There are hundreds and thousands of digital coins and tokens in the crypto market. They compete in the market to attract many investors and potential traders to their blockchain network. The increasing usability of cryptocurrencies has helped several projects grow their market cap and trading volumes in the last few years.

Mainstream cryptocurrencies like Bitcoin, Ethereum, and Cardano have solid fundamentals and roadmaps to support their growth in the crypto space. But at the same time, several other projects with somewhat unclear goals have also made a massive upsurge in the crypto world. This shows the unpredictable nature of the blockchain and cryptocurrency realm.

Also Read:

• Cardano Price Prediction: Is Cardano A Good Investment?

• Cardano Staking: What Are The Benefits?

This article will compare and contrast two primary crypto tokens of the market, Ethereum and Cardano. We will discuss their basic models, project details, features, key differences, smart contract capabilities, consensus mechanism, gas fees, price and market cap difference, and other factors. As a result, a concrete and factual analysis will be conducted for Cardano vs Ethereum.

Both Cardano and Ethereum have several similar features, like smart contracts and the building of decentralized applications, but they both differ in design, general philosophies, and goals. This is why Ethereum vs Cardano is often debated by cryptocurrency experts.

What is Ethereum?

Ethereum is the second-largest cryptocurrency in the digital asset industry, only second to bitcoin. The Ethereum blockchain is among the most popular and most used platforms for the sectors like decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs). Ether is the native cryptocurrency of the Ethereum blockchain platform.

The pros of the Ethereum blockchain

The Ethereum pros include that the blockchain hosts smart contracts in its ecosystem that help it function more smoothly and effectively. These smart contracts are currently one of the most valued and appreciated features in a blockchain network, as they incorporate more security and transparency into the network. Users can efficiently execute safe transactions and payments through a smart contract without the need for any third party.

The open-source nature of the Ethereum network allows anyone to create new dApps. These applications utilize the native cryptocurrency of the Ethereum platform Ether (ETH). Therefore, the decentralized application and the host network benefit from its success.

On September 15, 2022, the Ethereum blockchain transitioned from using a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) mechanism as part of the Ethereum Merge. Following this shift, a separate blockchain called ETHPoW was created, which operates on the old pre-Merge Ethereum PoW protocol. This means that ETHPoW is essentially a fork of the previous Ethereum blockchain that still uses PoW. Recently, ETHPoW has gone live as a distinct blockchain separate from Ethereum’s Merge.

The idea of the transition, otherwise known as ETH 2.0, is to improve the efficiency of the Ethereum network and decrease gas fees. The proof-of-stake consensus protocol is much more environmentally friendly, allowing miners to verify transactions and earn rewards for their contribution to blockchain technology.

The cons of the Ethereum network

- No supply limit: Unlike Bitcoin, Ethereum does not have a fixed limit on the number of coins that can be created, which could create deflationary pressure on its value. This might benefit those using Ethereum for transactions, but it’s a concern for long-term investors who hope to see the value of their coins increase over time.

- High transaction fees: Transactions on the Ethereum network can be slow and costly, which is a major challenge for people who are looking for an alternative to traditional banking and finance. This can also hinder the scalability of Ethereum as it seeks to maintain its position as the second-largest cryptocurrency.

- Limited capacity: The high volume of transactions on the Ethereum network can result in slow processing times and high fees, posing a challenge to the network’s scalability. To tackle this issue, Ethereum’s developers are actively working on a sharding upgrade, which is part of the second phase of Ethereum 2.0, also known as ‘The Surge’. The sharding upgrade is expected to address the network’s capacity and scalability issues and is set to be implemented in H2 2023.

What is Cardano?

Cardano was primarily developed to counter the Ethereum token. One of the co-founders of Ethereum built the Cardano foundation, which sparked an undying debate on Cardano vs. Ethereum. Nonetheless, Cardano and Ethereum have several similarities within their protocols. The native token of the Cardano protocol is called ADA, which is used for rewards on the network.

