What the FinTech Market must know about Blockchain Tech

When you look at this whole scenario, you have, on one hand, the whole FinTech market, which has been there for a very long time. It is the cornerstone for years right now, everything in the world functions because of the FinTech system. On the other hand, there’s a new kid on the block. It’s blockchain technology.

Blockchain technology can help the Fintech market in a great way to expand to what it needs for growth and to meet its goals. But at the same time, challenges of blockchain tech can also threaten the very existence of the FinTech market. FinTech is very closely tied with regulations and controls, whereas blockchain is the very opposite of that.

The bigger question is, how do you navigate through the difficulties of these challenges and end up to a point where the blockchain tech is helping the FinTech market, striking a balance through which it enables FinTech to function more efficiently than what it currently does. We will navigate through those challenges and look at the issues that we face, how to go about them and some potential solutions that we can use in the process.

Big opportunities come with big risks

So blockchain tech has a lot of applications but comes with a lot of unavoidable challenges, which is similar to any part of your life really, in life and business. Big opportunities come with big risks or big opportunities come with big challenges. It is inevitable. That’s how life and business works. So is blockchain tech, maybe just a little more than the usual.

The value of blockchain in FinTech can never be underestimated. I look at the existing FinTech as more like the old postal system, or the telegram, not the new Telegram app, but the actual old telegram where you send messages in a very slow and tedious process.

Blockchain Tech is the modern emails and phones and all the chat applications that we right now have. It is that different, it’s like two different centuries or it’s wide apart. And now it’s time for us to replace or upgrade the existing FinTech system with the blockchain and decentralized revolution that we have right now.

If you look at the existing banks and FinTech systems that we have right now, there are massive delays with fund transfers and a lot of paperwork, a lot of manual interventions. It’s expensive as well, obviously, not when you look at the gas price of Ethereum during the demand times, but normally, it is expensive.

The overall expense is not just the fees that you get charged on a transaction, but the fees on the economy, the number of people working (like huge numbers) around the globe to get this whole financial system to work. And it’s not like the moment everyone takes a holiday, the financial system continues to work. It doesn’t. We need the system to be like a blockchain, not dependent on people for the most part.

Filtering system

Obviously, blockchain has automation and interventions, but then, it is far more efficient compared to the existing FinTech products. And we also have regulations, as they are essential, no doubt. Without regulations, a lot of unhealthy things would happen. But at the same time, it cannot be a hindrance. So it’s like, you have some kind of a filtering system in place.

But then, the filtering system also adds like days and weeks and months of delay to something that’s passing by it. That’s a problem. So we need the system in place, which is efficient, fast, regulates, but without causing massive strides of delays and holdups. Because at the end of the day, if you look at what we have right now, people’s money is theirs. Regulation is there to help curtail the negative side of the things in the environment and ecosystem, but there needs to be a balance. And that balance is right now very possible with the blockchain system than ever before.

Transparency

So the obvious things, let’s get that out of the way. We don’t need intermediaries. If we are using blockchain, we can reduce the financial back office and also increase the transparency between the parties if you’re using transparent blockchains, not the ones with privacy protection. And we have real-time tracking, which is the best right now.

If you’re looking for blockchain to be mainstream, there are multiple bottlenecks that need to be addressed, until those bottlenecks are resolved or minimized. You will have challenges with getting it working on a larger scale or in a usable scale, even in a smaller enterprise. So, there are different ways you can work with blockchain in the FinTech.

One is that you can go with a new solution, creating your own blockchain. Or you can use an existing one for good and customize your needs and function from there. So, whatever your choices are, these bottlenecks would be pretty much in common for you, you have to make sure you are efficiently navigating them on an everyday basis.

Organizational challenge

So the first one is an organizational challenge. It is the challenge as an organization, being able to have admins who have the technology and widespread understanding of it. So if you look at governments or very large organizations, or even small businesses, they don’t get what the technology is. In fact, when I communicate with a lot of people, I see that the moment I mentioned blockchain or crypto, a lot of traditional old school people think it’s illegal, it’s wrong, it’s bad, and that they should stay away. And they believe that’s being a good citizen.

That is the kind of news that has been painted over years of news. And right now things are changing, things are becoming better, people are starting to see what it truly is.

But then, when you look at news spreading from point A to point C, probably the point C, the endpoint, the last of the citizens might even receive it 10 years later, a lot of people are not online reading this tech news every day, that’s not part of their job. And they might not even need the internet, a lot of people still live and function that way.

