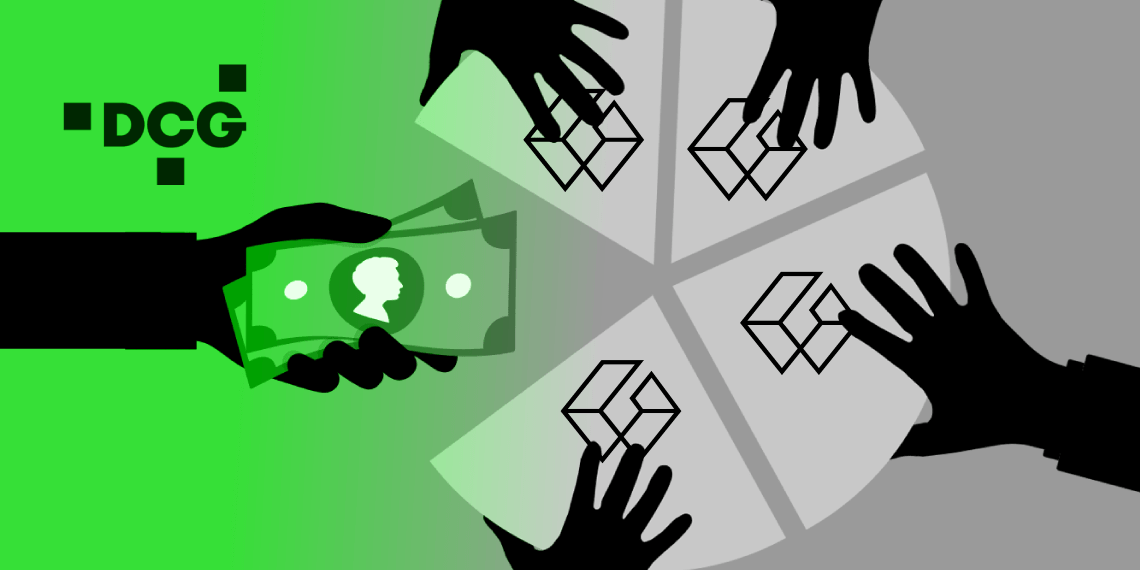

Digital Currency Group (DCG), the SoftBank-backed conglomerate, has started selling shares in its cryptocurrency funds at a discount as it seeks to raise capital to repay creditors of its bankrupt lending arm.

According to a Financial Times report, DCG has offloaded its holdings in several investment vehicles run by its subsidiary Grayscale. The move highlights the financial difficulties DCG is facing as it tries to raise funds to support its collapsed lending units and preserve its most cash-generative business.

DCG is one of the largest and oldest investors in cryptocurrencies and crypto businesses. It is backed by investors such as SoftBank, Singapore’s sovereign wealth fund GIC, and Alphabet’s venture arm CapitalG.

Grayscale, DCG’s asset management business, is a key asset as it earns hundreds of millions of dollars per year in fees for managing large pools of Bitcoin, Ethereum, and other cryptocurrencies in funds that investors can buy shares in from their brokerage accounts.

Why DCG is selling its Grayscale shares

DCG is selling stakes in one of its largest trusts, despite the shares falling to substantial discounts to the underlying value of the cryptocurrency they hold.

This is due to its efforts to raise money after the lending units of its crypto broker, Genesis, collapsed into bankruptcy in January.

The US group has been trying to repay more than $3 billion to its creditors and has been involved in a public dispute with Gemini, owned by the Winklevoss twins, over the debts.

To raise further funds, DCG last month hired Lazard bankers to help sell its trade news site CoinDesk, and it is also seeking to offload some of its $500 million venture portfolios.

The recent share sales by DCG have focused on its Ethereum fund, where the group has sold about a quarter of its stock to raise as much as $22 million since January 24.

The company is selling at about $8 per share, despite each share’s claim to $16 of Ethereum. The Ethereum Trust earns a 2.5% management fee on the 3 million Ethereum in the trust, which equates to $209 million in the year to September 2022.

DCG’s flagship Bitcoin trust holds about 3% of all Bitcoin, worth $14.7 billion, from which Grayscale earns a 2% fee. It earned $303 million from fees on the Bitcoin trust in the first nine months of 2022.

The company has also moved to sell down smaller blocks of shares in its Litecoin Trust, Bitcoin Cash Trust, Ethereum Classic Trust, and Digital Large Cap Fund.

The group does not allow investors to redeem their shares for the coins held in the trusts, which would help close the significant net asset value gaps.

However, closing the discount would mean giving up the management fees, which generate substantial revenue for the company.

Before cryptocurrency was easily tradable through reputable exchanges, the shares in Grayscale’s trusts traded at a large premium to the value of the coins they held. The situation has now changed, and the shares trade at a discount to the value of the coins they represent.