Grayscale Investment admitted last Friday that investors of its cryptocurrency investment products are becoming more inquisitive about the safety of the assets. Not surprisingly, this follows the storms of insolvency ranging over the crypto industry, and more especially, the parent company of Grayscale Digital Currency Group (DCG) and Genesis Trading, the liquidity provider for Grayscale’s Bitcoin Trust.

But while attempting to ride out the storm, Grayscale ended up arousing investors’ curiosity even more, by saying it cannot publicize on-chain addresses to the respective cryptocurrencies that underline its products.

Investors refute taking Grayscale at their word

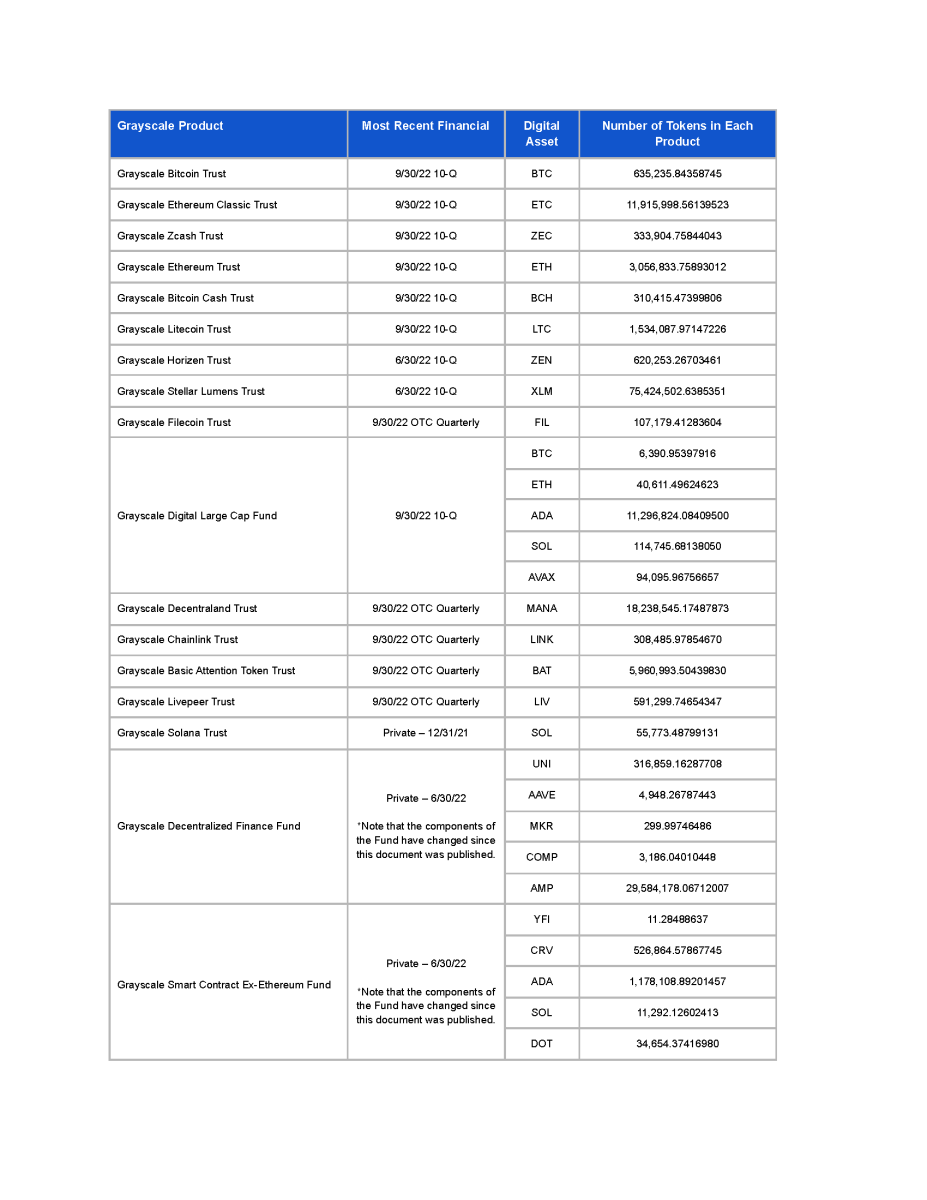

Grayscale offers about 17 crypto investment products, dominated by its Bitcoin and Ethereum Trust funds. While commenting on the safety and security of these assets on November 18th, the company said “each of Grayscale’s digital asset products is set up as a separate legal entity,” and defined by regulations that prevent the underlying assets from being “lent, borrowed, or otherwise encumbered.”

However, the product investors and cryptocurrency couldn’t bear the disappointment when Grayscale said it cannot publish on-chain wallet information or publicly confirm Proof of Reserve for individual products.

Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure.

Grayscale Investments

Many jeered at Grayscale for such a remark. Some questioned how Proof of Reserve, which several crypto exchanges and companies have published for transparency’s sake, has become a thing of security risk and concern. Among this group is Blockstream’s CEO, Adam Black, who said it “doesn’t make that much sense to me really.”

Doesn't make that much sense to me really.Taint-tracing firms know the UTXOs, and it's not hard to ask around for the export. Only vague thing you might argue is if Coinbase custody move them or have change it might reveal their IP address to geo- location on p2p. But use Tor…

— Adam Back (@adam3us) November 19, 2022

Coinbase Custody backs Grayscale’s claim

Grayscale uses Coinbase Custody, the wholly-owned and regulated subsidiary of the public-traded exchange, to secure the underlying assets of its investment products. More like an attestation, Coinbase wrote a letter detailing all of Grayscale’s assets under its custody to reaffirm the company’s claims.

Coinbase said it’s obligated to provide separate cold-storage on-chain addresses for each asset underlying Grayscale’s products. As such, Grayscale’s assets cannot be commingled with other assets held by the company. Moreso, Coinbase said each of Grayscale’s assets is solely for the product it represents, and that the company has never taken or reflected the assets on its balance assets as part of its assets.

Coinbase also reaffirmed that it cannot directly or indirectly lend out the assets. It also shared a breakdown of Grayscale’s assets in its custody as captured on-chain on September 30th.

But, while Coinbase Custody did say that Grayscale’s assets can be confirmed on-chain, some still doubt the reason the investment company has rather refused to publish the address as part of its Proof of Reserve.