Pros of the Cardano network

Cardano also allows the building of decentralized applications on its network, Like Ethereum. It currently hosts an NFT marketplace and an Indigo Protocol on the Cardano blockchain. It enables users to trade real-world assets with ease. Cardano and Ethereum 2.0 both use the proof of stake (PoS) consensus protocol, which is more energy-efficient than the proof of work (PoW) used in Bitcoin and the original Ethereum blockchain. However, Cardano’s design allows for more potential to scale compared to Ethereum 2.0.

Cardano’s scalability is based on its layered architecture, which separates the computational and settlement layers. The computational layer handles smart contract execution and transaction processing, while the settlement layer maintains the ledger state and records the transactions. This approach allows for a higher degree of parallelism and better resource allocation, resulting in faster transaction processing times and higher throughput.

Additionally, Cardano’s design allows for adjustments to be made without affecting payments and other transactions. This is accomplished through the use of sidechains and other off-chain solutions, which can add or remove features without disrupting the core blockchain. This enables Cardano to remain flexible and adapt to changing market conditions or user needs.

Compared to Ethereum and Bitcoin, Cardano offers more cost-effective transactions and operates on an energy-efficient blockchain. While Ethereum has made strides to enhance its energy efficiency through the transition to Ethereum 2.0, Cardano’s primary focus has been minimizing costs and reducing the environmental impact of blockchain technology from the outset.

Its Proof-of-Stake (PoS) consensus protocol eliminates the need for energy-intensive mining operations, and its layered architecture and off-chain solutions help to streamline transaction processing and reduce data storage requirements. As a result, Cardano is setting itself up as a third-generation cryptocurrency behind Bitcoin and Ethereum.

Cons of the Cardano network

While Cardano is a promising cryptocurrency platform, there are some potential drawbacks and limitations to consider, including:

- Limited adoption: While Cardano has gained some traction in the cryptocurrency market, it still lags behind Ethereum and Bitcoin regarding adoption and user base. This may limit the number of use cases and applications that can be developed on the platform.

- Long development timeline: Cardano’s development has been a long and iterative process with multiple stages and milestones. While this approach is intended to ensure a high level of quality and security, it can also slow down the pace of innovation and limit the availability of features and functionality in the short term.

- Centralization: While Cardano’s PoS consensus protocol is intended to be more decentralized than PoW, some critics have raised concerns about the potential for centralization due to the distribution of stakes among a relatively small number of participants.

- Limited smart contract functionality: While Cardano’s smart contract functionality is designed to be more secure and flexible than that of Ethereum, it is still in the early stages of development and may be limited in terms of the range of applications that can be built on the platform.

Use cases of Ethereum vs Cardano

Comparing blockchains

Ethereum, as well as Cardano, both have a strong reputation in the cryptocurrency market. They also have several use cases, making them unique in several aspects. Both blockchains promote the use of decentralized applications and smart contracts. But they differ in energy consumption levels.

Developers can use both the Ethereum (ETH) and Cardano (ADA) blockchains for similar features, including running custom programming logic (smart contracts) and building programs (decentralized applications). The heart of any blockchain platform is the algorithm it uses to create blocks and validate transactions. Cardano and Ethereum use different blockchains.

The significant difference at the moment is that Ethereum is older and exponentially bigger than Cardano in terms of market cap. However, the Ethereum network is perceived to be less flexible than Cardano’s Ouroboros consensus protocol.

During its foundation phase, Cardano created Ouroboros, the first proof-of-stake (PoS) protocol that has been proven secure. It was also the first to be informed by rigorous academic research. This research-based approach is central to the Cardano roadmap, which is organized into distinct phases, each anchored by a framework that incorporates peer-reviewed insights and evidence-based methods to guide progress toward specific milestones related to the future direction of the blockchain network and its native token, ADA. In this way, Cardano seeks to continually advance state of art in blockchain technology through a rigorous and methodical approach that emphasizes scientific research and a commitment to academic rigor.

