Staking cryptocurrencies is an excellent way to earn passive income in the crypto market. However, the rewards in staking can be particularly attractive for users who already have a significant portion of their net worth in cryptocurrency. So, the ultimate question is how to stake on Uniswap if you need passive income.

It is essential to know that there are two main consensus mechanisms in the crypto market: Proof of Work (PoW) and Proof of Stake (PoS). The PoS mechanism ensures that transactions are legit. Once transactions are approved, there is always a new block that is being added to the blockchain. In essence, these protocols help to secure the network.

On the other hand, Proof of Work (PoW) mechanisms use computational power to protect and secure networks, and they do not allow crypto staking.

PoS mechanisms help to maintain security through validators that put their crypto assets at stake or lock it up. This is where the term ‘crypto staking’ is derived from. In return for staking cryptocurrencies to secure the network, validators are rewarded by earning more tokens.

The DeFi space approves unique tools for traders to profit in the crypto space. This space works in a dynamic way because there is no need for an intermediary. Uniswap offers such services. This guide will show you how to stake on Uniswap to earn passive income.

Also Read:

- DeFiChain Community Brings Attractive Rewards For DFI ERC-20 Pairs on Uniswap

- Ethereum price rise after Uniswap decision, will $400 stand?

- Uniswap Vs. Sushiswap: Why DeFi wars are actually beneficial

- Uniglo (GLO), Curve DAO (CRV) And Uniswap (UNI) Likely To Lead DeFi Bull Wave

- Uniswap price analysis: Bearish clouds fade as UNI prices near $8.87

- Uniswap Price Prediction 2022-2031: Will UNI Keep Steady?

What is Uniswap?

Uniswap is one of the largest decentralized exchanges {DEX] today. However, it runs on Ethereum and allows you to exchange ERC-20 tokens that use the Automated Market Maker protocol {AMM] instead of an ordinary spot market order book.

Uniswap is an automated liquidity protocol that allows liquidity creation and trading of ERC-20 tokens on Ethereum. Uniswap is like a middleman that cut through the unnecessary red lines to provide fast and efficient trading. Furthermore, it’s open-source software, and it’s been licensed under GPL.

In addition, you can control your funds, unlike other centralized exchanges that require traders to give up control of most of their private keys. Control of your private keys helps prevent the risk of losing your assets if the exchange suffers a cyberattack.

Uniswap was introduced on the 16th of September 2020 by a retrospective airdrop to users who have interacted with the necessary protocols by swapping tokens or providing liquidity.

What is Uniswap Exchange?

Uniswap exchange works by incentivizing liquidity providers to provide collateral and make liquidity pools. Users then use these liquidity pools to trade instead of trying to find a prospective buyer or seller on the spot market.

Liquidity Providers – These are users known to lend their cryptocurrency to an AMM for people to trade in return for earning interest and other rewards. Again, a liquidity provider gets incentives from the fees generated when other users trade in a liquidity pool.

Liquidity pools – This pool involving two cryptocurrencies allows traders to trade in and out of the pool without needing another person on the other side of the trade.

How does staking on Uniswap work?

Uniswap is a means of exchange that allows users to swap ERC-tokens, which allows Uniswap to pool it into smart contracts. Most users then trade against the liquidity pools. Individuals can add tokens to a pool that earns some fees. You can equally swap or list a token on Uniswap.

However, each pool is a smart contract that is not centralized or with any facilitator for the trade. The smart contract has several functions that help to add liquidity and enable the swapping of tokens. Each smart contract is a pair that helps manage a liquidity pool of reserves of two ERC-tokens.

Uniswap runs basically on smart contracts. These smart contracts are “Factory” contracts and “Exchange” contracts. These two are automated computer applications that are designed in a way to carry out specific functions when certain conditions are met. In addition, the exchange contract helps to facilitate all token swaps, and the factory contracts are being used to feature new tokens to the platform.

How to Stake on Uniswap

You need to know that Uniswap liquidity staking is straightforward, unlike other decentralized exchanges requiring many technicalities. Without further ado, these steps will guide you on how to stake tokens on Uniswap.

