The Crypto market is facing one of the toughest years but this week is, even more, worsening due to the FTX dilemma. It is going deeper and deeper into a pit from where there is no coming back. Within a week it went from one of the top crypto exchanges to penniless and its sister token FTT has lost more than 80% of its worth.

The FTX community constantly ensured the people did not worry about withdrawal but now they should worry about it. The problem started with Binance’s announcement that they are going to liquidate all of its FTT tokens to rescue its exchange from another Luna-like crash. This saw enormous withdrawal from the FTX exchange and it was on the verge of disaster when Binance came with another announcement.

Binance and FTX; the love-hate story

On Tuesday this week, Binance announced that they are going to buy FTX, the fourth-largest exchange. This made the situation a bit under the control. However, on Wednesday, Wall Street announced that Binance is backing up from the plan and they have no intention to buy FTX. This was a shock for the crypto market and the shock became shocker when Binance confirmed the news.

Semafor reports that Binance has issued a statement saying that “The issues are beyond our control or ability to help,..”. According to the report, Binance’s intention to back out is due to the “mishandled customer funds and alleged US agency investigations.”

FTX; downtrend tendency

The company that backed dozens of companies now needs a company for its survival but no one is there to give it a hand. FTX had bought the naming rights of NBA, the Heat, and bailed out several top crypto firms during the financial crisis. Only a few months ago it had stacked in companies like Robinhood and Skybridge.

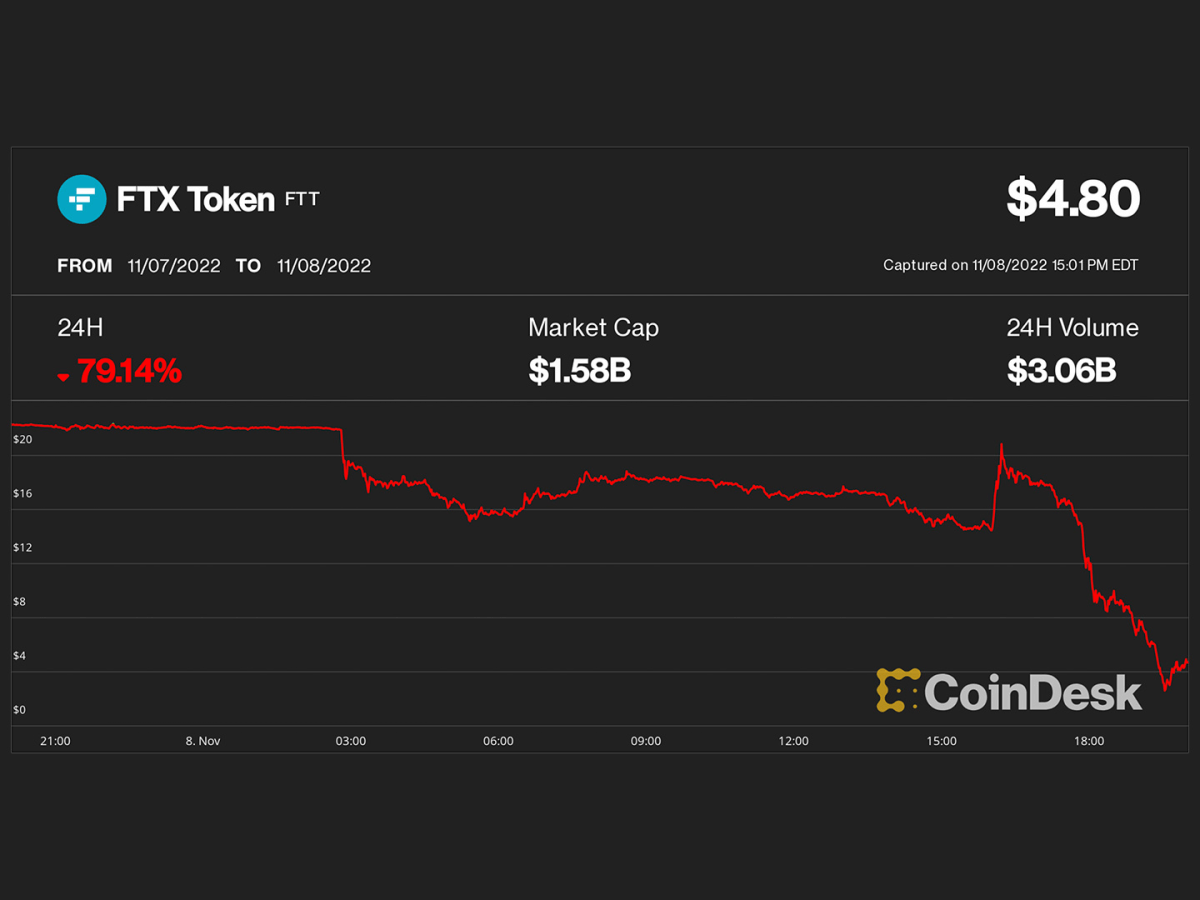

Now it is fighting the war for its survival. Its sister token FTT has lost more than 80% of its worth. Billions of withdrawals happened from this exchange in a few days. The semafor reports that “Most of FTX’s legal and compliance staff quit Tuesday evening, people familiar with the matter told Semafor, leaving few executives who could answer questions that now loom large over the firm.”

Additionally, the firm had requested Silicon Valley and Wall Street billionaires for a $1 billion bailout hoping to control the situation. But it might not work for them because the damage has already been done to the company and its survival is now at stake.

How FTX came to this?

No one knew that something this terrible could happen to FTX. The cracks begin to start with news shared by CoinDesk. It broke the news that Alameda Research has a large sum of FTT tokens on its balance sheet signaling that it does not rely “on an independent asset like a fiat currency or another crypto,” the first victim of this news was FTX because FTT is created by it.

The news created uncertainty and uneasiness among the investors and they started to sell out their tokens. This dragged down the price of FTT to an abnormal level creating more distress. People sell out FTT not only on FTX but also on several other crypto exchanges making the situation worse for the company. The Semafor site writes that “The CEO of Alameda research and a spokesman for FTX didn’t immediately return requests for comment.”

Final thoughts

May is not far away and the crypto industry is facing another crash. Many crypto experts do believe that this could be tougher than the earlier collapse of Terra LUNS and the crypto hedge fund 3AC. Since last year, crypto is facing a lot of problems in the shape of hacking, crashing, and selling out.