Importance of smart contracts and decentralized applications

Smart contracts are predefined and irreversible, making them safe and secure and ensuring transparency for the stakeholder. However, a smart contract is like a vending machine because it processes transactions and completes the task without any facilitator or third party. These contracts are public, and any individual can build their contracts.

On the other hand, dApps are believed to be the next big thing in the blockchain industry. They are not only used for informational purposes, but they are also helping in raising awareness about decentralization and anonymity – the basic concepts of the world of crypto.

Conduct and verify transactions

Both projects are looking for ways to solve the crypto industry’s scalability issue. However, Ethereum faces more difficulties because it has a high value and targets a sizeable financial scale. So, the transactions on the Ethereum network are slower and more expensive. Cardano is more scalable than Ethereum, giving it an advantage in the Cardano vs. Ether debate. Nonetheless, once the anticipated Ethereum 2.0 rollout is completed, things might be different for both of these altcoins.

Proof-Of-Stake mining requires a lot less energy and fewer resources than Proof-Of-Work systems since Proof-Of-Work miners have to do much more ‘work’ to mine blocks. Ouroboros requires a small number of ADA holders to be online and maintain good network connectivity. Transactions can be validated quickly and cheaply due to this improvement.

Seeing the advantages of a Proof-of-Stake mechanism, Ethereum has begun transitioning from a PoW to a PoS model. Cardano has the advantage of being the first mover in this field, and Ethereum will have to do some catching up. Cardano is one of the few Layer-1 blockchains that refuse to compromise their other attributes in favor of scalability. And like ETH, it takes no shortcuts, has a similar grand vision for the future, and is supported by a vast, loyal community. But is it taking too long?