Step 1: Get an Ethereum Wallet

Before you start staking any token on Uniswap, you will need an Ethereum wallet or an Ethereum-supported wallet. This is because the Ethereum Uniswap is built on Ethereum, and most activities require a wallet supporting Ethereum. For this tutorial will use Metamask. So go to Metamask.io to download the Metamask wallet. Note that you can also download for Chrome if you use a Chrome browser.

Step 2: Buy some Ethereum

- In the second step, you must buy Ethereum and send it to your Metamask wallet. You need ETH tokens to offset the gas fees when you want to stake the token of your choice.

- When you are done with these, the next step requires that you send the total amount of token you wish to stake into your Metmask wallet.

- Note: You can buy Ethereum from Binance and deposit it in your Metamask wallet. Go to your Metamask app/page and click on ‘Buy.’

- After clicking ‘Buy,’ scroll to see the Directly Deposit Ether option. Click ‘View Account.’

- After clicking the ‘Directly Deposit Ether’ option, Metamask will show you the QR code and the wallet address. You can scan your QR code or copy the wallet address to Binance.

- After you have copied the Metamask wallet address, go to Binance. Make sure you have some amount of ETH tokens on your Binance.

- If that’s checked, to send/withdraw option and paste the address you have copied from Metamask.

- Fill in the necessary details and click send. Then check your Metamask Wallet.

Step 3: Start staking on Uniswap page

The next step involves entering the staking portal of the Uniswap page; once you have gained access, you will be required to connect your wallet to the portal.

Note the permissions that you allow when assessing sites with your wallets. Then go ahead to stake any amount of your token that you wish to stake. At this stage, you will be required to pay ETH as a gas fee depending on the amount of staked tokens.

How much can you earn by Uniswap Staking?

Liquidity staking with Uniswap is a unique process using automated liquidity protocol. To take part in Uniswap liquidity staking, you need ETH and an ERC-20 secure wallet. Then, you can exchange (swap) your ERC-20 tokens by taking part in Uniswap liquidity pools. As Uniswap is an Automated Liquidity Protocol, there is no order book or any centralized party needed.

