The SUI tokens launch on Binance‘s Launchpool has drawn much attention from the crypto world. Validators can vote on upgrades according to the Amount they have staked via SUI, which is used for network support and staking. The involvement of Justin Sun and the prospect of legal action have increased the interest in the growth of the SUI token.

What is SUI Token and how is it used?

SUI supports and runs the Sui network, specifically to cover transaction and administrative costs and compensate validators for protecting the network. Validators can vote on network upgrades by possessing and staking SUI, and each vote is proportional to the amount of SUI they stake.

Holders who transfer their tokens to validators and so distribute their votes among other users are also rewarded by Sui. Delegators can change their allocation after each epoch, which is a 24-hour period, which encourages validators to act honestly.

According to a CNBC report, Binance stated that SUI tokens would be made accessible through its Launchpool, which enables users to deposit their crypto holdings into a liquidity pool and get rewards. The launch of SUI tokens on Binance Launchpool significantly increased interest in the SUI token within the cryptocurrency community.

Justin Sun, the founder of Tron, made a large deposit of TrueUSD (TUSD) stablecoins into Binance following the announcement, which is needed to farm SUI tokens. Whale Alert, a program that monitors significant asset transfers between blockchain addresses, discovered the transfer.

Changpeng Zhao (CZ) tweeted that the Launchpool was created for retail users and not simply whales after the move attracted the community’s attention.

Justin Sun would face repercussions from CZ if he uses any of the deposited TUSD to acquire Launchpool SUI tokens, as the business was suspicious of a possible SUI token grab and threatened legal action. In response, Justin Sun clarified that the deposit was not intended to participate in any exchange promotion but to facilitate market-making across the top TUSD exchanges.

SUI Tokens Staking – What are the requirements?

A set of validators, each with a specific amount of stake from SUI tokens holders, process operations. Each validator’s voting authority for processing transactions is proportional to their share of the network’s total stake. Staking SUI signifies that the SUI tokens are secured for a predetermined period of time, known as an epoch. When an epoch changes, SUI token holders are free to redeem their SUI or transfer their stake to a new validator. Here are the requirements forstaking SUI:

1. A validator must stake a minimum of 30 million SUI.

2. A validator must maintain a minimum stake of 20 million SUI.

3. No set minimum must be delegated. Please note that a delegator must pay additional gas fees in SUI tokens.

4. There is no set time limit for staking. After each era, delegators can shift validators or withdraw SUI.

5. There is no cap on the length of stakes for validation.

6. Delegation fee rates start at 2%.

How to Stake SUI Token

Step 1: Install the SUI wallet

To start staking, install the SUI wallet extension. There are various applications with nearly identical names, so use caution while clicking any links.

The SUI network and the native SUI wallet support the Ledger wallet.

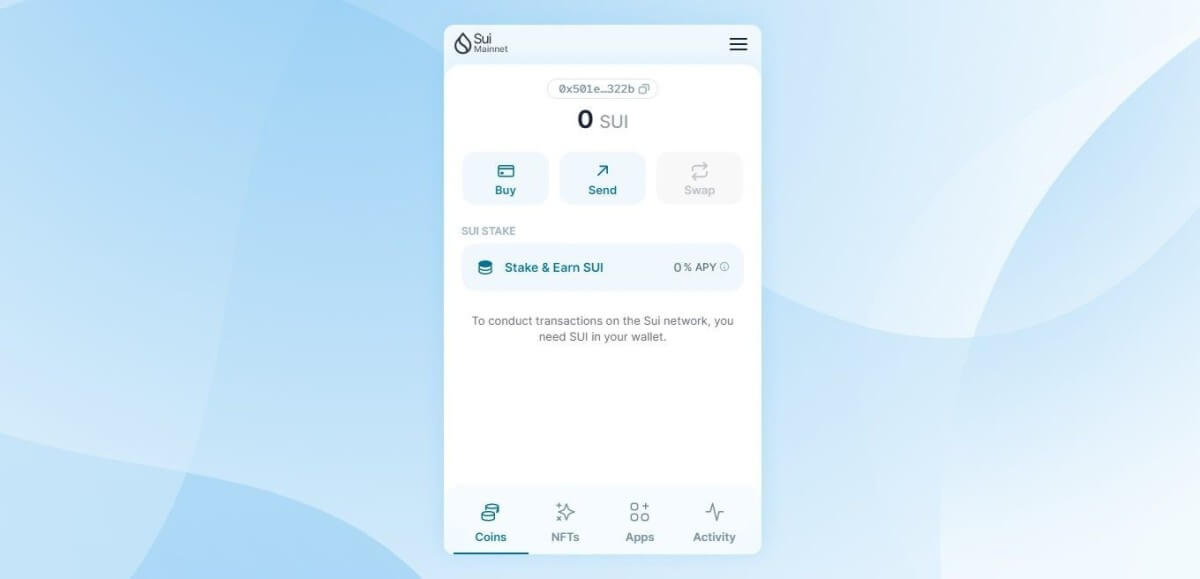

Here is what the setup looks like after:

Step 2: Buy SUI

The SUI network presently allows customers to purchase SUI using Transak or MoonPay.

