Silicon Valley Bank’s (SVB) downfall resulted from an unfortunate combination of losses, uninsured leverage, and an extensive loan portfolio. However, this has acted as a stark reminder of the fragility of the traditional financial system and highlighted the vulnerability that many US banks are now facing. According to a recent economic analysis, should even half of the uninsured depositors choose to withdraw their funds, nearly 190 banks are at risk of collapse, with an estimated $300 billion in insured deposits potentially on the line.

Central banks’ monetary policies can have an adverse effect on long-term investments such as government bonds and mortgages, leading to losses for banks. In addition, the report details that insolvency is determined when the market value of a bank’s assets falls short of the amount needed to repay all insured deposits after paying all uninsured depositors. Consequently, this could leave banks with a major deficit.

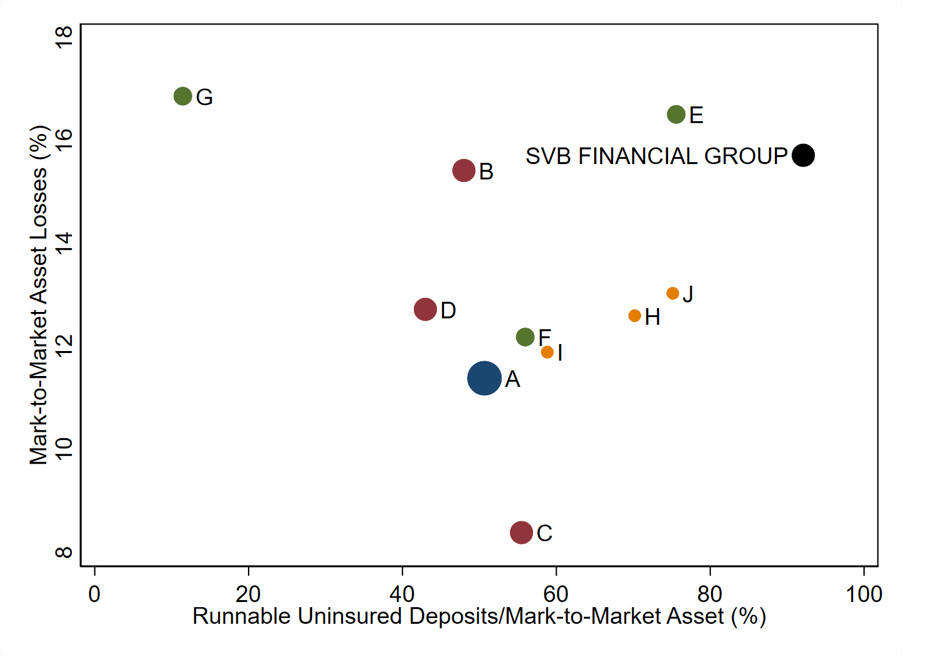

The data in the above graph represents the assets of U.S. banks based on call reports for Q1 of 2022. As seen, SVB has the highest asset value among all banks, with $218 billion. However, those in the top right corner have been affected the most by asset losses and have large amounts of uninsured deposits compared to their mark-to-market assets.

The recent rise in interest rates, contributing to a total loss of $2 trillion in the U.S. banking system’s market value of assets and the large share of uninsured deposits at some banks, has caused significant fragility and threatens the stability of the banking sector. According to the study, this has significantly increased the chances of a run on uninsured deposits.