Ethereum vs Cardano Price Analysis

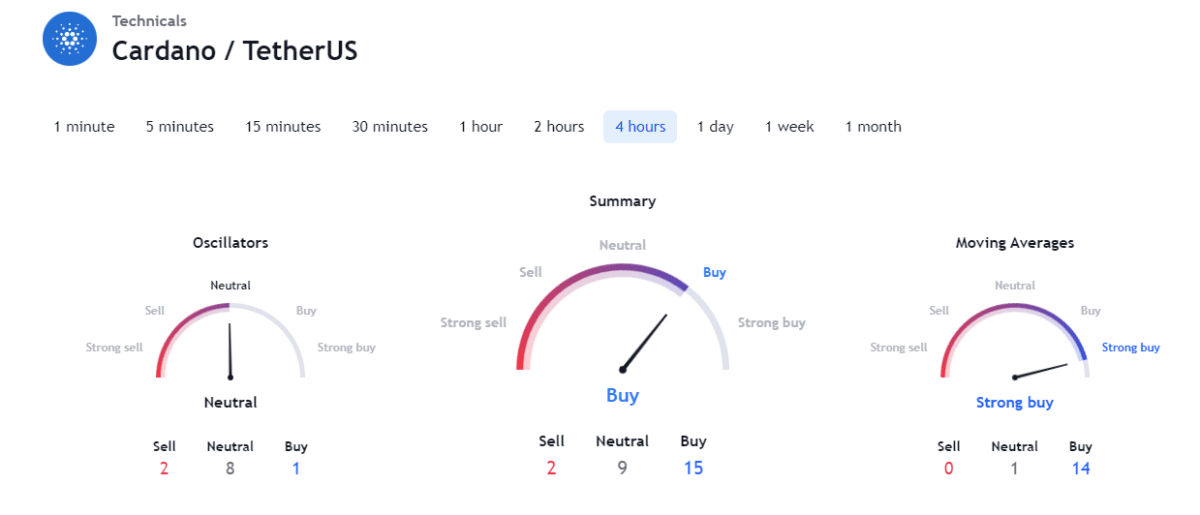

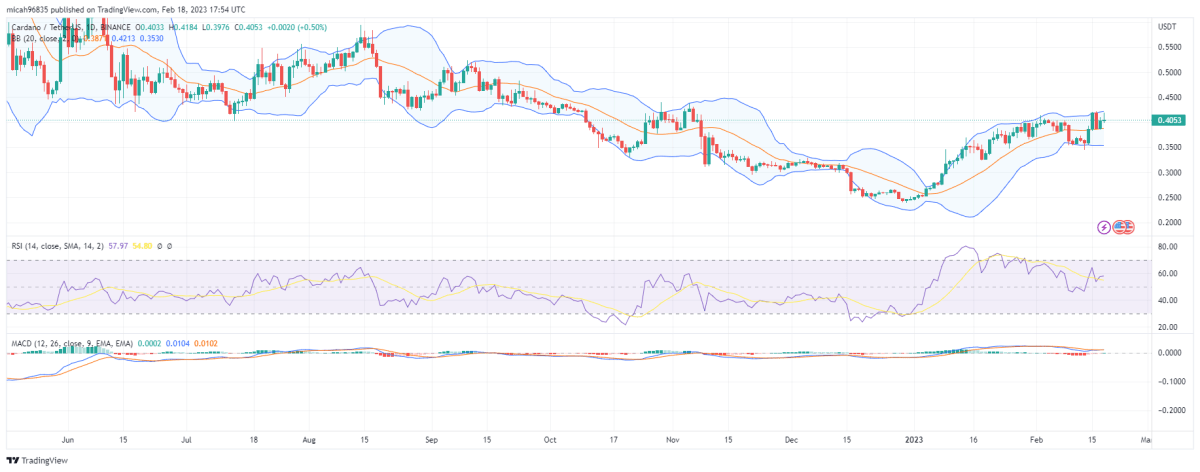

ADA/USD traded between $0.3985 – $0.4159, indicating mild volatility over the last 24 hours. Trading volume has declined by 15.54% and totals $369,223,307, while the market cap trades around $369,223,307, ranking the coin in 7th place.

