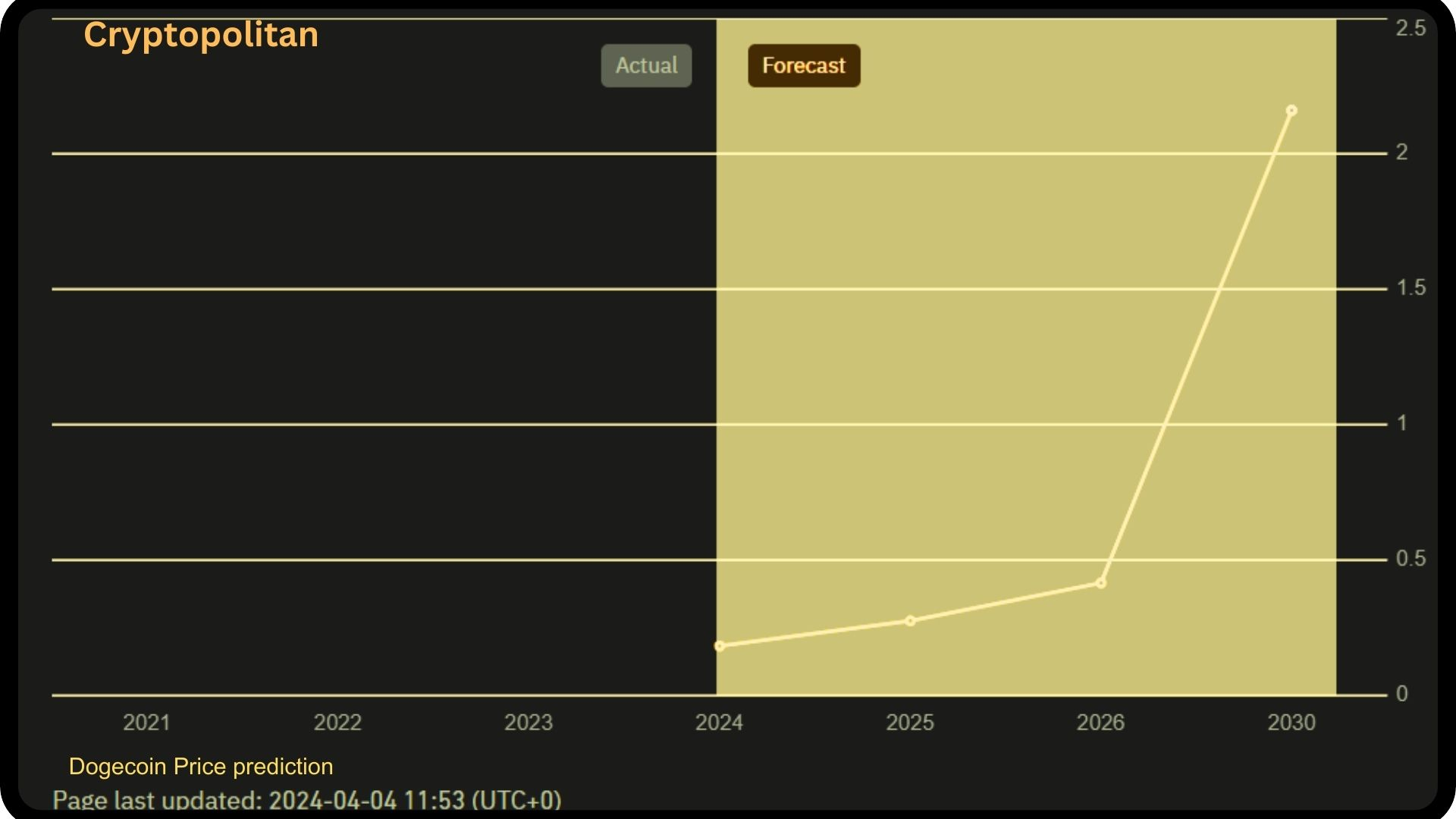

Dogecoin Price Forecast by Cryptopolitan 2024-2033

| Year | Minimum($) | Average($) | Maximum($) |

| 2024 | 0.126 | 0.1412 | 0.2314 |

| 2025 | 0.25 | 0.26 | 0.29 |

| 2026 | 0.38 | 0.39 | 0.44 |

| 2027 | 0.55 | 0.58 | 0.67 |

| 2028 | 0.4851 | 0.4985 | 0.5738 |

| 2029 | 0.73 | 0.75 | 0.85 |

| 2030 | 1.04 | 1.07 | 1.28 |

| 2031 | 1.52 | 1.56 | 1.78 |

| 2032 | 2.14 | 2.20 | 2.56 |

| 2033 | 3.17 | 3.26 | 3.77 |

By following our Dogecoin price forecast in the cryptocurrency market, it will help in making best decisions on when to buy Doge as we provide historical data, current prices and dogecoin forecast following best market trends, news, on-chainmarket analysis. Dogecoin being a meme coin has taken the trends of cryptocurrency market building reliable doge community to leverage the risk associated with cryptocurrency prices.

Dogecoin Price Prediction 2024

Dogecoin may surge in price to a maximum price of $ 0.2314 trading with an average price of $0.1412 by the end of the year 2024. The minimum trading price of the coin is $0.126

Dogecoin Price Prediction 2025

According to our Dogecoin price forecast for 2025, Dogecoin’s price is expected to reach a maximum price of $0.29,trading at an average price of $0.26 with a minimum of $0.25.

Dogecoin Price Prediction 2026

According to our Dogecoin forecast for 2026, Dogecoin’s value will reach a maximum price of $0.44, trading at an average price of $0.39 and with a minimum of $0.38. This show a promising future of Dogecoin

Dogecoin Price Prediction 2027

According to our Dogecoin price prediction for 2027, Dogecoin might be trading at a maximum price of $0.67, average price of $0.58 and a minimum price of $0.55. If Dogecoin continues to pursue interoperability, the network might see an increase in developers and investors, driving prices to the projected levels.

Dogecoin Price Prediction 2028

According to our price prediction for most cryptocurrencies, Dogecoin is expected to trade at an average price of $0.84, minimum price of $0.81 and maximum price of $0.97 by the end of 2028 respectively.

