Up until a few years ago, any business looking to raise capital had two major ways of doing so effectively. The first was turning to venture capitalists or angel investors to finance their projects. The second was to rely on crowdfunding by the power of the internet.

However, the rise of cryptocurrency in the 2010s allowed for a new channel for investment, one that was all the rage circa 2016 – 2017. The phenomenon in question was token sales, also known as the Initial Coin Offering (ICO).

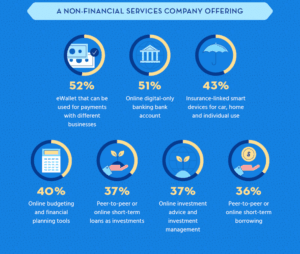

Token sales made the rounds a few years back as a revolutionary way to get enterprises funded quickly. Plenty of startups, in particular, have leveraged ICO’s to rise up and massively impact industries – such as the disruption of the financial sector.

For a good two years, entrepreneurs and investors talked up a storm about token sales. Enormous sales amounted to billions of dollars fueling business growth per year, and it seemed like the sky was the limit for the ICO model.

However, the trend eventually slumped in popularity by 2018. Mind you, it still helped raise some hefty capital – the $14.5 million Bitwala ICO certainly attests to that – but the numbers obviously waned in comparison to prior precedent.

And now, with 2020 here, many are wondering whether the prospect of token sales is worth pursuing anymore. But are these doubts justified? Should businesses still consider token sales a valid option for capital raising in 2020?

That’s what we will be trying to discover in this article. But some of you might not be aware of what token sales, a.k.a., ICO’s, are. So, before we move on with our analysis, we ought to clear up any misunderstanding.

Token Sales Explained

Token sales are inseparably tied to cryptocurrency and blockchain projects. In essence, they are a crowdfunding effort for such enterprises, with a bit of a crypto twist. That said, it’s difficult to pin it exactly as a crowdfunding effort since they also often give some authority to the investors after the project is completed. But let’s not get too ahead of ourselves: how does the process actually work?

Token sales involve a company selling a limited amount of its own crypto tokens to investors in exchange for money (usually in the form of Bitcoin or Ether, Ethereum’s native coin). They usually post all the details regarding the project for the public to see online (the team, deadlines, goals, whitepaper, and the like) so that people can come to an informed decision whether to fund the project or not.

The hope is that the project generates enough buzz to acquire a substantial number of enthusiasts that will donate their money to the cause. In return, they get the aforementioned tokens, which are imprinted on the blockchain and serve as a kind of record of their contribution.

After the project meets great success, the investors can do two things with their tokens. They may either sell them at a profit or use them to unlock features and gain a measure of say in the ecosystem. For instance, they might get the right to vote on whether a project in the network should be funded or not.

Benefits of Token Sales for Businesses

Token sales were quite popular a few years ago. This popularity couldn’t have come out of anywhere, so there are clearly merits to the idea of an ICO. So, what does it bring to the table that you don’t see in other funding venues?

No Shares

For one, the act of giving away a token does not confer ownership rights to the takers in the traditional sense. In other words, shares, as we know them, don’t exist in the ICO environment. Rather, investors can gain a slither of authority in terms of what happens on the blockchain later on, and that functions more or less like a proper share (although without any of the legal guarantee).

Liquidity

The tokens that investors receive have a degree of liquidity. Traditional investment usually relies on sales contracts and/or convertible notes, and the money you entrust would be de facto locked into the project up until its completion – when things would begin to pay off for you. But a token’s high liquidity gives you more control over your investment, providing options like buybacks or burning. And as long as there’s a functioning coin exchange around, you’ll have ways of regaining what you’ve given.

Easy to Make

Companies or startups wishing to get an ICO rolling can do so with little effort if they employ the right help. Not only are there dozens of services readily available to create a token for you, but you can get one made in a matter of minutes. This is especially true if you intend on running an ERC20 token, which operates on the extremely popular Ethereum network.

The Drawbacks of Token Sales

Just as it boomed in popularity for a reason, the downfall of the token sale was not unwarranted. Both investors and enterprises gradually came to a realization that the entire idea wasn’t exactly spotless. All the intense use of ICO’s allowed for some alarming patterns to emerge that painted the process in a more disillusioned light. Here are some that you should know about.

Teeming with Fraud

Saying that a lot of money went into token sales between 2016 and 2017 would be an understatement. Both their quantity and their profitability managed to rake in millions on top of millions at this time.

Unsurprisingly, this fertile ground gave way to a few bad eggs trying to gull the investors seated comfortably on the hype train. But “a few” doesn’t exactly bring to light the severity of the situation. A concerning number of ICO’s had malicious intent behind them, and they burned the community pretty badly. For instance, the Pincoin scam snatched a hefty $660 million out of investors’ wallets.