Why FinTech must adopt Blockchain Tech sooner than later

Blockchain’s going to take a long time before everyone understands it. But at least from the organization standpoint, people in the organization, people who are functioning and dealing with decision-making, they should have that level of understanding of, not only the technology, but also the business application, and how it can be used.

If you look at the current blockchain crypto space, at least until a year or two before, it was completely dominated by geeks, that technique, technical guys, the actual coders, and they were not making it easy to understand for the general audience on how it works. Even right now, it pretty much still is.

That’s not easy for people in the world of business to operate, function, dive in, understand what blockchainis and go with it. So, a lot of companies right now who are trying to adopt blockchain technology as an organization, they hire third-party developers, third party consultants, a lot of third parties, because they don’t have that resource in house. But that leaves them open to security challenges and privacy issues.

Third parties are risky

Right now, they are almost giving primary keys to the organization to the third parties, which is a challenge. And it’s a risk that every organization has, which is one of the reasons why a lot of organizations right now remain in the R & D stage. Blockchain technology is evolving so fast that when we say blockchain and crypto are here to stay, it’s more complicated than it seems.

It’s like blockchain and cryptocurrency as the words are here to stay. But the technology that is here right now, maybe three years down the line, could be drastically different with not even a percentage of whatever remains now remaining there. It could be so radically different. And so, as the technology is shifting, so fast, so wide, you cannot say that it’s the same thing that you have now that you’d have later.

It’s like the human body, you are the same person now and after 50 years as well. But then every few years, your body is new in entirety. The cells are completely replaced, everything is different. And that’s exactly what’s happening here. So businesses are trying to keep up with it. But it’s changing very rapidly.

It will be so different in the future than what it is right now. I believe organizations should be ready to invest the time and energy knowing the risk that what they learned right now might not be useful tomorrow. It gives them the edge by staying out there, dipping their feet in something that could be the future.

Blockchain is expensive

This is a challenge from the organizational side. The cost of initiating a blockchain project, implementing and maintaining it. So if you look at everything in the world of blockchain right now, it is expensive. It runs on premium – people resources, anything and everything called crypto and blockchain.

So, the initial cost of implementing is pretty high, the management cost is high, the cost of transactions is high, the cost of maintaining the updating the security, keeping up with the trend, all of that is hard. Things can get obsolete so fast. That actually decreases the return on investment for the business.

When we say that blockchain reduces the cost of something because it decentralizes things, it also actually increases the cost right now. I’m not saying that’s the case in the future, but right now, it does increase the cost so much that it actually reduces the return as well. As the adoption is there, the cost will fall over time. It’s a chicken and egg story. Do you do need adoption first or reduction of costs first?

Push and pull of adoption and cost

First, you need to have a better cost for adoption to happen. But then the adoption will happen when there is a better cost. So right now, it’s like a push and pull between these two elements. That push and pull friction is creating the progress right now, which is good, which is definitely a good thing, but just that it is slower related to what it could actually be.

When I say slower, it’s a very relative Blockchain is growing very fast, but compared to what it could if the rest of the world chips and puts in their time and effort into it as well.

Over-regulation vs under-regulation: Which Is better for the FinTech market

Right now, the existing regulations are confusing. Regulators don’t understand how the blockchain will fit within their worldview. They are unsure how they can make things work, they are unsure how the existing regulations can be adjusted to fit this new evolving world of decentralized systems.

This is a significant hurdle that we face. It makes them insecure because the regulator’s feel that the system can override all the controls that they put in for hundreds and hundreds of years, and it can derail all the efforts that they have taken in the past. But it can also produce a whole new model of functioning. So it’s like you can’t really fit decentralization into centralization.

Centralization regulators are trying to fit that decentralization inside, which is where things break down, things don’t work.

Fitting a rectangle into a small circle

So with the regulation, yes, it is a challenge fitting a rectangle into a smaller circle, it doesn’t work. It’s going to take more time for new regulations to adopt new perspectives completely and to build processes ground up specifically for blockchain-based operations, or even better, for the decentralized world as it evolves. And when that happens, we will start seeing standardization. Right now, things do not work in a very standardized manner. If you look at the number of projects, technology, methods, everything, they are all standalone, they’re different.

