When you need to recover from investment losses, consider the best way to increase your earnings which need no technical training. This guide will shed light on how to stake Telcoin, the precautions, and the processes by which you get the best rates from Telcoin.

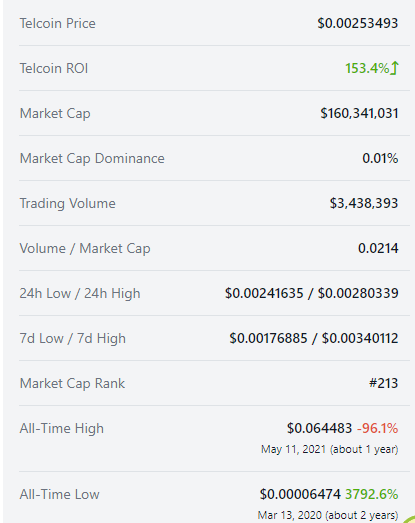

Telcoin is up 20.37% in the last 24 hours. The current CoinMarketCap ranking is #162, with a live market cap of $153,047,471 It has a circulating supply of 60,990,249,278 TEL coins and a max. supply of 100,000,000,000 TEL coins.

What is Telcoin (TEL)?

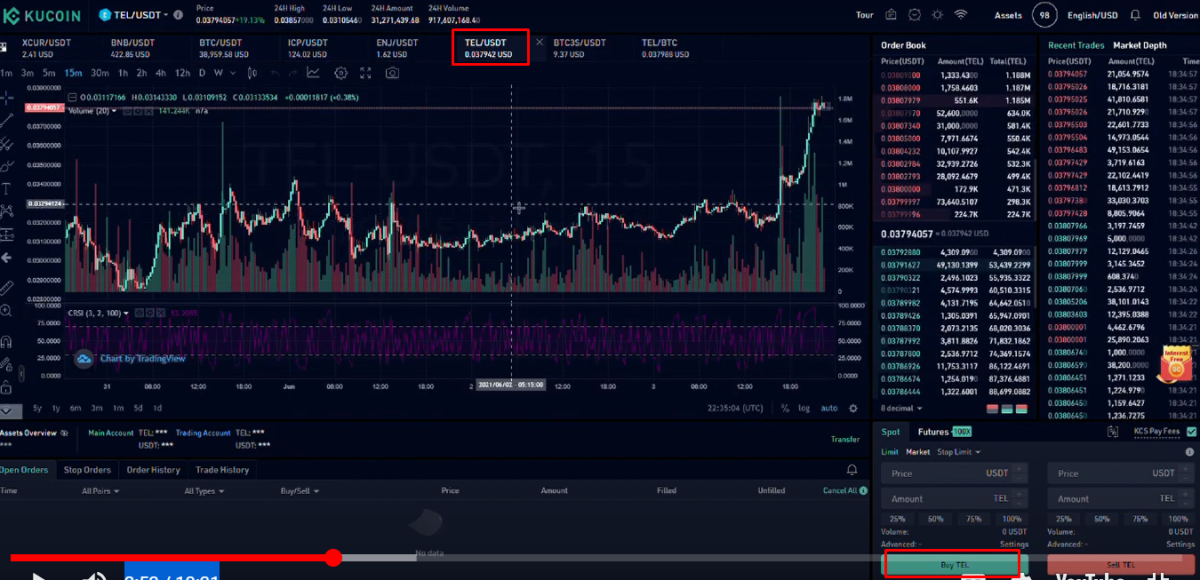

Johnny Lyu is a co-founder and CEO of KuCoin, a global dominating cryptocurrency exchange. KuCoin rapidly boomed in popularity to evolve into one of the biggest international crypto exchanges. Lyu, is based in Asia, and KuCoin is not licensed in the United States, and few people from the U.S are using this exchange.

However, as the changes in the crypto market became evident, there are chances that blockchain systems like Telcoin will replace big names like Western Union. The utility of the coin will determine its longevity. Below is an overview of the coin:

Telcoin’s V3 decentralized financial platform

TELxchange and the Send Money Smarter (SMS) Network are the two components of this service. Telcoin is a user-owned financial product that hopes to lower the costs of remittances, Telcoin platform power, and everyday payments by launching on Polygon.

TELx liquidity mining is live with 6 incentivized markets on QuickSwap, including:

- TEL/WMATIC, with 3 earning

- $TEL

- $QUICK.