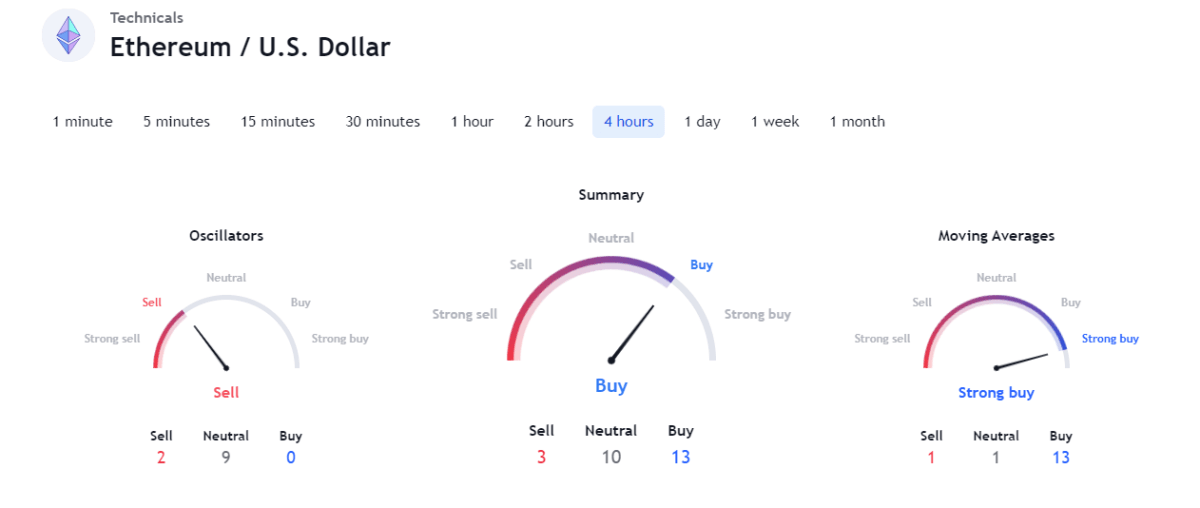

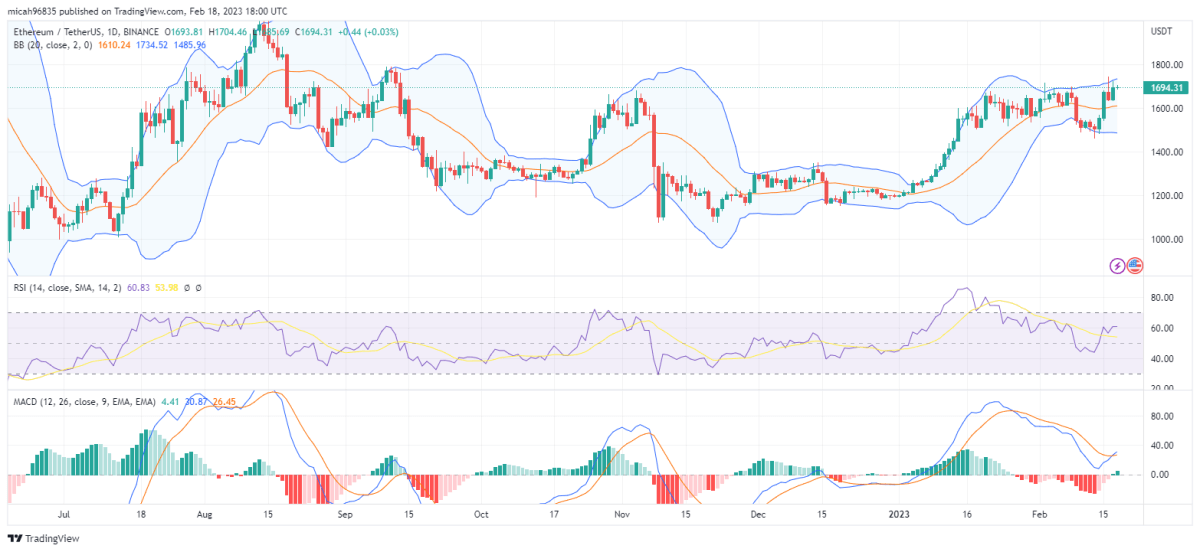

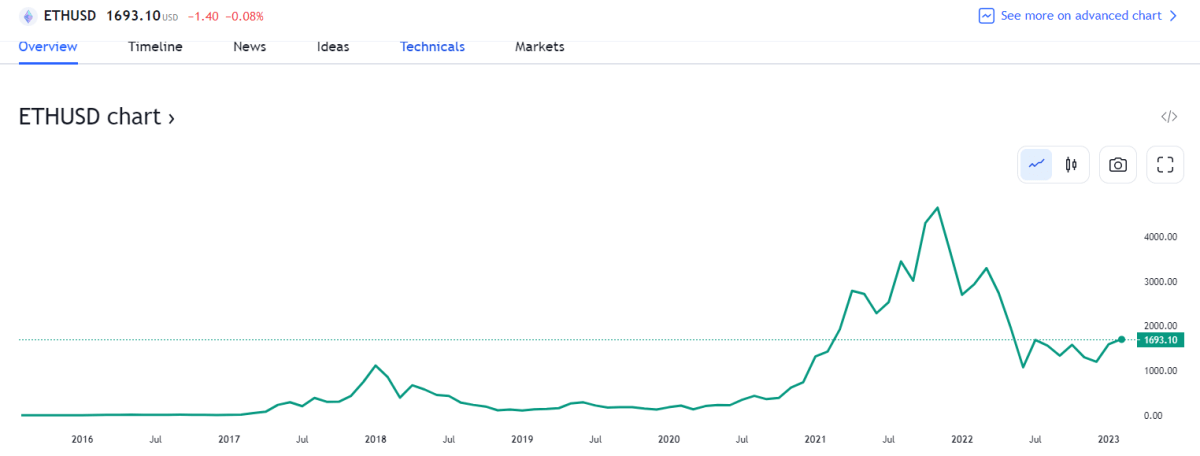

ETH/USD traded between $1,675.39 – $1,716.78, indicating significant volatility over the last 24 hours. Trading volume has declined by 37.41% and totals $6,602,458,024, while the market cap trades around $207,460,370,094, ranking the coin in 2nd place.