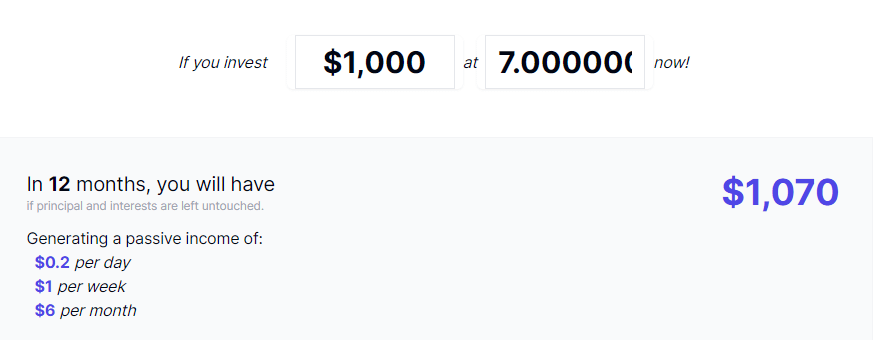

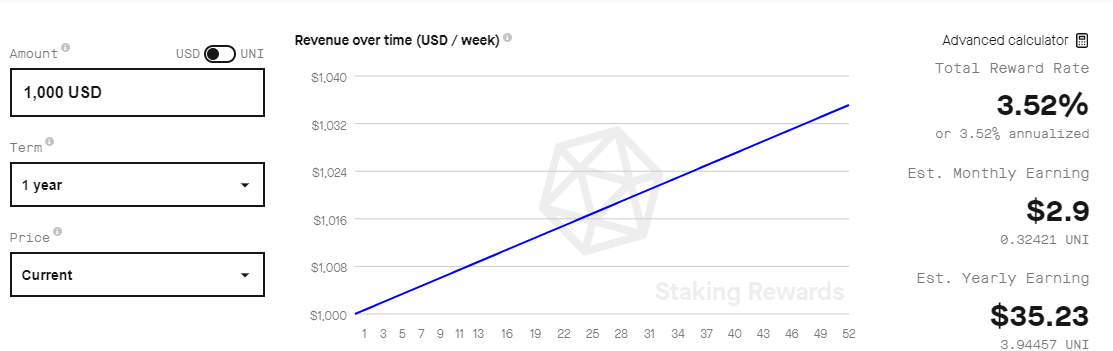

How much can you earn by staking Uniswap? If you stake $1,000 worth of UNI at a rate of 7% during 12 months, you will have $1,070. You can calculate the amount using a crypto staking calculator. Simply enter in the amount of UNI you want to stake and the calculator will show you how much staking rewards you can expect to earn per day, per week, per month, or in the long term. It’s a great way to get an idea of the potential rewards available from staking Uniswap.

Calculate how much you can earn by staking Uniswap. Results vary based on the staking amount, term, and type selected. There are numerous staking pools offering different amounts of rewards but best to go on the Uniswap site if you’re starting out as a beginner.

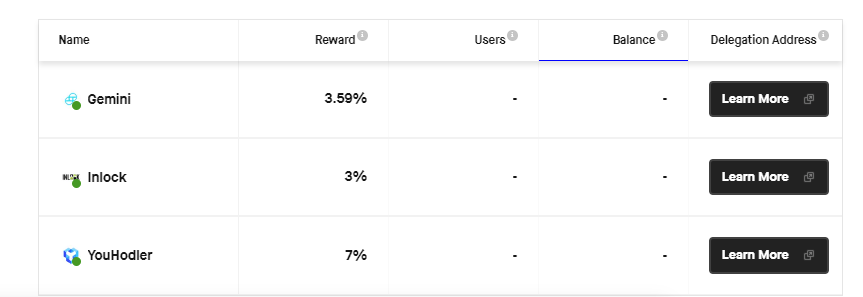

The validator list is per default sorted by staked balance and features reward, user, balance, balance share, and delegation address.

Be diligent in learning thoroughly and interact with the Uniswap community before making an investment decision.

Benefits of staking on Uniswap

- Uniswap is one of the top cryptocurrency exchanges

Uniswap can be found in the top 10 crypto exchanges worldwide. It’s imperative since millions of users trust these exchanges all over the world, and they hold digital assets for the long term.

- Uniswap is an enormous capital asset

The significant capital assets involved in Uniswap make it extremely important in determining its stability.

- Increased users due to no verification

Uniswap does not require a government-issued verification card. It is a reason for the increase in users.

Risks of staking on Uniswap

- Network speed is an issue

Uniswap is an ERC-20 token, which makes it one of the applications running on the Ethereum network. It makes it a little bit slow compared to other competitors.

- Competition from other decentralized exchange space

Uniswap is Facing competition from other decentralized exchanges platform present on Ethereum, and this can affect the future of Uniswap.

- Being susceptible to crypto news in Bullish and Bearish moments

Uniswap, by now, should have achieved some form of independence from mainstream cryptocurrencies as a token behind a decentralized exchange. Sadly, this DeFi platform has not been able to achieve this until now, which can affect Uniswap staking in the future.

Should you Stake on Uniswap?

Staking is one of the easiest ways to earn a passive income in the DeFi space. Traders can also stake tokens on Uniswap through other websites, but you need to be vigilant, as hackers and fraudsters are always on the lookout to scam traders, and traders may enter the wrong site if they are not well informed. In addition, it’s imperative to do research before doing anything in the DeFi space.

On Reddit, you can come across such comments as across most of the pools, the volume has been down the past couple of weeks. Gas fees have also been generally lower most days on the network. Is it just a summer lull? Whales not trading? You can see that Uniswap staking, like most activities in the crypto space, is affected by FOMO, current rumors, and sentiments, all stemming from the crypto winter.

Those who have tasted actual financial freedom gave up plenty in exchange for them, which is most likely, the security offered by traditional banks and lending institutions. If you’ve had enough of regulations, exorbitant fees, and delays of long lines as you queue up for the measly income eked out from traditional jobs, what else can you give up on before you move over to something substantial? This is not an investment decision but something to chew upon.

[the_ad_placement id=”writers”]