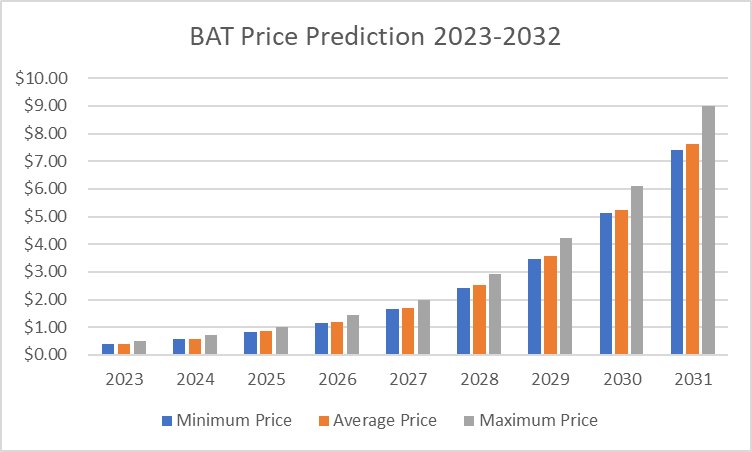

BAT Price Prediction 2023-2032

- BAT Price Prediction 2023 – up to $0.37

- BAT Price Prediction 2026 – up to $1.23

- BAT Price Prediction 2029 – up to $3.45

- BAT Price Prediction 2032 – up to $10.24

Basic Attention Token (BAT) is one of the cryptocurrencies taking the crypto space by surprise. This project will make massive improvements in the digital advertising space and related fields.

As crypto markets plummet, Basic Attention Token, the crypto behind the privacy-centric web browser Brave, is currently defying the downturn. The BAT community can start earning and using BAT now in the Brave browser. They’re making crypto and DeFi accessible for everyone.

Knowing the Basic Attention Token price is essential for creating a wise investment move. If you are concerned about BAT price prediction, you are in the right place.

How much is BAT worth?

Today’s Basic Attention Token price is $0.269324 with a 24-hour trading volume of $23,856,024. We update our BAT to USD price in real time. Basic Attention Token is down 0.93% in the last 24 hours. The current CoinMarketCap ranking is #91, with a live market cap of $402,597,620. It has a circulating supply of 1,494,845,201 BAT coins and a max. supply of 1,500,000,000 BAT coins.

What is BAT?

The Basic Attention Token (BAT) was created for the Brave Browser in 2015, and developed on the Ethereum platform. BAT is Brave browser’s utility token. It was meant to make a remarkable difference in users’ experience in the digital advertising space. The project came on board to solve some issues plaguing the online advertising space.

Basic Attention Token is a project that garnered attention as soon as it entered the crypto discourse. The brain behind the BAT project created a JavaScript programming language intending to get people’s attention all over.

BAT founding team

The founder desires to reach great heights with the project within ten years. BAT’s capability to affect the online advertising space makes it a great project.

There was an ICO for the project on the 31st of May, 2021, and BAT exploded to realize $35 million within 30 minutes.

The creators have maintained their goal, and the project has supported this line of progress over time. Presently, there are up to 5.5 million active monthly users of the platform.

BAT has caught the attention of people since it came into the business. Brendan Eich, an American programmer and the originator of JavaScript and Mozilla Browser, is interested in the project.

What is the mission of Basic Attention Token cryptocurrency?

BAT aims to solve some issues in the digital advertising space and bring some benefits to users, advertisers, and everyone concerned. Given the technological breakthrough that has reordered the advertising firm globally, it is only expected that more technological innovations will come on board to improve the system.

Given that people are getting more versed in social networking and advertising and the tools involved, some improvements are needed. For instance, ad-blocking software is in demand for millions of smartphones and computers.

Considering the resources that go into viewers’ data and the number of people using these platforms, it becomes relevant to improve the system, which BAT has come to do.

Advertisers and Publishers

BAT has improved users’ experience as well advertisers’ and publishers’ returns in a significant way. With BAT, the level of accuracy has improved.

These advertisers can have publishers take their ads to the end-users for just a token. The result is that advertisers can now have improved targets for their audience and get better returns for their expenses. However, the models work best with fewer ads.

Users can earn while they use the internet. They deserve BAT when they view Brave ads. The brave browser uses ML machine learning technology to monitor attention.

With the improved experience, BAT has helped the entire society. BAT has partnered with renowned and well-respected brands like Amazon, Apple, Starbucks, and Uber, and these alliances have accepted the use of coins on their websites. These partnerships have advertised the brand to millions of people and have improved its acceptability among users.

BAT Price History

BAT held its initial coin offering at $0.04 which ended on 31 May 2017. The coin has to date recorded a return on investment (ROI) of 58.8% from its earliest known price. Coinmarketcap listed the first BAT price at $0.17 in June 2017; BAT set its all-time high price on 28 November 2021 at $1.92. Its lowest price ever was $0.006621.

BAT has been on a continuous downward trend from this year’s opening price of $1.21. It has lost 70% of its value this year.

