- Uniswap is now ranked on Defipulse as the fifth-largest platform in the DeFi market.

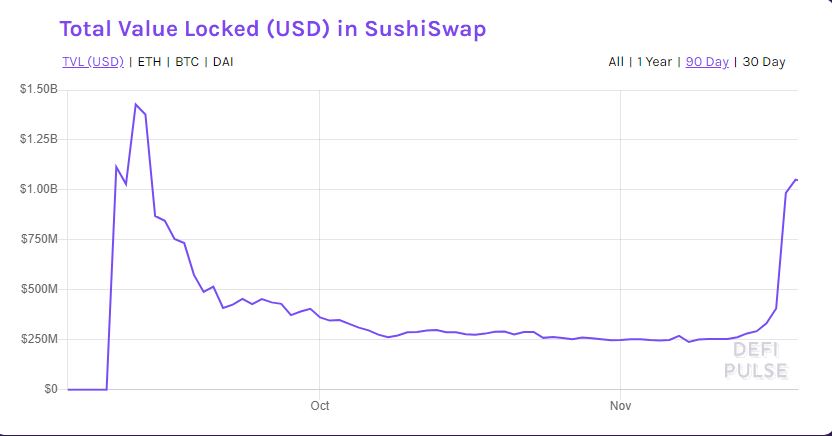

- As the exchange lost liquidity, other rivals like SushiSwap gained more liquidity.

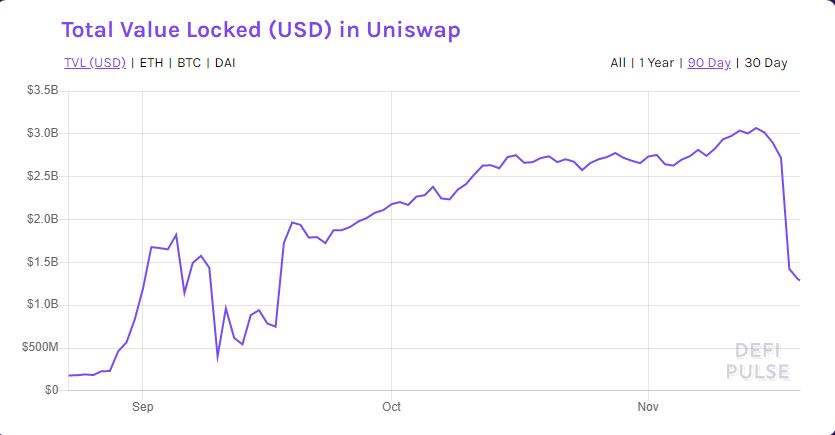

Leading decentralized exchange (DEX), Uniswap hasn’t been in good shape since the conclusion of its liquidity reward program on November 17. Within a period of 24 hours, the total value of assets locked on the protocols decreased by more than $1 billion, dropping the exchange’s market dominance to the third-largest at the time. Today, the decentralized exchange has dropped further, as its rivals continue to launch vampire incentives to scoop its liquidity.

Uniswap assets decrease as rivals’ soars

According to Defipulse, a DeFi market analytics platform, the DEX is currently the fifth-largest protocol in the decentralized finance market. The remaining assets on the platform are worth $1.29 billion. The massive withdrawal of assets from the platform began the next day after Uniswap reached $3.015 on November 15. Comparing the stats with the current record, the leading exchange lost over $1.7 billion in assets within fours.

Following the top DeFi protocols, one can easily conclude that Uniswap liquidity has been moving to other rivals, especially SushiSwap, which was forked from it. At the moment, SushiSwap is the closest and sixth-largest protocol with an asset valuation of $1.05 billion. It has a positive 24-hour assets change of 1.88 percent, while the leading DEX is tanking by 11.09 percent.

To understand this better, SushiSwap had only a total of $571.79 million in assets, as Cryptopolitan reported on November 17. This is an exponential growth compared to its stats at the beginning of this month.

Vampire incentives

As Uniswap ended its liquidity reward program, SushiSwap used that opportunity to scoop its liquidity provides, announcing incentives for the same four pair incentivized by the leading DEX. Yesterday, 1inch also announced an incentive for liquidity providers.

“Right now, we’re seeing a lot of other projects launching incentives after Uniswap’s ended,” said Sergej Kunz, the CEO of 1inch. “We decided to announce our new liquidity mining program in order to hunt for the freed up liquidity from the Uniswap.”