Bitcoin is the leading token in the market, and Ethereum is the only one that is believed to be the competitor of Bitcoin. However, Ethereum has many altcoin competitors of its own. This is why Ether’s market capitalization receives a dent now and then because of its several killers in the market.

The concept “Ethereum killer” has been bandied around by countless crypto projects, shillers, and media platforms for several years. Yet, many retail investors merely scoff at them, as Ethereum has remained the undisputed king of decentralized applications (dApps). When a project decides to build a blockchain app, Ethereum (ETH) has always been the go-to network 9 times out of 10.

Ethereum ranks as the second largest cryptocurrency by market capitalization, whereas Cardano is currently in seventh place. Both of them have commendable figures as their market caps and trading volumes, but in comparison with each other, ETH is four times ahead of Cardano. However, concurrent with the success of DeFi and NFTs, many startups have decided to either leave Ethereum for other networks, utilize layer-2 solutions (L2s), or become multi-chain to allow their users to enjoy the low fees and quick processing times of different blockchains.

The overall market sentiment has been bullish since the start of 2023. Bitcoin has soared by 49.23 percent, while Ethereum’s value has increased by 41.77 percent. Meanwhile, Decentraland (MANA) is the top performer, with a gain of over 135 percent.

Large institutions and investors are keen to invest in ETH, as they believe it to be the next big thing in the crypto market, topping the world computer of digital assets after Bitcoin. But on the other hand, small-scale investors, traders, and organizations are heavily invested in Cardano. No one can give clear financial advice in this scenario, but this shows both tokens’ wide popularity and growth.

Experts from Deutsche Bank call Ethereum the ‘digital silver,’ a position initially held by Litecoin. The German multinational investment bank says cryptocurrencies are “too significant to ignore.” Deutsche Bank also predicts digital currencies surpassing traditional fiat money by 2030.

Buying Ethereum and Cardano

The cryptocurrency market is becoming more and more inclusive of different regions as people worldwide continue to explore the new concept. This popularity was initially driven by Bitcoin, and then after Bitcoin, the likes of Ether, Cardano, Doge, and Ripple took charge. As a result, the role of cryptocurrency or bitcoin exchanges increased worldwide. These exchanges proved to be a bridge between the consumers and the live trading digital asset market.

The centralized and decentralized exchanges have facilitated bitcoin and crypto enthusiasts from all over the world. They offer extensive crypt0-related services like buying, selling, trading, and exchanging coins and tokens. Also, users can use these exchanges to hold their assets in reliable crypto wallets. Therefore, anyone who wishes to invest in Ethereum or Cardano tokens can opt for a reliable business and carry on with their trading or investing career.

Where to buy Ethereum and Cardano

Since Ethereum is so popular, most cryptocurrency exchanges will let you buy ether, but we recommend sticking to a few more popular exchanges like Coinbase, Gemini, or eToro. Ethereum is also one of the few types of crypto you can buy on platforms like Venmo or PayPal. General steps to buy Ethereum and Cardano:

- Decide how much Ethereum or Cardano you want to buy.

- Find a secure cryptocurrency exchange or brokerage.

- Create an account, deposit money, and buy your Ethereum or Cardano.

- Consider a wallet.

There’s a good discussion here of each step.

Conclusion

Ethereum and Cardano have solid fundamentals and support from the crypto community to back themselves. They are the next ones in line after Bitcoin to make a statement in the industry. The native tokens of both networks are expected to continue on an upward trajectory in the competitive market, and the competition between the two might also get fierce. Nonetheless, the success of Ethereum and the constant pressure from Cardano might be a positive sign for the overall market and the future of digital assets.

Cardano has its strengths, so if you’re willing to invest in crypto, it could be a good bargain to hold your investments for the long term. Regardless, you should conduct thorough research before investing in either cryptocurrency.