As the novel coronavirus pandemic spreads across the world, the DeFi market dips responding to the impacts of the epidemic on the global economy. The entire amount of Ethereum (ETH) under decentralized finance applications is plummeting as the virus ravages the world.

Per DeFi Pulse, a decentralized finance data aggregator, the total market cap of ETH under such financial tools is now at its lowest point in the year. This indication tips off bearish scenes in both the industry and for Ethereum. A closer focus into the actual cause of the downfall, the recent shortcomings by MakerDAO and the implications caused by COVID-19 stands out above the rest.

Ethereum volume in DeFi market dips to annually low

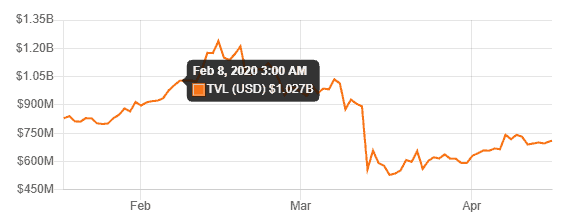

The year 2020 started very brightly for the digital currency industry as well as the decentralized finance market. The total value locked (TVL) across the entirety of all DeFi apps in the sector reached an all-time peak of $ 1.239 billion back on Feb.15. DeFi firms MakerDAO, Synthetix, and Compound, lead the pack.

Nevertheless, during the colossal mid-March “Black-Thursday” price fall, the TVL has dipped by almost 43% to the present level of $712 million. Moreover, the total volume of ETH stored increased, reaching an all-time peak of 3.235 million ETH on Feb.5. Unfortunately, the value of ETH stored on decentralized financial applications has since descended as a result of COVID-19 and the Shortcomings of Maker.

At the peak of Maker’s failings, which resulted in more than $8 million in Ethereum auctioned for zero cash, the Eth locked in DeFi platforms dropped by more than 46% to $558 million within a week. The ravages caused by the widespread coronavirus has seen consumer behavioral changes happen rapidly.

COVID-19 causing the DeFi market dips?

Over the past, about one month, more than 10 million Americans have filled jobless claim applications demonstrating the terrible effects of the virus. Furthermore, the “Great Lockdown” has led to the shut down of many small scale business ventures worldwide, which is the spine of the DeFi ecosystem, and thus, caused the DeFi market dips.

At times of such disasters, cash is the most widely preferred method of payment, which results in many investors liquidating their assets to navigate the tough times. The high liquidity nature of digital currencies across the globe makes it an ideal asset for the majority of investors to liquidate when in need.