In the crypto community, there is a debate going on regarding the Bitcoin block size limit. And the community stands divided both in favor and against bigger sizes.

Some are totally in favor of larger blocks due to the perks that come along with it, such as less crowding and faster transactions.

While some don’t seem to agree with it and point out the inconveniences attached to large blocks, such as the bandwidth issue and they take up large storage.

When did the Bitcoin block size limit debate start?

However, back in 2008 when Satoshi Nakamoto first created Bitcoin, the block size limit was not introduced. It was introduced in 2010 when one megabyte (1MB) limit was instituted by him, giving birth to the debate.

It started gaining momentum over a period of five years as the transaction volume of Bitcoin started to rise.

After several proposals, the Bitcoin community increased it’s the limit of its block size to two megabytes (2MB) back in August 2017.

SegWit was also introduced by Bitcoin in November of 2017 to handle signatures efficiently and to free up some block space.

This addition of SegWit lead to the splitting of Bitcoin Cash and opted for the eight megabytes (8MB) limit that later increased up to thirty-two megabytes (32MB) in May 2018.

History repeated itself and in November of 2018, there was a split between Bitcoin SV from Bitcoin Cash to introduce a one hundred and twenty-eight megabytes (128MB) limit, which was then raised to two gigabytes (2GB) in July 2019.

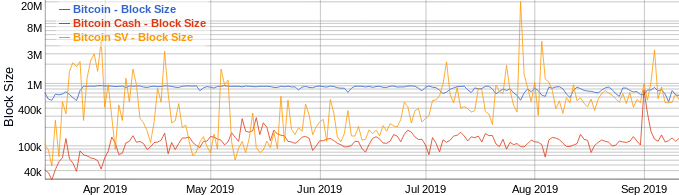

Though the block size limit of these three blockchains, namely Bitcoin, Bitcoin SV, and Bitcoin Cash is different from each having ten minutes block time, roughly.

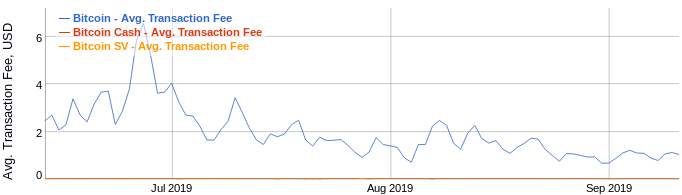

So, in order to observe their performance, it is best to do it indirectly rather than Bitcoin block size limit. Moreover, Bitcoin Cash and Bitcoin SV have almost zero fees and this indicates that users need not to compete to in order to get their transactions included in the upcoming blocks:

However, low demand could be yet another factor involved in the high performance rather than the size of the block.

Furthermore, Bitcoin SV and Bitcoin Cash hardly ever reach their full block capacity, and typically their average bloc sizes are way low than those that are found in the Bitcoin.

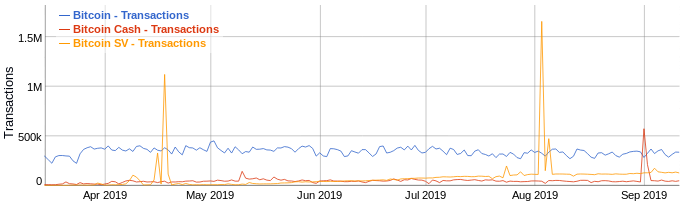

Also, both the blockchains have lower transaction volumes than that of the Bitcoin, as illustrated above. Whereas, Bitcoin price against the United States dollar stands much higher than the two hard forks resting the case for comparison.