Bitcoin price movement is the very key that holds power to move and sway the price charts across the cryptocurrency market, and that makes it of tantamount importance day in day out.

While the market sentiment makes a huge contribution to the Bitcoin price movement and even the power to cause sway in the market, this is where retail traders come in, a force to be reckoned with when it comes to the number of transactions in a day.

Traders view on Bitcoin price

Kraken recently conducted a user poll, and the results revealed that the majority of traders are anticipating that before 2021 Bitcoin would be breaking all-time highs.

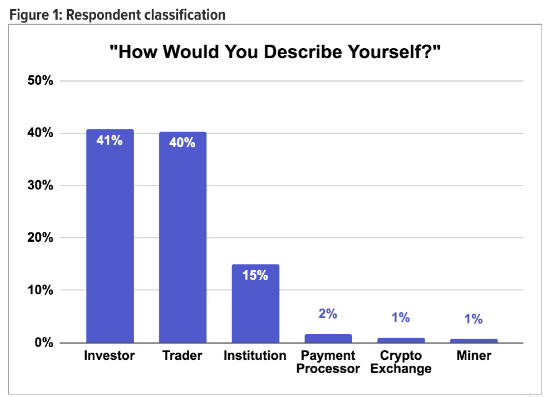

In the poll, the responses of highly respected 400 crypto traders on Kraken were analyzed. Around 41 percent of respondents identified themselves as investors, 40 percent as traders, 15 percent as institutions, and the remaining 4 percent comprised of payment processors, crypto miners, and crypto exchanges.

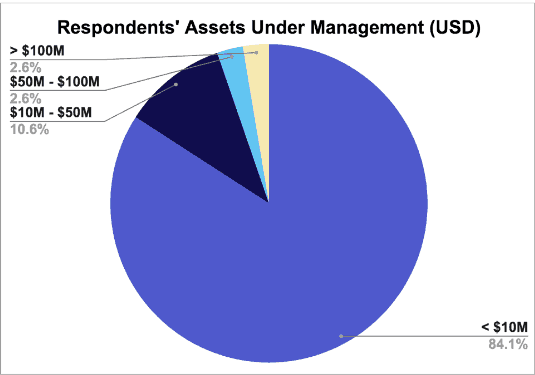

Per the poll results, about 84 percent of respondents manage below $10 million capital, whilst 11 percent manage between the range of $10 million and $50 million. The 6 percent remaining is divided evenly between the traders that manage $50million to $100 million and the traders that mobilize over $100 million.

Per the survey, Bitcoin’s average price target for the year 20202 is $22,866. However, traders are not expecting Ethereum to experience new highs with the average price target of $810.

As a whole, the market sentiment seems slightly bullish. About 44 percent of participants stated that there is a bullish trend in the cryptocurrency markets. 22 percent participant believes that a bearish trend is prevailing, while 34 percent stated that they are not sure.

It seemed that there was little understanding among the traders as to which factors would accelerate the Bitcoin price growth over a period of 12 months. The topmost answers indicated the 19 percent think that adoption would accelerate the growth. While another 15 percent viewed the upcoming halving event of Bitcoin as a potential factor for growth.

Another 11 percent thought that political conflict could also be a contributing factor, fear of missing out was chosen by 11 percent, and 9 percent think that economic crisis would be the driving force behind the growth acceleration of crypto.

The sentiment makes the market sway, and in the current Bitcoin price halt after the short run, it is not very certain which way it would rest.