You don’t have that collaboration between blockchain platforms, coding languages, consensus mechanisms, privacy methods, or even security policies. Their differences are so wide — you can see the disarray of the whole system without coordination

Mass adoption is almost impossible

Lack of standardization takes away the consistency from a lot of things. If you look at things like security, businesses and organizations, you’d expect consistency there. And that makes mass adoption, both to the end-user perspective and for a business user, difficult and almost impossible. But innovation comes from confusion, right? Chaos creates solutions.

So it’s inevitable, it is the phase that we are in and this phase is essential for the progress to happen. It will settle down and organize itself in the future but it does pose challenges in the growth of the specific industry nevertheless. As it evolves, we will learn to connect, stabilize, standardize, and at that point in time, the limitations will start to come down. We might not have as many innovations as what we have right now then, but it’s how an industry matures.

Decentralization, scalability and adoption tied together

The innovations will be limited but that stabilization is a mature phase of any industry and that will happen. And that will increase adoption on a very wide scale. The next part is the scalability. So scalability is something that goes well with adoption as well, scalability or network can put a strain on the adoption. If something cannot scale, you cannot increase adoption. If you cannot increase adoption, you cannot scale it.Both challenges/goals of the blockchain form a cycle.

So you can say that the decentralization, scalability, and adoption functions are three interdependent elements. They are tied to one another. If you have less scalability, you have lower adoption. If you have lower adoption, you have less decentralization, if you have less decentralization, you have lower adoption. And you can work on a reverse version of the same cycle as well.

So it’s a pretty intertwined, interdependent process. Right now, the most important thing for us to understand is that we are faced with challenges which depend on one another. Scalability has to be created and it is being created by a lot of projects. But they were created by either sacrificing the security aspect or the decentralization aspect. What we need is doing that without sacrificing something, or anything.

Challenges remain and will remain for a few years to come. But as adoption goes up, scalability comes down as the network becomes bigger. The scalability has to grow as well to sustain it. So that balance has to be brought in.

Security and responsibility of enterprises

Now, let’s jump in on the security aspects with enterprises. Enterprises have a great responsibility because individual users, small businesses, big businesses, everyone depend on these enterprises, for a lot of things, their tools, their data, their functions, and services, and so on.

They have a responsibility to customers, they also have a responsibility to the law, a lot of reporting. A big company going down takes a toll on the economy as well. So with that in mind, they cannot just jump in if the security aspect is not fully tapped.

They understand the trend. They’re doing research and development, but fail to tell the jury in a court of law why something works in a particular way and why something went wrong because they offered something too quick, which is not stable.

So progress will happen. The implementation might follow in a little slower approach. Governments and enterprises are doing the R & D right now. This will change with time as the technology progresses. But security is a prime aspect without which large organizations might have the challenge to start using it in practical utility.

We can see even elections happening in the blockchain. A lot of enterprises are starting to create larger use cases and stronger security to make it happen, but the question that remains is, what’s going to be the compromise? Can there be a solution without compromises?

Integration of the blockchain-based system to traditional markets

How do we integrate the blockchain-based system with the legacy, the old school systems that Governments and Enterprises have? And how can it be bridged, if not integrated? Or does it need a complete restructuring of the previous system?

Blockchain is not a technology, it’s a new philosophy. It is about how you think. It’s decentralization. It’s also about how you feel being a part of this new system. It’s all about who owns the responsibility. Blockchain is fundamentally changing everything we know and believe in the world right now.

That new perspective comes with a cost. It’s like, when you move from physical papers to virtualization of computers, you redo everything. And this is exactly the same thing. You redo things from the ground up, integrations will work, but it’s going to be temporary us sooner or later, you have to change it. And yes, you need integrations between the things which are decentralized, which are not decentralized, there will be a lot of things where decentralization and blockchain are not needed at all. So how to make them work together in the long run, efficiently without mishaps?

Old ways of doing business will die

There are a lot of places where the blockchain will replace the old and existing systems in full. The old ways of doing business will die, it’s a matter of time. People can step up, take the opportunity, take the effort to lead the change. Or they can follow the change later, or the business might die with the change.

If you look at the new startups, they are coming in and they’re taking the similar position that traditional companies had in the same industry. They are starting to be the leaders of this economy in a decentralized world. So the old economy, the old businesses, have a legacy audience. But if the legacy audience is moving to the new economy, doing the business with these new startups who are providing them decentralized solutions, then the old school enterprises are bound to die. Traditional businesses might try to compete and come back to a decentralized model later, but that might be too late.