Unfortunately, the network is incompatible with widely used wallets because SUI uses the ‘Move’ programming language.

The minimum SUI purchase quantity on Transak for card payments and Google Pay is $30 (as of this writing), with fewer costs. The minimum rate is the same for MoonPay.

Step 3: Choose SUI validators

Click ‘Stake & Earn SUI’ on your dashboard after you have SUI in your wallet.

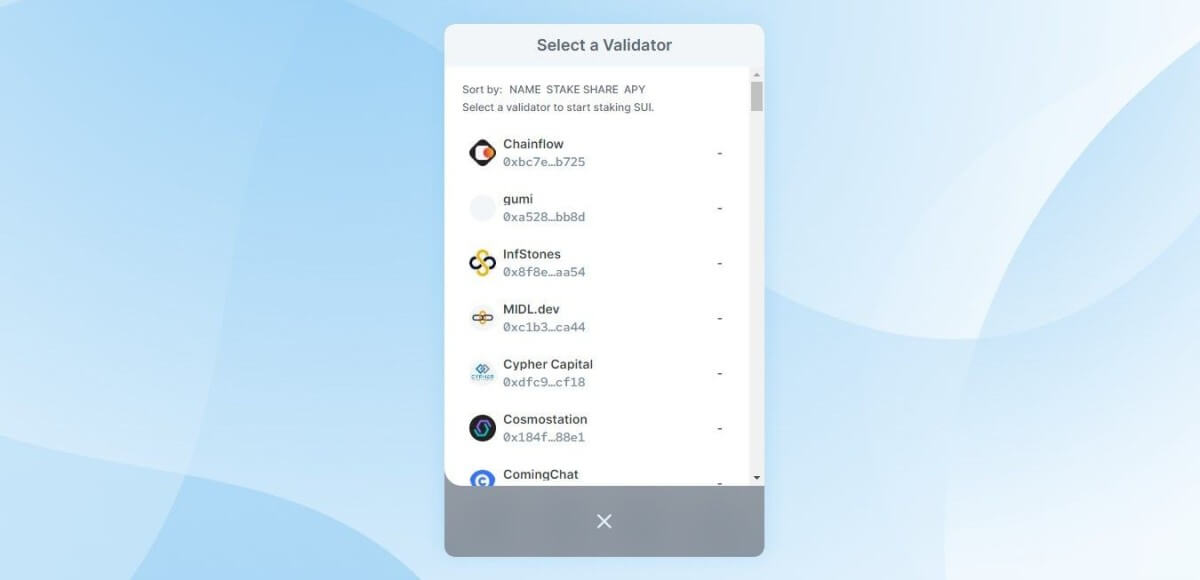

You can arrange the validator list by name, stake share, or APY depending on your priority.

Select Amount by clicking on the validator.

All the validator’s metrics are available, including the staking APY, stake share, Amount staked, start and end times for staking rewards, as well as gas costs.

Step 4: SUI delegation

Click “Stake Now” after entering your stake amount.

You’ll have to hold out until the delegation is officially confirmed. As stated in the start time for staking rewards, this procedure takes approximately 6 to 7 hours.

Once your delegation is approved, you can begin collecting stake incentives. You will receive incentives in SUI depending on how many tokens you have delegated and how long you have been staking.

Step 5: Unstake SUI

Similar steps to delegating your SUI must be taken if you choose to unstake your SUI token. After choosing the validator, you must unstake your tokens.

Each period’s end allows SUI token owners to unstake their SUI or change their stake to a different validator, as stated in Sui.io.

Crypto exchanges where to get SUI

Binance

Binance Launchpool, a DeFi platform that enables users to farm new assets, was announced as the first place where users will be able to farm SUI.

OKX

According to a blog post, SUI will also be accessible through the Jumpstart platform of the Seychelles-based cryptocurrency exchange OKX. The exchange announced last month that holders of OKB, the exchange’s native token, could purchase tickets for a token allocation lottery as a way for users to get involved early. Then, lottery winners would be permitted to purchase SUI.

KuCoin

KuCoin has stated that investors will have quick access to tokens. According to the exchange, the only trading pair will be SUI/USDT, and USDT-margined futures will be offered once USDT’s liquidity is sufficient.

Bybit

On May 3, Bybit held an SUI “recognition sale” in which only a small number of members of the community could purchase the token. Retail traders will be able to trade the SUI/USDT and SUI/USDC pairings.

📣 $SUI will be listed on #Bybit Spot on May 3, 12PM UTC. @SuiNetwork

— Bybit (@Bybit_Official) May 2, 2023

Explore $SUI now: https://t.co/OOX2eavzdW #TheCryptoArk #BybitSpot pic.twitter.com/pAXHGlOm8K