BAT Technical Analysis

BAT price analysis shows the BAT token has been trading in an ascending trendline, climbing from a $0.1971 low to a monthly peak of $0.3161 on May 8. The token price action shows an “M” shaped pattern since the beginning of January, with the lower boundary of the pattern at $0.20 and the upper boundary at around $0.30.The prices have declined gradually since peaking on May 8, but the trendline still remains intact.

The Basic Attention Token is trading at $0.268, down by over 9% in the last 24 hours. The BAT/USD pair has been trading in a descending channel since Jan 15, and the downward pressure remains strong.

The MACD indicator has dropped into negative territory, with the histogram showing increased bearish momentum. The 50-day EMA line is also trending below the 100-day EMA line, indicating further downside on the cards.

On the flip side, if buyers can push back above $0.280, we could see an upward reversal that could take BAT back to its previous highs. If the bulls can break out of the descending channel, there is a chance of a breakout and a rally toward the $0.32-0.34 level in the near term.

The Relative Strength Index (RSI) indicates that BAT is oversold, with the indicator at around 28. This suggests a chance of a price reversal in the near term, which could take BAT prices to the previous high of $0.30.

A break above this resistance level could lead to a larger upside and possibly push BAT’s prices toward its monthly high of $0.3161.On the downside, the first major support level is at around $0.255, and if this fails to hold, BAT could fall further toward the 50-day EMA line, around $0.23.

The prices could face resistance at the Fibonacci retracement level of 23.6% ($0.29), which is an important level for bulls to break above in order to extend the upside momentum.

Overall, BAT looks bearish on the daily time frames, with a potential downside target at $0.23. However, if buyers manage to push back above the $0.30 resistance level, they could set up a possible rally toward the $0.32-0.34 level in the near term. The next major support is at $0.20; if this fails to hold, we could see a downside extension toward $0.17 in the near term. The BAT token has been trading in a wide range for the past several months and is likely to remain volatile in the short term.

BAT Price Prediction by Cryptopolitan

BAT Price Prediction 2023

The Basic Attention price prediction for 2023 is BAT crypto to trade at a minimum price of $0.40 and an average forecast price of $0.41.The BAT token could potentially surge to a maximum value of $0.49 by the end of the year.

BAT Price Prediction 2024

The basic Attention Token price prediction for 2024 is a minimum price of $0.57, an average trading price of $0.59, and a maximum price of $0.71.

BAT Price Prediction 2025

The Basic Attention Token price prediction for 2025 expects the token to have a minimum price of $0.84, an average forecast price of $0.87, and a maximum value of $1.02 by the end of 2025.

BAT Price Prediction 2026

The Basic Attention Token price prediction for 2026 suggests the price of Basic Attention Token could reach a minimum of $1.15. The BAT price is predicted to reach a maximum level of $1.44, with an average trading price of $1.19.

BAT Price Prediction 2027

Our Basic Attention Token price prediction for 2027 is a minimum value of $1.66 and an average price of $1.71. Basic Attention Token’s price could reach a maximum value of $2.00 by the end of 2027.

BAT Price Prediction 2028

Our Basic Attention Token price prediction for 2028 expects the BAT token to reach a minimum value of $2.42 and an average price of $2.51. The maximum BAT coin price could potentially reach up to $2.92 by the end of 2028.

BAT Price Prediction 2029

The Basic Attention Token price forecast for 2029 expects the BAT token to continue on an uptrend, with a minimum value of $3.45 and an average price of $3.58. The maximum BAT token price could reach up to $4.21 by the end of 2029.

BAT Price Prediction 2030

In 2030, the Basic Attention Token BAT price prediction is a minimum price of $5.11, an average forecast price of $11.19, and a maximum value of $6.09 by the end of the year.

BAT Price Prediction 2031

The Basic Attention Token price forecast for 2031 expects steady growth in overall BAT coin price, with a minimum value of $7.42 and an average price of $7.63. The maximum BAT coin price could potentially reach up to $8.99 by the end of 2031.

BAT Price Prediction 2032

The Basic Attention Token BAT price forecast for 2032 expects a minimum of $10.81 and an average of $11.19. The BAT token price could trade at $12.84, the highest price for the year.

Basic Attention Token Price Predictions by Wallet Investor

Wallet Investor has a bearish BAT price forecast for the next year as the website expects Basic Attention Token cost to go down by -97.7% from $0.266 to $0.0220 in one year. The website says the BAT token is a bad, high-risk one-year investment option. BAT price prediction for 2025, 2030, and 2040 is $0.0168, $0.0098, and $0.0063, respectively. Wallet Investor believes that Basic Attention Token will decrease in value and is not a profitable investment option.

Basic Attention Token Price Predictions by DigitalCoinPrice

DigitalCoinPrice has a bullish outlook on the future price of BAT tokens as the website suggests a buy rating for Basic Attention Token. According to the website, BAT’s price can reach $0.58 by the end of 2023 and potentially reach up to $1.21 by 2025.