Aave, SushiSwap, QuickSwap, and other DeFi blue-chip projects are part of Polygon’s expanding ecosystem. Increased user adoption can be achieved with a smooth user experience thanks to Polygon’s full-stack Ethereum scaling solution.

What is Telcoin staking?

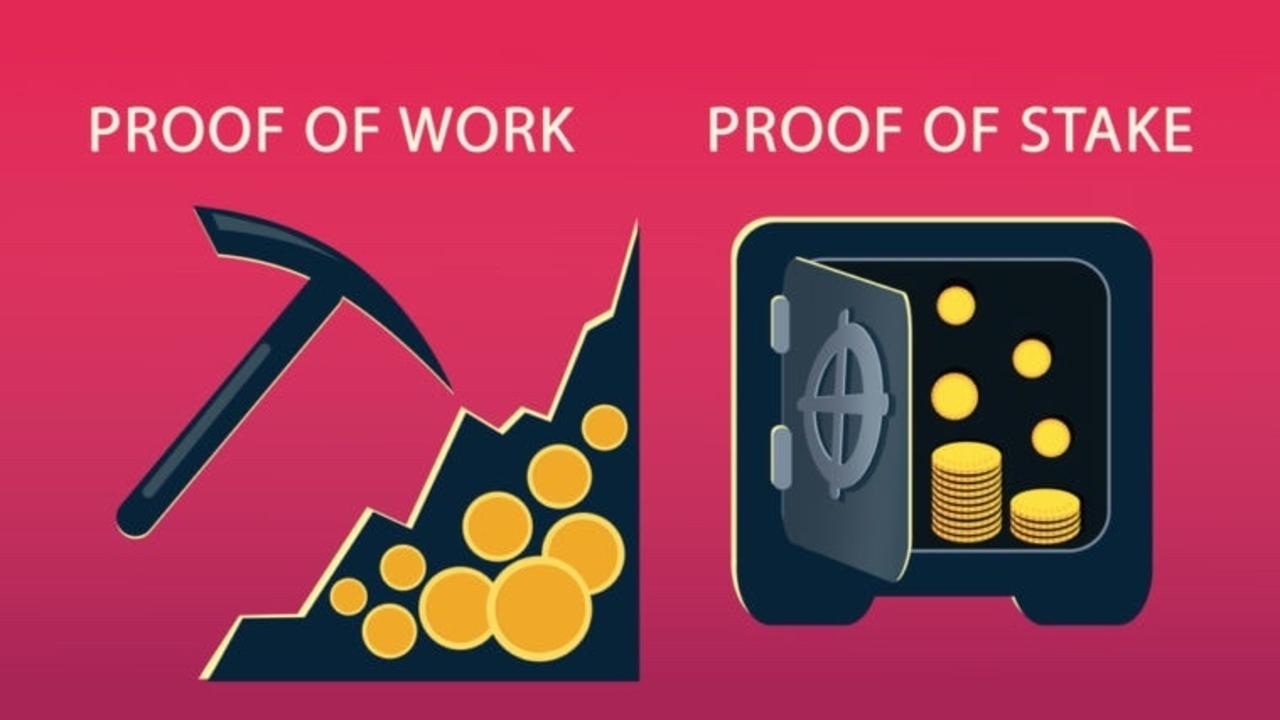

One thing all blockchains have in common is the requirement for transactions to be verified before they are recorded. For Bitcoin, this is done via a process known as mining, which consumes a significant amount of electricity (Proof-of-Work). Consensus mechanisms are used for validation in other ways.

The consensus mechanism known as Proof-of-Stake (PoS) has a variety of variants, as well as some hybrid models. All of these will be referred to as staking in order to keep things simple.

It is possible for currency holders to influence the network through coin staking. You can cast a vote and earn money at the same time by putting money on the line. It’s a lot like earning interest on money kept in a bank account or entrusting the bank with the task of investing it.

How does Telcoin staking work?

What it really boils down to for users is locking their crypto assets in the wallet and receiving rewards as a result. Essentially, by verifying transactions, you are able to earn interest on your investment.

In order to ensure the integrity of the stakeholder’s decision to verify the process transactions, the funds are locked. Validators who are found to be dishonest are subject to a penalty, which can take various forms depending on the version of the algorithm used.