It’s like history all over again. You are bartering, then you’re using metals, like gold, silver, and you went to promissory credit notes, which turned into cash. And later that cash turned into banking systems and digital cash. And right now we have crypto, so one replaces another and that’s growth. That’s how it works. Mutation vs Evolution.

Integration is like a bandaid

Integration is more like scanning the papers and calling it digital. But then, it’s not truly digital. It’s like a band-aid. It’s temporary, and digitalization is the future.

Developers are visionaries

The next challenge is the lack of skilled developers. Blockchain space has amazing developers, but then quantum is very less, and they are busy with their own projects.

With more organizations wanting developers, they have to hire new people. Those developers are just learning it. They are not experienced as much. They are learning as beginners, they tend to make a lot of the same mistakes. There are not a lot of scalable developer resources available currently.

A lot of developers call themselves blockchain developers right now. But then, they are just changing the title in LinkedIn, they are changing the title in the freelancing sites, but they don’t really know what it is. They do not function at the best levels of efficiency, working on a project real-time to understand the technology, mindset and the philosophy in full. It takes time for the new developers to gain experience by learning, practicing, and working on other projects. It’s a matter of time. But it’s happening pretty fast.

Right now, there is an acute shortage of adequately trained professionals. A lot of people with a name exist, but not real professionals who can get you the job. And they need to understand the complexity of p2p networks, the challenges, not just the way to code something, but to think about the reason behind the structure.

If you look at the blockchain world, the whole industry is by the developers, for the developers. But then those developers were visionaries, they thought through, they were not just coding things. They thought of solutions to the problem as the first step. Then, they go ahead and code what was envisioned.

We need more of those developers and more skilled people.

Consensus mechanisms as one of the major challenges

We have these energy-hungry consensus mechanisms – proof of work. Most projects are either a clone of, Ethereum, or Bitcoin and they’re all proof of work-based. The computing power that’s needed to function and to verify transactions becomes a hurdle.

We have a lot of alternates coming up, but then, they are not yet stabilized and tested in full. Ethereum’s proof of stake is a major hope when it comes up. Or newer models from other blockchains as they arise. They can enable larger-scale deployments, and if it is tested and functioning, that will really help with what’s upcoming.

A lot of projects are coming up with new consensus mechanisms in their own way. But that does not necessarily mean that that is perfect by any means, or usable in large scale. Most are specific to certain use cases.

If you’re looking at higher transaction costs, that’s a challenge to address which the above helps with. We know that many blockchains are solving it, some have already solved a good portion of it. But there are compromises to it. Transaction cost is pretty important in expansion, adoption and growth. The traditional payment system is actually lower in per-transaction cost currently compared to top blockchains. We do see it already changing, and in a year or so, we should have a wider adopted solution to the same.

It’s not just what the cost is right now, but the cost over a period of time. Ethereum can increase in its cost drastically during surge transactions. As we’ve witnessed recently in the DeFi trend. We need that lower transaction cost capability through an extended period of time to bring in consistency.

If you look at USDT and Ethereum, they can function in blockchains like Tron, OMG, etc. That is good progress. It has not been widely implemented yet. Binance does implement the withdrawal mechanism in multiple such blockchains as a forerunner.

Blockchain has to be more widespread, more functional, usable between people on a B2B basis and with different apps and so on. That will make things better and easier.

