Bitcoin options aggressive skew on Valentine’s Day may finally be enough to see the apex cryptocurrency cross $10,000. This is according to Su Zhu, chief executive of Three Arrows Capital who argues Bitcoin Options could be in for a pleasant surprise on the 14th of February 2020.

Will it be enough to see Bitcoin cross $10,000?

It has been more than four months since Bitcoin last traded above the $10,000 mark. Bitcoin options have become an important metric of market sentiment, and it’s now suggesting a positive outlook for options expiring on Valentine’s Day.

Considering Bitcoin’s overall market conditions, Bitcoin Options aggressive skew is likely to have a positive impact on the coin’s price. Given that Bitcoin is currently trading just under $9,800 ($9,791.43) at the time of writing, it seems likely that the skew could result in gains pushing Bitcoin above the $10,000 level.

Zhu cites data from cryptocurrency exchange Deribit. The chart implies that contracts “BTC – 14FEB20” are substantially more bullish than the ones expiring on the 21st of February, 28th of February, or those expiring later on the 27th of March.

Deribit dominates the derivatives market

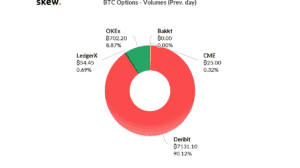

Bitcoin options on Deribit hold substantial weight given the exchange’s dominance in the derivatives market. So much so, in fact, that monitoring platform Skew Markets has revealed that Deribit accounts for over 90 percent of all Bitcoin options volume.

According to the data, Deribit saw a total 7,131 BTC equivalent volume traded, equating to a volume of close to $70 million ($69.93 million) at the time of writing.

Image source: Skew

To give more context, contracts expiring on the 27th of March have a volume of over 700 Bitcoin (708.1), and are bullish at a price of $12,000. Behind these are the Valentine’s Day contracts with $10,250 and $9,750, with 257.6 and 256.6 Bitcoin volume.

Image source: Skew

As reported, Deribit recently moved its headquarters from Europe to Panama. The decision came after the EU implemented the Fifth Money Laundering Directive (5AMLD) As such, Deribit is no longer under the control of Dutch company Deribit B.V., but by DRB Panama Inc.

Featured image by Pixabay