Dogecoin Price Prediction 2029

Our Dogecoin price prediction for 2029 is a maximum price of $0.85. Our analysts project an average price forecast of $0.75 and a minimum price of $0.73 by the end of 2029.

Dogecoin Price Prediction 2030

Based on our Dogecoin price prediction for 2030, Dogecoin will have a maximum market value of $2.04 and a minimum price of $1.67. Investors could also expect an average price of $1.75.

Dogecoin Price Prediction 2031

According to our Dogecoin price prediction for 2031, the value of this cryptocurrency is expected to increase to a maximum of $2.92 by that year. Based on our price analysis, Dogecoin’s expected minimum and average price will be $2.31 and $2.5, respectively.

Dogecoin Price Prediction 2032

According to our Dogecoin price prediction 2032, Dogecoin may reach a maximum of $4.0 and an average price of $3.37. The lowest possible price is predicted to be $3.14.

Dogecoin Price Prediction 2033

Based on our Dogecoin price forecast for 2033 indicates that the coin might reach a maximum trading price of $4.44, a minimum market price of $3.42, and an average price of $3.67.

Dogecoin Price History

2013

2013 is marked as the beginning of Dogecoin price history as that the year was launched in the market. Dogecoin’s growth was slow in the beginning but over the years it has faced drastic changes. The $3.5 million market capitalization was not worth the market’s attention. However, within a few months, it began its upward trajectory and grew exponentially.

The start of Dogecoin’s price was beyond its prediction as it surged from $0 to $0.0004 in the first days of trading. Since then Dogecoin prices expected to surge more as it was a good investment.

2014

The second-year Dogecoin prediction was disappointing as Dogecoin hit new lows and felt the pain of a market-wide downturn. Also, it faced immense competition from new coins, including Stellar, Neo, and Monero.