Tracking difficulties and solutions in the Fintech market

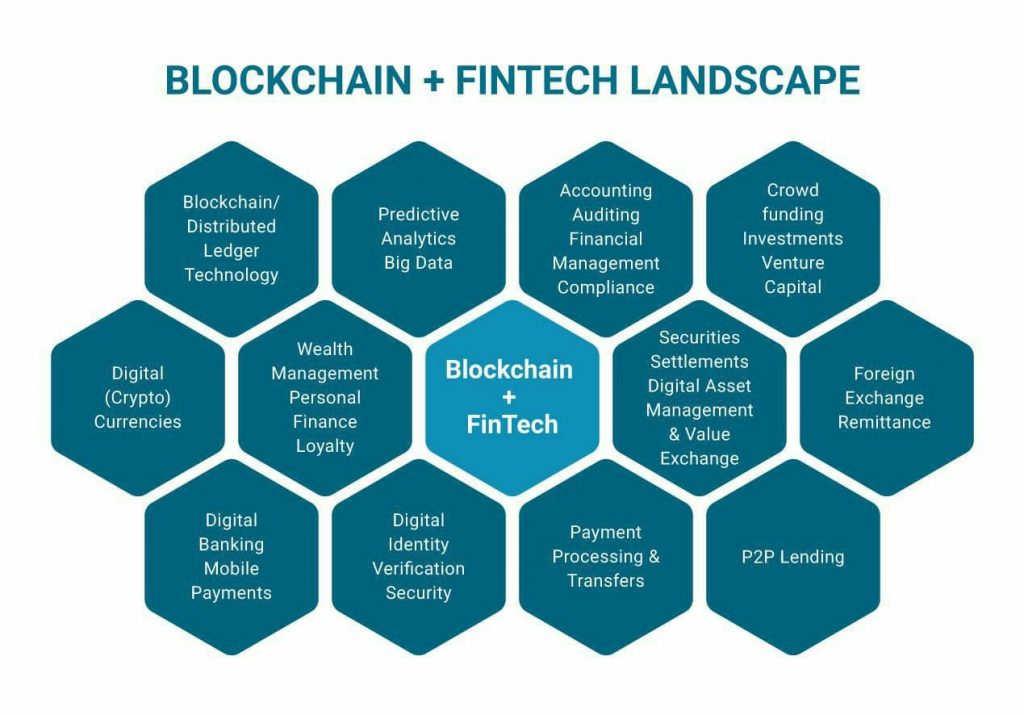

If you look at the mindmap we have here, we have adoption, scalability, and decentralization depending on each other. Decentralization, the more it happens, it increases security. The security will make regulation happen positively. Regulation helps adoption. Adoption adds pressure on regulators for better regulation, and faster.

Regulation helps with standardization of things. At the same time, it also helps organizations by either increasing or decreasing, delaying or speeding up their options or challenges there. Organizations adopting it, increases standardization, also increasing the integration potential. Standardization also makes things easier for the integration at that point in time.

All these also help with the reduction of the cost of implementation and maintenance. If you look at the chart, everything is so interdependent on one another. The transaction costs, the skilled developers, and so on are intertwined. It’s a chart which you need to spend more time studying to know what’s happening there. I have added as many details as I can towards it.

This is to make things simpler, not to complicate. There are things happening everywhere. There are challenges everywhere, everything affects everything else. And it is a moving cloud of things, moving cloud of happenings, and moving cloud of challenges. So the way to navigate this is not trying to solve everything at once. There are different people solving different parts of the puzzle, at their speed, at their efficiency in their own way. It is again, not a centralized approach, but a decentralized approach of everyone working together to solve it, the end of the day.

The Customer-Centric Approach

If you’re looking at it from the perspective of a financial services business, the major adoption of blockchain technology should be questioned with customer retention in mind. What do my customers want? What is their primary goal? What is their problem that I’m solving?

If you start thinking from customer retention, customer standpoint, understanding their needs, challenges, their futuristic demands, what makes their life easier with blockchain, etc., the answers will guide you. The answers you get is where you need to start with first, then do your pros and cons analysis, risk-reward ratio, and more. Obviously, the risk-reward ratio might not always balance up most of the time at the start, but look at it with a 3 or 5 years trajectory.

It is not a short term, instant gratification. It is a long term accomplishment, long term trajectory of the business and the livelihood of the business that we are aiming for.

Solutions to FinTech difficulties in adapting Blockchain Tech

Find a niche. Just like in business, find your niche within the blockchain space too. If you look at the chart shared earlier, you can find your own niche from the set of challenges presented there. You can say, “okay, skilled developers, I’m going to solve that. I’m going to start a startup that helps people get educated and deployed”.

Or you can say, “I’m going to solve organizational challenges, I’m going to go out there and consult organizations to help them become more apt and adapt to the changing situations.”

Or, “I’ll pick the part of adoption to help get the word out and build a business based on onboarding more people and onboarding more users to my industry”, maybe it’s a delivery service, or it’s some specific FinTech product itself.

You could use any part of this puzzle, fit that into your business, make that your focus. You cannot solve everything. I’m not saying that you cannot. You can probably but you cannot take up the responsibility for the whole system on your own.

Take one thing, select one that most inspires you, if it’s a consensus mechanism or standardization. That’s what Bitcoin did. Bitcoin did not come out there and say that it’s solving everything. It did one thing: seeding the idea in the minds of people, opening up possibilities.

