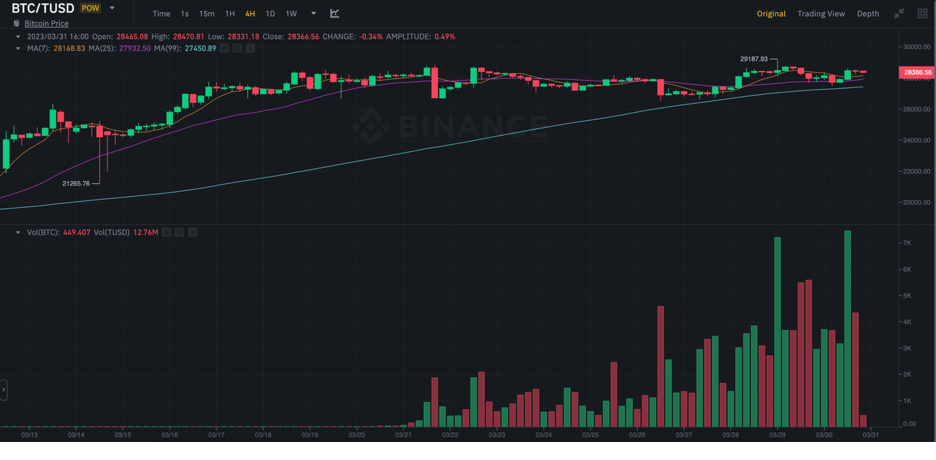

Trading with TrueUSD (TUSD) has seen a significant surge over the week, as reported by crypto price tracker CoinGecko. This is largely attributed to Binance‘s support for the stablecoin, offering zero-fee discounts when buying and selling Bitcoin (BTC). CoinGecko data shows that TUSD’s 24-hour trading volume exceeded $1 billion on most days of Thursday and Friday. This is a remarkable increase from earlier in the month, which saw TUSD’s daily trading volume remain mostly below $100 million. According to Binance data, the BTC-TUSD pair alone recorded an impressive $713 million in trading volume over the past 24 hours.

The recent surge in popularity of TUSD, a stablecoin, can be attributed to Binance, the world’s largest crypto exchange by trading volume. Following a regulatory crackdown on its own Binance USD (BUSD), which is issued by Paxos, a fintech firm based in New York, and ordered to stop minting tokens there, Binance reinstated TUSD on its platform. On March 22nd, a zero-fee trading promotion was granted to the BTC-TUSD pair before being extended this week to other popular coins such as SOL, OP, MATIC, and XRP. This move increases the appeal of TUSD as a favored stablecoin trading pair on Binance.

Last week, Clara Medalie, head of research at crypto market data provider Kaiko, reported that Binance has chosen TUSD as the likely successor to its namesake stablecoin. This rapid growth in the $132 billion stablecoin market reveals a drastic reshuffling because of several regulatory actions and banking issues. TUSD has particularly benefitted— its market capitalization has more than doubled since the start of this year, growing from beneath $800 million to over $2 billion, making it the fifth-largest stablecoin in circulation.

ArchBlock, a digital asset firm, is the issuer of TUSD and its intellectual property belongs to Asian investment conglomerate Techteryx. There has been speculation linking crypto investor Justin Sun to the token; however, this was denied by ArchBlock. This comes in light of a recent lawsuit filed against Sun by the U.S. Securities and Exchange Commission (SEC) for market manipulation.