Consultancy giant McKinsey has recently released new research claiming that Blockchain technology is slow to enter the retail banking sector because of regulatory hurdles.

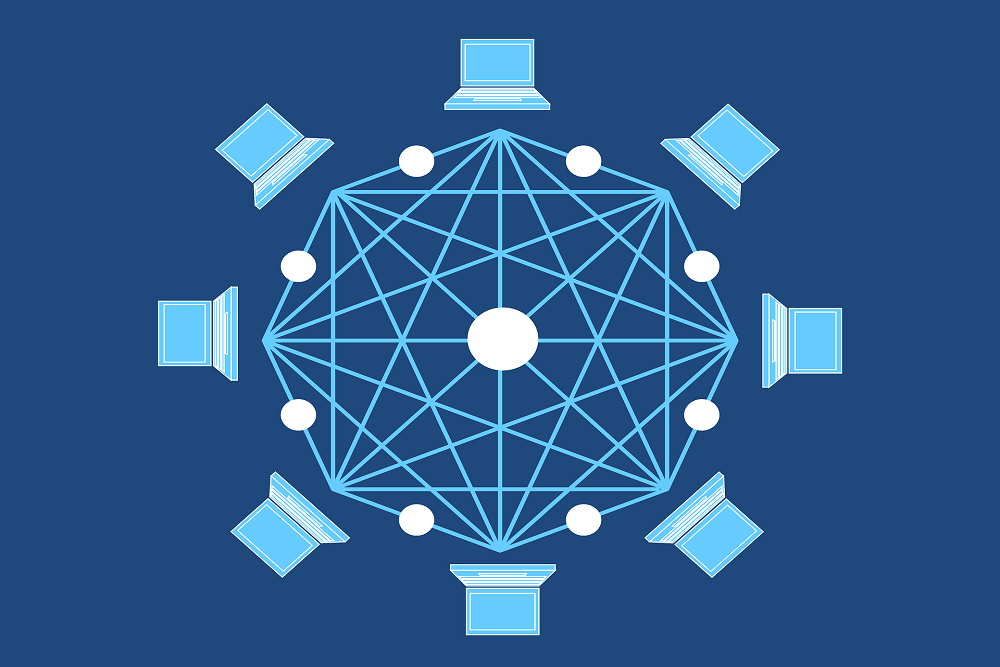

According to one of the contributors to the research, Matt Higginson, cryptocurrencies like Bitcoin will face numerous challenges because they are decentralised and self-regulated through Blockchain ledgers. This type of regulation is not trustworthy enough for retail banks, and they remain cautious about experimenting with the new technology.

Contrary to the retail banking sector, investment banking is going full-throttle with Blockchain, as it boosts diversification options. Not only that, but cryptocurrencies are enjoying a rising interest from all types of investors, which additionally makes the Blockchain technology a primary focus for the sector.

The main aim of retail banking is to reduce costs, and according to McKinsey, one of the best ways to do that is through Blockchain. The research estimates that the introduction of ledgers can bring a four billion dollar (USD4bn) reduction to the cost of cross-border payments.

Another sector where Blockchain can lead to cost reductions is security, as smart contracts are undoubtedly the most effective way to prevent frauds.

Those benefits are clear and more people are starting to realise this, consequently wondering why retail banks are so slow to adopt Blockchain. According to McKinsey, customers seeking their consultancy services are now asking more questions related to the benefits of Blockchain, rather than precautions on how to prevent people from purchasing tokens and cryptocurrency.

Blockchain has a lot of potentials to revolutionise the retail banking sector, and McKinsey’s primary recommendation is for a speedy resolution to the regulatory problems currently at hand so that the technology can be adopted as fast as possible.