2015

Jackson Palmer, the co-founder of Dogecoin, quit Doge, which didn’t bode well for the coin. The year saw much negative press about Dogecoin, and many analysts predicted its death.

2018

The year 2018 was bearish for cryptocurrencies, and Doge was no different. The altcoins went down significantly in a few months.

The recovery saw the Dogecoin trade near the $0.017 level, but bullish Dogecoin predictions were short-lived as the price touched a low of $0.002 and remained there for an extended period.

2020

Dogecoin traded in a strict range of $0.002 to $0.005 for most of the year. It gained steam at the end of 2020 when Bitcoin touched new highs.

2021

In January, the Dogecoin price chart saw green candles across the chart as the month ended with the price live at 0.037 USD. In just a few days, the Dogecoin price managed a 692.14% price surge, while in April 2021, Dogecoin rose by 527.6%.

Dogecoin’s price finally fell by 22% in June, and the price declined by more than 18% in July. Recent Dogecoin price predictions show that the coin’s market price has risen after Elon’s tweets.

This Dogecoin (DOGE) price currently is $0.2 as the market value of the coin experiences a surge today. In September, Doge’s price fell by more than 26%, although, recently, we have witnessed that AMC will start to accept Dogecoin for payments.

According to the Dogecoin community, the Dogecoin network is perfect for transactions. Hence, Dogecoin projections for 2021 show that one should expect abrupt Dogecoin market changes in the short term as the price journey and abrupt price changes continue beyond 2021 as Bitcoin’s price rally continues.

Compared to prices at the start of the year, DOGE has gained massive profits in 2021, over 3100% in 2021.

2022

In 2022, Dogecoin began bearishly. During that time, the bulls struggled to sustain a breakout above the $0.20 level. In the current 4-hour chart, the Dogecoin technical analysis shows that the cryptocurrency market trades above the 50-day MA but slightly below the 100-day MA. The coin price broke out of its upper Bollinger band, with resistance at $0.135. Until it breaks the resistance, it may return to the support at $0.126 in the next few days. Doge is still trading in the green zone, and it has been up by 0.61% in the last 24 hours.

2023

In 2023, Dogecoin exhibited significant fluctuations and notable influences. The year began with Dogecoin trading around $0.08, maintaining a steady position in the crypto market as the 10th-ranked cryptocurrency by market capitalization. During the year, Dogecoin experienced a series of ups and downs, reflective of the volatile nature of the crypto market. A key moment occurred when Elon Musk completed a $44 billion deal to acquire Twitter, which led to a nearly 100% surge in Dogecoin’s price. Musk has been a vocal supporter of Dogecoin, often referring to it as the “People’s Coin.”

This surge was also fueled by speculations that Musk might integrate Dogecoin into Twitter’s operations, especially following his announcement about a paid subscription model for Twitter’s blue tick verification. Over the year, Dogecoin saw a 60% rise from its October value of around $0.05, driven by bullish market momentum and investor sentiment. Despite periods of correction and a four-week-long downward trend, Dogecoin’s price remained resilient, bolstered by positive investor sentiment and its growing reputation as a viable asset in the cryptocurrency market.

More on Dogecoin price analysis

Following the introduction of the spot Bitcoin Exchange Traded Fund (ETF), the digital currency market experienced a moderate contraction, and Dogecoin (DOGE) emerged as the front runner in this decline, registering a 1.80% dip to $0.08479 over the last 24 hours. Concerns escalate as the trading volume takes a notable hit, plummeting by 27% to $609,330,772, suggesting potential challenges for Doge price.

Interestingly, the memecoin sector, encompassing Dogecoin and Shiba Inu, exhibits signs of recovery, surpassing previous setbacks. This resurgence is attributed to substantial investor accumulation, as highlighted by on-chain data. It’s essential to note that while Doge price faces challenges, the broader cryptocurrency market landscape continues to evolve, presenting varied opportunities and trends across different assets.