For the most part, staking involves storing coins in a wallet or using a smart contract to keep them secure (master nodes). Staking and voting processes have been made more random in some coins, making it more difficult for bad players to manipulate the outcome of their stakes and votes.

How to stake Telcoin on KuCoin

1. Log into your KuCoin account

click [Earn] – [KuCoin Earn], scroll the page and you will [Stable] section. Please note that you can search the coin type or filter the type as Staking to check all the Staking products we support now.

Step 2 – Check assets

Staking products we currently support and the reference annual yield are listed here. Subscribe to the products you want to stake by selecting them and clicking [Subscribe]. Click [Subscribe] after you’ve carefully read the page’s content

Note:

- APR is projected based on historical data and may not reflect actual profits.

- You may trade ownership of your staked assets or redeem them before the due date.

- POL staking fees of 8% will be deducted from POL profits.

Step 3 – Check History

Once you subscribe to the staking product successfully, you can check the staking history at [Financial Account] – [Staking]. And the profit from your Staking products will be issued to the Main account.

Benefits of Kucoin staking

- Safety. You can trade comfortably on KuCoin, knowing that your digital assets are secure on the exchange. KuCoin utilizes numerous layers of security, including micro-withdrawal wallets, industry-level multilayer encryption, and dynamic multi-factor authentication; which means Kucoin is safe for all crypto traders/investors who intend to leverage the platform.

- Multi-earning opportunities. Those who participate users will obtain both staking rewards and POL Credits.

- Multiple digital assets. No matter where you’re coming from, you’ll find the Kucoin platform easy to use with its array of supported altcoins.

- Proof-of-stake is a major improvement and control to the energy-intensive proof-of-work algorithm in the global marketplace.

- Less Pollution. Through the PoS network, active Telcoin users can help keep the environment less polluted, all while having quicker and easier access to their staking rewards. Also, ensure you do your own research before investing in the crypto world.

- Liquidity. During the period of staking, users can trade their staked assets in the Liquidity Trading Market for liquidity.

- Affiliate Program. On Kucoin users can leverage the affiliate program and earn up to 40% commissions for inviting users to the platform and this can be done simply by telling/recommending Kucoin to their friends and family.

- Referral link. Users can create a unique referral link and share it with others. Anyone who completes the registration will automatically become an invitee. As a reward, the users will receive commissions based on the tradings completed by the referee across all platforms, such as Spot, Futures, and Margin trading

Risks of Kucoin Staking

- Market Unpredictability. Adverse price movement in the asset(s) they are staking. Crypto investors, therefore, need to choose carefully the assets they decide to stake and are advised not to choose their staking asset purely based on APY figures.

- Illiquidity of the asset. You may find it difficult to convert your staking returns into Bitcoin or stablecoins upon its release and the landscape has changed. Staking liquid assets with high trading volumes on exchanges can mitigate liquidity risk.

- Locked periods during which you cannot access your staked assets. If the price of your staked asset drops substantially and you cannot unstake it, that will affect your overall returns. Staking assets without a lockup period would be a way to mitigate lockup risk.

- Waiting period for rewards. This can reduce the time that you can re-invest your staking rewards to earn more yield (either by staking or by deploying assets in DeFi protocols. To mitigate the negative effects of long reward durations on your overall crypto investment returns, investors can choose to stake assets that pay daily staking rewards.

- Validator Risk. Ensure that there are no disruptions in the staking process. Nodes need to have 100% uptime to ensure that they maximize staking returns. If a node misbehaves, you could incur penalties that will affect your overall staking returns. You could delegate your stake to a third-party validator to avoid this risk.

- Validator Expenses. Running your own validator node will incur hardware and electricity costs while staking with a third-party provider typically costs a few percentage points of the staking rewards. Make sure that they don’t end up eating too much into staking returns.

Should you stake TEL?

TEL, the official native token, has been traded by top crypto traders and a lot of investors are bagging a lot of it because of its potential to bring good ROI.

There is always the potential that you lose your wallet’s private keys or that your funds are stolen if you don’t pay adequate attention to security.

Regardless of whether you are staking or simply “HODLing” your digital assets, making sure you backup your wallet and store your private keys safely is imperative for safe digital asset storage. We also advise staking using apps where you hold the private keys as opposed to using custodial third-party staking platforms.

[the_ad_placement id=”writers”]