Such instances, and the fact that creating a con ICO proved so easy, created an extremely tense relationship between aspiring token creators and potential buyers. The whole debacle marred the concepts’ reputation and deflated what were pretty high hopes at the time.

Difficulty and Risk Factor

Creating an in-house blockchain and expecting quality results afterward is far from straightforward. It takes a lot of resources to pull off, and the effort you put in might not even pay dividends in the end.

For one, collecting a team that’s capable of doing the job competently is difficult, to say the least, having in mind how recent the outbreak of blockchain technology was. And the experts that mastered blockchain have made it refined to the point where integrating it into a standard business model becomes tasking. On top of that, reaching market-cap expectations can take anywhere between five and ten years – if not more – implying a long wait indeed.

This all creates a rather risky prospect for the business considering an ICO. The challenges awaiting such an enterprise could not even prove worthwhile, especially given the fraud-happy precedent of recent years. To many, it seems more like a gamble than anything else.

Trouble with the Law

ICO’s are a fairly new phenomenon, one borne out of similarly young technology. So the entire process can be pretty complicated from a regulatory standpoint. The main problem is that it all seems regulation-free while, in fact, it isn’t. Just because the word “deregulated” gets thrown around a lot when talking about blockchains, you shouldn’t assume that you can just do whatever you want.

Nevertheless, it’s pretty easy for a company to rush in head-first into a token sale and not realize the legal aspect of it. For example, some countries consider the profit gained from tokens susceptible to capital gain tax.

It’s not only taxes that token sales will be dealing with in the future, though – government regulation for cryptocurrency, in general, seems to be on the rise, while some countries even prohibit ICO’s, such as China. The aforementioned prevalence of scams and frauds only fuels the justifications for other countries to do the same.

There are also plenty of other obstacles for businesses to watch out for, with institutions like the IRS and the Securities and Exchange Commission paving the way for further government control. Every country around the globe is trying to fit crypto in with the rest of its legislation. And this process can make ICO’s a minefield for companies in terms of regulation.

To Use or Not to Use: the Verdict

So, what can we glean from all of this information? For one, token sales can be pretty easy to initiate if you turn to outside help. Not only that, but they also offer a more convenient alternative to people looking to invest.

So, what can we glean from all of this information? For one, token sales can be pretty easy to initiate if you turn to outside help. Not only that, but they also offer a more convenient alternative to people looking to invest.

And that may indeed be the pivotal point. Here’s the gist of it: investors benefit from token sales, whereas companies barely do. In fact, it could be wasteful for a business to engage in an ICO if they don’t have the proper experience, resources, and infrastructure.

Startups, though, can get away with using a token sale. Startups have to be malleable in order to suit market needs, and as such, they are no strangers to an operational plan that functions in quite the same vein as blockchains. Therefore, their business model can adapt enough to accommodate a blockchain-centric model.

With that in mind, and considering the statistics up until now, 2020 will probably not be the year of ICO for underfunded startups and small-time businesses. Smaller businesses would likely be better off avoiding them. However, Enterprises launching a token sale has increasing potential due to the benefits they come readily with.

Alternatives

The prospect of token sales still has redeeming factors, and current innovations have produced some alternatives.

For example, STO’s (Security Token Offerings) can perform just as effectively, but with one crucial difference. Namely, these tokens are viewed as securities, which clears up much of the regulatory uncertainty, in addition to being more trustworthy than an ICO. They’re effective, and they can reach a vast number of people, making them a sound option. But they are expensive, challenging and time consuming to get started as well.

Alternatively, an IEO (Initial Exchange Offering) can get your fundraising up and running. In essence, an IEO entails a business running their token sale on a well-established crypto exchange. Doing so ensures a trustworthy transaction, given that the exchange can destroy its reputation if it decides to host a fraudulent ICO.

Not only that, but they are quite straightforward, seeing that you only need an account at the exchange in question to get started. However, most exchanges running IEOs are a scam and the only reliable way to run it, is with Tier 1 exchanges, the ones in the top 5, which is an expensive and time-consuming ordeal as well.

The Hybrid Solution

My preferred solution here would be to remain strategic. Build the product, team, and resources to be able to stand head to head with enterprises and then, use a standard ICO to raise funds. That sounds simple, but it’s hard – as you are building a real business and not just a fundraising scheme.

A real business will win, regardless of short term failures and challenges. I would rather focus on building the business as a primary objective and ICO/IEO/STO/or-what-have-you as a secondary objective in the process. That change in perspective makes a massive difference in how it’s looked at and executed. Yes, you should do token sale in 2020, but you should do it carefully and do it right with your intention and focus set on a 5 or 10 years timeline to building a successful, solid business you could be proud of.

If scammers take so much effort, real businesses should take so much more than them. Even if the market is going down, you will continue progressing because you’re a bonafide business, not speculation. You should plan for the long run, for the long term and people will judge your progress regardless of what happens in the market.