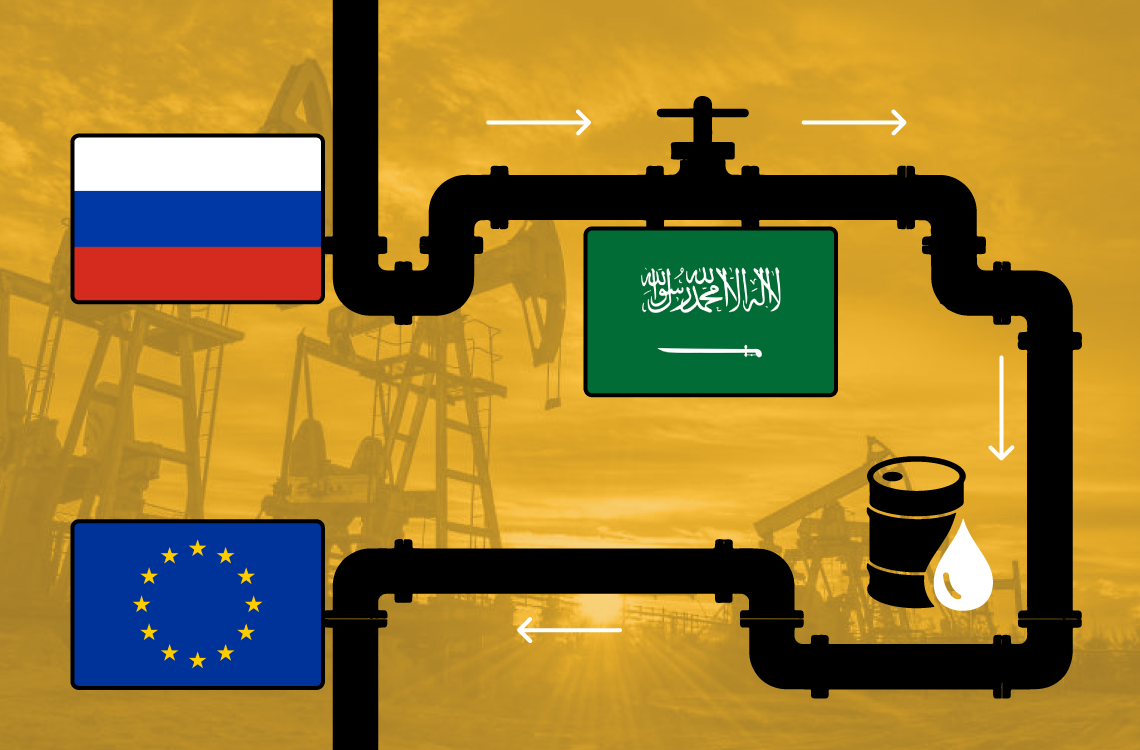

Saudi Arabia has bought record volumes of Russian diesel to evade U.S. sanctions, according to a recent report by Reuters. Data from Refinitiv, Kpler, and Vortexa showed that traders have taken advantage of low prices to stock up on fuel at the Fujairah hub of the United Arab Emirates and in Saudi Arabia.

The Middle East is fast becoming a crucial supplier of industrial fuel to Europe and Africa while also adding to stocks in Asia. Rising output from Saudi and Kuwaiti refineries, combined with Russian oil, has effectively pushed Asian diesel exporters out of those markets, further depressing prices and refiners’ margins in the East.

Sanctions force change in Saudi Arabia’s oil imports

Saudi Arabia is the top oil exporter globally and the largest producer in the Organization of the Petroleum Exporting Countries (OPEC). With the U.S. enforcing sanctions on Russian crude and oil product imports, Saudi Arabia has been forced to diversify its suppliers.

Saudi Arabia imported 261,000 tonnes of Russian diesel in March and early April, the largest volume it has ever received from Russia. One of the cargoes went to Ras Tanura, while three were discharged at Jeddah.

March-loading Russian diesel cargoes traded at $60 to $70 per barrel on a free-on-board basis, which is a discount of about $20 per barrel to the Middle East benchmark.

This is below the price cap of $100 per barrel set by the G7 grouping, which allows traders access to Western ships and insurance services.

Curbs on access to Western insurance and ships have made it difficult to sell Russian oil, with traders opting to store the oil at hubs such as Fujairah before re-exporting it.

The discounts have to be large, given freight rates plus a high-risk premium, to ensure the costs are still less than the alternative marginal barrel, said Mark Williams, research director at Wood Mackenzie.

Rising output to boost global refining margins

The Middle East’s monthly diesel exports to northwest Europe averaged above 1 million tonnes for the first quarter of 2023, up from 785,000 tonnes a month in the final quarter of 2022, according to Refinitiv data.

March-loading exports to Africa hit a four-month high of 2.57 million tonnes, up from a monthly average of about 1.3 million in 2022. Volumes to Asia also reached a new high for March.

Energy Aspects analysts said in a note that “Middle Eastern exports to Asia rose to 150,000 barrels a day in March, filling some of the void left by slower Chinese exports.”

Saudi Arabia has ramped up diesel exports from Yanbu and Rabigh, where state giant Saudi Aramco operates joint venture refineries with Exxon Mobil, Sinopec, TotalEnergies, and Sumitomo Chemical, to Europe, the data showed.

The rising supplies could weigh on global refining margins, which could hit $6.60 a barrel in the fourth quarter, down from an average of $11 in the corresponding quarter of 2022, according to Wood Mackenzie analysts.

The sanctions on Russian crude and oil products have forced Saudi Arabia to change its suppliers, leading to a significant increase in Russian diesel imports.