Ethereum came up with the whole flexibility with smart contracts and how it can build and expand. Obviously, Ethereum has a whole ecosystem, which is very big, very wide, very complicated, and very different from Bitcoin, but it came up with one thing that is so strikingly different, and that is smart contracts. At least from a business user perspective.

So focus on one thing, which you can make the most difference in, and then build upon the rest as you go from there. And this chart can help you brainstorm, come up with ideas for your business or product.

This job by no means is a complete one. There are a lot of other challenges that are not listed here. A lot of interdependencies that I might not have pointed to here. But the point is, this could be a starting point, this could be an initiation of an idea.

So start from there and see where it takes you, you could probably find a lot of things that most people have not thought about and build from there. Solutions are made every day for all challenges by a lot of different people in their own decentralized blockchain businesses. And it will be a while before it’s all shining, and good for adoption.

But then, be an early adopter. If you’re coming in at a point in time in the future, when everything is shiny, and everything is ready, it’s a plug and play then. You just come in and start using, then probably you have a million new people ahead of you.

You’re just going to be one among the many and you’re not going to win easily, you’re not going to have a history, you’re not going to have a brand, you’re not going to be the first in your industry. Find a niche. Take that first step right now. It might be a loss, the business might break, things might not work, but you still took the first step, and you have a brand and presence in the blockchain space.

Yes, you did risk, you’re losing money if it went south. But then you also have the opportunity of equal size to be the first to market and to have a larger audience in the future as your solution grows.

To win and become a multi-billion dollar organization in your niche, you cannot go out there and build a new FinTech product in the old school environment. Big companies like PayPal and all those different established Visa, MasterCard, and so on own the place.

But now if you start something in the FinTech world, in the blockchain, you can be the next one of those big names, and it is possible. But for that, you have to take a risk. You have to spend your time, spend effort, spend money, spend organizational resources, and move towards that with ownership, create a solution, and improvise.

If someone else takes that solution up and builds upon it, that’s fine. That’s how growth happens. There’s nothing to be envious about it. But you did your part and you’re growing and you’re reaping your benefits. There’s nothing to compare with others. Look at what you gain out of it and look at what you’re contributing, look at the change you’re bringing about.

And that is where that’s what matters right now. Be part of the solution rather than waiting for a solution. That is the solution here.

I wanted to keep this piece less technical because business users are the majority in the world and they are not technical geeks, just functional users. They are not mostly geeks, and they don’t understand the technical terminologies and challenges.

From a business solution standpoint, keeping all the tech parts aside, be part of the solution. This will help yourself and speed up the process. If everyone chips and puts in their effort, puts in their thought, they’re part of the push-in taking the blockchain forward. Learning to run a marathon teaches you more than actually running one.

That’s what this is all about. Are you going to learn in the process? Or are you going to wait for someone to learn everything and then you just use something like the end-user, missing out on the opportunity and waiting for the next big life-changing moment? The challenge exists but the opportunity of equal or larger size exists too. In the traditional markets, the quick growth that you can have here is impossible. Use the opportunity, while it lasts.

The solution is to be a runner, make things happen, take responsibility for anything that you can and move forward. There are challenges for blockchain technology in FinTech. But if you deploy it in a minor step by step manner, in a calculated fashion, you can make things happen, you can make things work because this solves a lot of problems that your audience wants solving. That means you’re helping them; it’s not pure risk.

So, the conclusion is that the blockchain is here to stay, and it cannot be ignored or taken lightly, irrespective of all the challenges because what blockchain has created, what decentralization, as philosophy and technology have created, is so massive, so powerful, that it’s something that you cannot afford to ignore.

And as transaction fees minimizes or adoption increases, as major companies like Facebook and many even governments start deploying it, the technology barriers will fall sooner or later. And the question is, are you on the earlier side creating a brand, creating a name for yourself and contributing or are you a follower. That’s pretty much left to you.

Frequently Asked Questions

Is there a chance that regulations will increase as more FinTech companies come into the market?

Yes, it will. Right now, a lot of FinTech companies are waiting, they are waiting before entering, hoping that the regulations will come in sooner. If more FinTech companies are coming in, it will increase the pressure on the regulators to bring in regulations. It’s not that “more regulations” are coming in, just that the regulations due will come in sooner than later. Now, there are no regulations in place in most parts of the sector.

But how soon it happens really depends on how fast adoption takes place, so that it threatens the regulators or shows them that it is okay, as well. It is a need of time, it cannot be delayed anymore. No one can afford to put it for later.