Dogecoin’s 2024 Price Forecast: Navigating Expectations Amidst Market Dynamics

Market Overview

As Bitcoin inches closer to the $70,000 mark, the crypto landscape is rife with optimism, particularly within the altcoin sector. Dogecoin (DOGE), renowned for its meme coin status and a market cap of $11.26 billion, is positioned to capitalize on the broader market recovery. However, recent price dynamics hint at a potential delay in significant upward momentum, raising questions about its viability and future prospects.

Influential factors and speculations

Elon Musk’s influence remains a significant factor in Doge price trajectory. The recent surge in Dogecoin’s price followed Musk’s $44-billion deal to take over Twitter, coupled with his continuous support and advocacy for Dogecoin as the “People’s Coin.” Speculations about Dogecoin’s integration into Twitter’s functionality have fueled investor sentiment and contributed to recent Doge price spikes. This has heavily influenced the current market sentiment of Dogecoin

Influencer verdict and future integration

Influencers within the crypto community express varying opinions on Dogecoin’s future. Some, like Matt Wallace and That Martini Guy, foresee Dogecoin breaking above the $1 mark. Musk’s announcements, including the potential integration of Dogecoin with Twitter, have strengthened these speculations. However, cautious optimism is advised, considering the volatile nature of the cryptocurrency market.

How do you mine Dogecoin?

Dogecoin mining differs from Bitcoin’s Proof-of-Work protocol in several ways, one of which is by using Scrypt technology. The altcoin also has a block time of 1 minute, and the total supply is uncapped, which means there is no limit to the number of Dogecoin that can be mined. You can mine Dogecoin either solo or by joining a mining pool.

With a GPU, a Doge miner can mine the coin on Windows, Mac, or Linux. As of 2014, you can also mine Litecoin in the same process of mining Dogecoin as the processes were merged.

What can Dogecoin be used for?

Dogecoin has been used primarily as a tipping system on Reddit and Twitter to reward creating or sharing quality content. You can get tipped Dogecoin by participating in a community that uses it or get your Dogecoin from a Dogecoin faucet.

A Dogecoin Faucet is a website that will give you a small amount of Dogecoin for free as an introduction to the coin so that you can begin interacting in Dogecoin communities.

How can you buy Dogecoin?

You can buy Dogecoin or sell at any exchange offering, store it on an exchange or in a wallet, and tip it in any community that accepts Dogecoin. Click on our market pairs tab for this cryptocurrency’s latest list of exchanges and trading pairs.

DOGE/USDT on Binance

Two hundred part-time developers and an army of internet admirers support DOGE’s operations. Many look like Ross Nicoll, a fundamental contributor who works for free to keep an ever-expanding system running smoothly. There aren’t enough resources to create proprietary code, which is why so much of its code is copied from other coins. Dogecoin’s tens of thousands of social media followers are a good example: They regularly beg the currency’s developers to limit the supply.

Dogecoin’s price will rise to $10 if investors do more than buy the currency and tweet about it. Improvements may only be made with the support of a generous donor.

Several high-profile backers have already expressed interest in the currency. Elon Musk said sometime back that his SpaceX company would launch a penny to the moon. By forming a “Dogecoin Foundation,” he may have a greater effect on the future of cryptocurrency. So far, he’s blamed the “Dogecoin Whale” for everything. Instead of hounding developers, regular investors might aid by making a financial contribution. There is a potential that Dogecoin might rise to $10 if the community comes together one day.

Conclusion

Dogecoin (DOGE) has surged to a two-year high, exceeding $0.17, driven by a substantial increase in new wallet addresses and a remarkable uptick in on-chain fees. The surge is reminiscent of the 2021 bull run, with transaction fees soaring by an impressive 739% since the start of 2024. Notably, DOGE has surpassed the milestone of 6 million wallet addresses, a significant increase from its previous all-time high in May 2024.

As the bullish momentum continues, technical analyses reveal an oversold condition with an RSI of 36.13 while the upper Bollinger Band at $0.2011 acts as a resistance level, caution is advised for potential corrections or consolidations.

Note that Doge market experience high volatility and traders should closely monitor these key levels and adjust their strategies to navigate potential market fluctuations effectively.