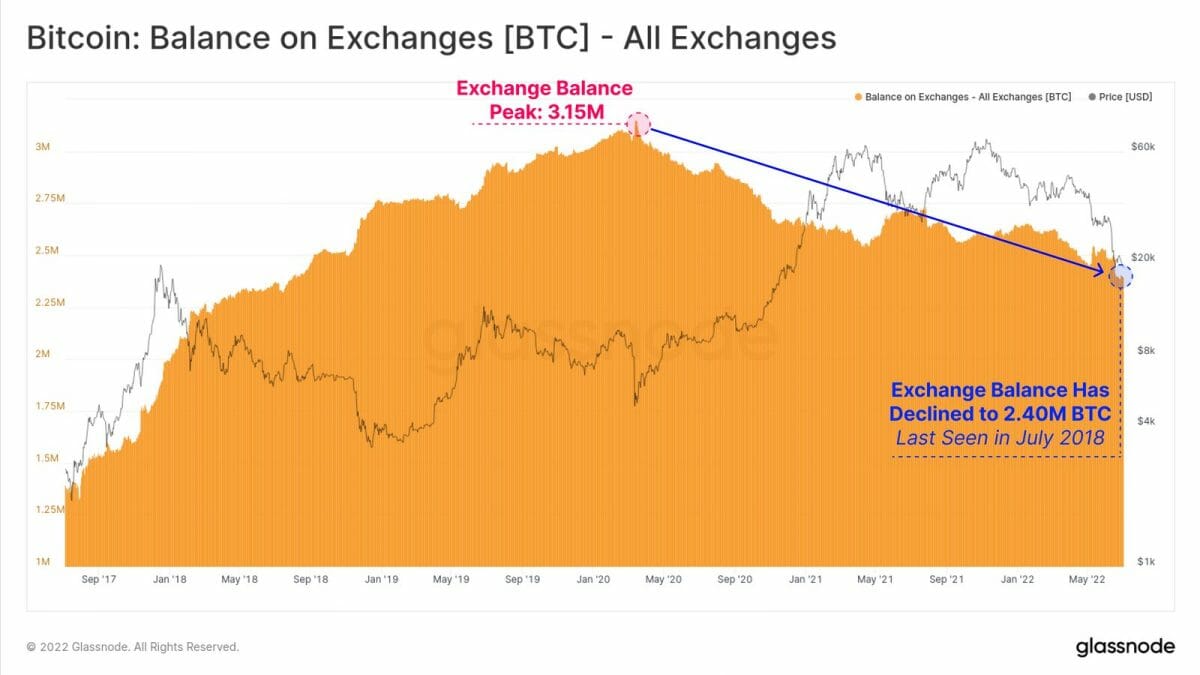

Crypto exchanges’ Bitcoin balances are significantly reducing in spite of the intense bear market. There are traces of large and small investors accumulating BTC but it remains to be seen if the momentum would sustain the crypto price from further plunging in the near future.