The long procedures and regulation during the implementation of the blockchain system is a major discouragement to businesses. What can be a major encouragement?

Obviously, it is tedious to see regulation changes and it can take down a whole business as it happened to some centralized exchanges in some countries or various other startups in others. Procedures are cumbersome, but then the opportunities, big market capitalizations, huge, untapped potential is massive and being first in the industry is worth anything. It’s like if you can be first in your industry right now, without using blockchain, you would. But now with blockchain, you can, why wouldn’t you? So massive upsides are there, there are risks, there are losses, but it’s up to you to evaluate how much of a risk you can take and what your risk appetite is.

Can you provide me with a good approximation of expenses for blockchain technology, hardware power equipment, to be set up for a small business?

You don’t have to worry too much about hardware and power. At this point. For most of the business users, you can run off nodes in Amazon AWS, or similar. In cloud platforms, the cost can be pretty low. Resources depend on what blockchain you use, user base and consensus mechanism. If it’s a private blockchain, it’s relatively easier.

You can really forget about the hardware, the power, and those challenges (for now) and focus more on the solution part. Of course, when something is scaling and more people are joining, your hardware or the overall expenditure on AWS could increase, but that’s part of growth. And that’s part of any business.

How can I integrate blockchain in a finance app?

“How”, that’s a very big question here. You need to go to the whiteboard, look at your audience’s problems, and look at what they want to solve, how blockchain can help, how it can work as a new application or as part of your existing application. How can you onboard users to the new app? Or if it’s an existing one, how can you integrate it so that the users flow to the blockchain infrastructure or interact with it seamlessly? It is something that you’ll have to work from both a business solution standpoint and with your developers to figure out, but it is doable.

Startups with no experience of skills in blockchain technology must rely on third parties to implement and manage it for them. Can you help site a reliable company who can do this? What are the standard rates for this kind of service?

It depends on a case to case basis. You can use freelancers to reduce your cost, but then it increases the risk, challenges increase. Enterprise development companies are reliable but expensive. It’s a personal choice based on personal skill set.

I don’t want to specify a company’s name. But make sure you work with people after making sure that they have the skills and expertise, and they have done something similar in the past. If they have done something similar, it’s easier; it’s lower in cost as well. They already figured things out. It’s easy to rework and deploy.

Take it in a step by step approach there. But be cautious and make sure you do the right due diligence, cross-check, cross verify, and take the steps towards that. And the standard rates don’t exist. But you can definitely reduce cost if you work with someone who has done it previously.

What are some tests to decide whether a process or a business is a good fit for blockchain? And when it’s not?

Yes, not everything is a good fit. To be frank, sometimes some things are better off in the centralized world from a technology perspective. Start with customer expectations, then have your own vision on improvements that you can make.

Look at anything that relates to trust, decentralization of data, crowdsourcing, and anything to do with third-party integrations or data transfer between multiple parties. And if any need of timestamping exists, or any automated functioning of contracts and things like that, that’s worth moving to the blockchain. There are massive use cases, massive ways things can function on the blockchain.

But these are some of the keywords. If you come across any business process that involves any of these or all of these, then it makes sense to get that out on the blockchain.

Blockchain technology has a lot of benefits, and you can ask yourself more questions to see if it fits. But my major questions would be regarding the adoption, and regarding usability for the end-user. If the user cannot use it, whatever you create is not helpful.

Think about it all the way through the user perspective, why would they use it? And how can you make them use it? How can they enjoy using it? And why would it make their life better? If that happens, any innovation you choose solves all the different purposes and all the different challenges.

About The Author

Mr. KEY – Karnika E. Yashwant has been an avid marketer leading blockchain projects since 2013 and executing Content Marketing for Fortune 100s since 2007. He is the CEO of Utopian Capital, an investment firm for blockchain technology, and the Founder of KEY Difference Media, an agency rated in numerous Top 5 and Top 10 lists in the Blockchain/Crypto space year after year. He can be reached at LinkedIn or Telegram.

He helps businesses understand how they can function and use blockchain technology to benefit their businesses. His whole perspective stems from marketing, helping businesses reach the marketing objective – be it raising investment or attracting users.

He can help them navigate the challenges and help make the right choices, and most importantly, get the message across to the crypto audience. He is a master at educating the audience, onboarding them and increasing customer acquisition using crypto news media, influencers, Content Marketing, and community connections.