On March 10, the California Department of Financial Protection and Innovation (DFPI) ordered Silicon Valley Bank, a major financial institution for venture-backed companies, to be closed—making it the first FDIC-insured bank failure in 2023. The DFPI did not disclose why the shutdown was necessary but appointed the FDIC as receiver to protect all insured deposits.

The FDIC announced that depositors would have full access to their insured deposits no later than Monday, March 13, 2023. Additionally, uninsured depositors will receive a “receivership certificate” for the remaining amount of their uninsured funds and be entitled to future dividend payments once all assets from Silicon Valley Bank (also known as SVB) have been sold. The bank operates 17 branches in California and Massachusetts; all will open on the 13th to allow depositor access.

SVB, one of the largest banks in the United States by total assets, faced a swift downfall less than 48 hours after disclosing its need to raise $2.25 billion in stock to maintain operations. In its mid-quarter financial update, SVB revealed that it had sold $21 billion in securities at a staggering loss of $1.8 billion. In addition, the bank has been providing financial services to well-known crypto-focused venture firms such as Andreessen Horowitz and Sequoia.

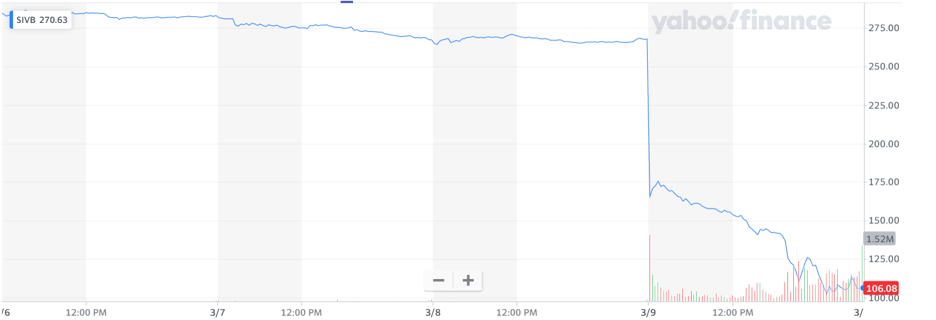

On March 9, SVB stock (SIVB) experienced a shocking 60% drop in value, and trading was immediately halted due to extreme volatility. This marked the biggest single-day wipeout in history.