DigitalCoinPrice also projects that the BAT token can hit a high of $2.78 in 2030 and will be trading at a price of $5.19 by 2032.

BAT Token Price Predictions by Coincodex

Coincodex provides predictions for the BAT token as well by looking at historical data, fundamental analysis, and extensive technical analysis. According to Coincodex’s BAT predictions, the current price trend is bearish, and a potential upsurge of about 17% is expected in the short-term prediction, with a possible maximum price of $ 0.311593 by February 15, 2023.

In terms of long-term BAT price predictions, Coincodex suggests that the coin could hit a high of $1.11 by 2025, $ 9.91 if the token follows Facebook growth, with a maximum price prediction of $ 1.136446 could Basic Attention Token follow internet growth. Coincodex suggests it is a good time to buy Basic Attention Token.

Based on Coincodex Basic Attention technical analysis, Basic Attention Token price prediction sentiment is bearish, with 12 technical analysis indicators signaling bullish signals and 17 signaling bearish signals.

BAT Price Predictions by Industry Influencers

BAT cryptocurrency is expected to continue its long-term uptrend by the end of 2023. The token already made a positive push in 2023, gaining more than 67.48%, which makes it one of the best-performing altcoins this year in the crypto market.

Youtube-based altcoin prediction channel the Crypto Vault is optimistic about the future of BAT as they forecast that by the end of 2023, the token may reach a high price of $0.45 per coin. With its current market capitalization and liquidity, BAT is expected to be one of the top digital assets in terms of value and total market cap in the coming years.

On the other hand, a Popular market analyst on Reddit, Sir X, predicts that the BAT token price may reach up to $1.40 by the beginning of 2024 but expects a possible dip in-between before reclaiming its bullish momentum. The market expert has given a fundamental analysis of the user growth of the Brave web browser and believes that a rise in the number of users will also directly affect the BAT token’s price.

According to Sir X, Brave is gaining tremendous momentum, with its daily active user base recently surpassing 2.8 million and monthly active users now exceeding 8 million. Brave boasts an impressive 290,000 verified publishers in total – 200,000 of which are YouTube creators, 33,000 text bloggers, and 15,000 Twitch gamers. Furthermore, 28,0000 Twitter accounts have recently signed up to collect BAT rewards.

Since Brave Ads launched six months ago, the platform has seen an impressive partnership surge. In total, there have been 385 campaigns onboarded to the Brave network and generated over 97 million ad confirmation events!

Ad Platform engagement is absolutely impressive, boasting a click-through rate of 14%—far exceeding the crypto industry average of 2%. Even more remarkable? 12% of those clicks result in page visits that last 10 seconds or longer. Practically every marketer will tell you – this kind of success is remarkable.

BAT price predictions may differ from one cryptocurrency market analyst to the other, but what is certain is that Brave and its Basic Attention Token have a bright future ahead of them. With the potential user base growth and a wide range of partnerships, BAT may reach new heights in the coming years.

Conclusion

Basic Attention Token has a lot of potentials as it solves a real problem in the digital advertising industry plagued by fraud and privacy concerns. The token is also backed by a strong team with a lot of experience in the crypto market. The BAT ecosystem has continued to draw investors who use the platform to explore opportunities its ecosystem presents, including Defi, the crypto market, and NFTs.

BAT has experienced tremendous growth since its integration into Brave browser, a global private ad platform. Brave boasts over 55M active users, 1.5M verified creators, millions of wallets, and thousands of ad campaigns. The coin is now bridged on the Ethereum and Solana blockchains.

Predicting cryptocurrencies can be a tricky business as the slightest change in the market can have a significant impact on prices. Despite this, many experts have given their Basic Attention Token price predictions for the next few years. Among the myriad of cryptocurrencies, Basic Attention Token (BAT) is one that particularly stands out. This is because the token solves a real problem in the digital advertising industry plagued by fraud and privacy concerns.

According to the BAT whitepaper:

Digital advertising is broken. The marketplace for online advertising, once dominated by advertisers, publishers, and users, has become overrun by ‘middleman’ ad exchanges, audience segmentation, complicated behavioral and cross-device user tracking, and opaque cross-party sharing through data management platforms.

These intermediaries not only take a large share of the revenue but also collect and sell user data without the consent of the users. This results in a loss of privacy for the users and a generally bad experience.

The BAT solution is to create a decentralized, transparent digital advertising platform on the Ethereum blockchain that eliminates the middleman and allows direct interaction between advertisers, publishers, and users. Users will be rewarded with free Basic Attention Tokens for viewing ads which they can then use to tip their favorite content creators or redeem for premium content.

The long-term Basic Attention Token price predictions seem very optimistic as the prices are expected to surge in the next few years. However, it is not certain that BAT will be able to achieve mainstream adoption as it faces stiff competition from other digital advertising platforms such as Google and Facebook. Nevertheless, if the team can execute its vision successfully, then the Basic Attention Token could potentially revolutionize the digital advertising industry.

The above projections are based on analysis and price history. Investors are advised to do their own research and due diligence before investing in cryptocurrencies. This is not investment advice.