Worst times in crypto

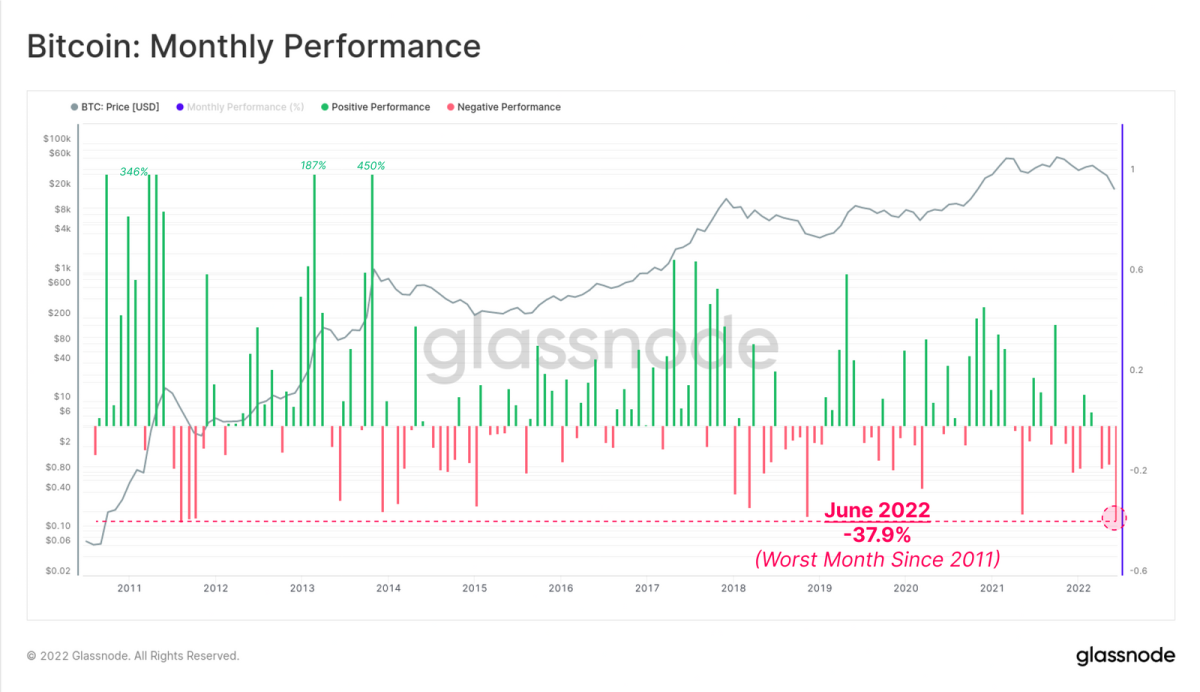

June 2021 goes down as one of the worst trading months for the largest cryptocurrency. In the last 30 days, Bitcoin dropped more than 37% of its market value, “competing only with the 2011 bear market, for the crown of the worst month on record,” where BTC traded below $10, according to an on-chain analytics platform, Glassnode.

Bitcoin is currently up 3% at $19,809 in the last 24 hours. Regardless of the gloomy crypto market, on-chain data reveals a steadfast trend of either Bitcoin accumulation or self-custody, giving exchange balances are reducing at historically high levels. “It appears that a near-complete purge of market tourism has taken place,” Glassnode says.

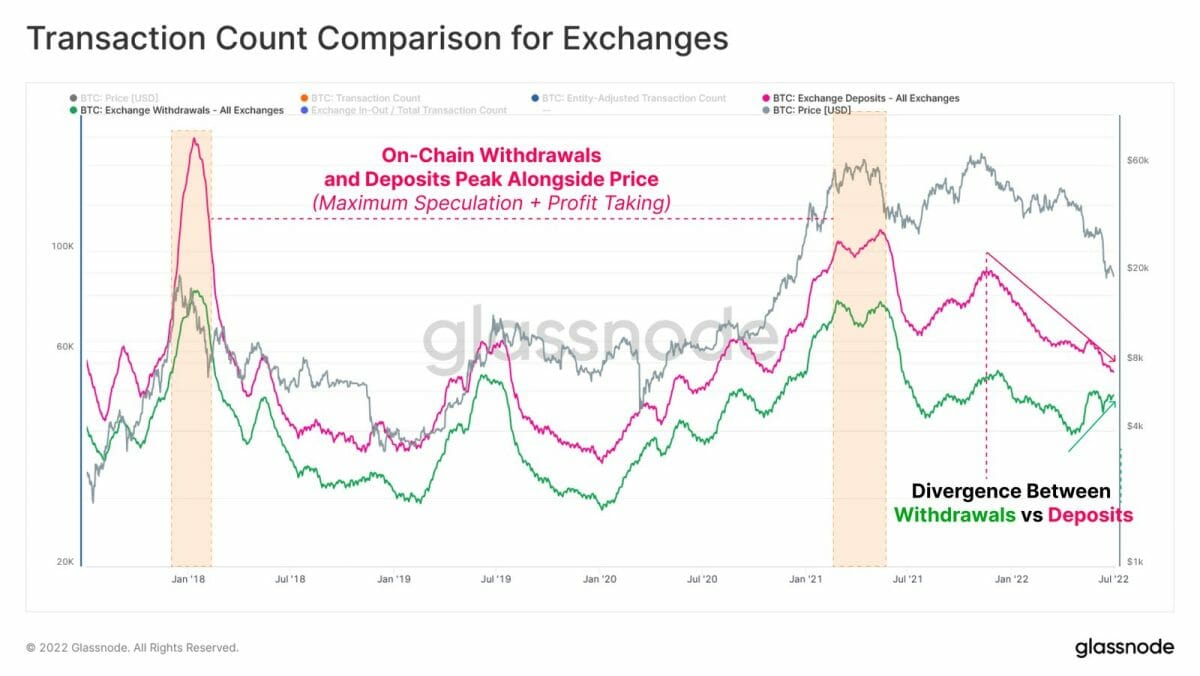

The aggregate amount of BTC deposits to crypto exchanges has declined likewise net withdrawals. The analytics platform said the aggregate Bitcoin balances on exchanges have declined to levels last seen in July 2018. This attests to either accumulation and/or an awoken interest in self-custody, following the continuous report of withdrawal suspension and finance strain on crypto firms.

Exchange Bitcoin balances may have declined because of self-custody

For instance, the Bitcoin balance on the US exchange Coinbase has reduced in a” persistent 10k to 30k BTC step function,” and an aggregate of 450k BTC in the past two years, while Binance gained over 300k BTC at the same time. Probably, the persistent withdrawals from Coinbase are a result of the recent bankruptcy speculation.

Overall balance on Exchanges have seen an aggregate outflow of -750k BTC since March 2020. The last three months alone have seen some 142.5k BTC in outflows alone, a remarkable 18.8% of the total.

Glassnode.

For the accumulation part, the supply of whales/largest (10k+ BTC) and shrimps/smallest (<1 BTC) holders increased as the exchange supply dropped. The smallest addresses are reportedly accumulating 60.46k BTC per month, “the most aggressive rate in history.” However, the supply of wallets holding between 10 to 10k BTC has made no noticeable change.