A severe blow has hit Gemini, the cryptocurrency exchange, as the Digital Currency Group (DCG), the parent company of Genesis Global Capital, defaults on a payment to the tune of $630 million.

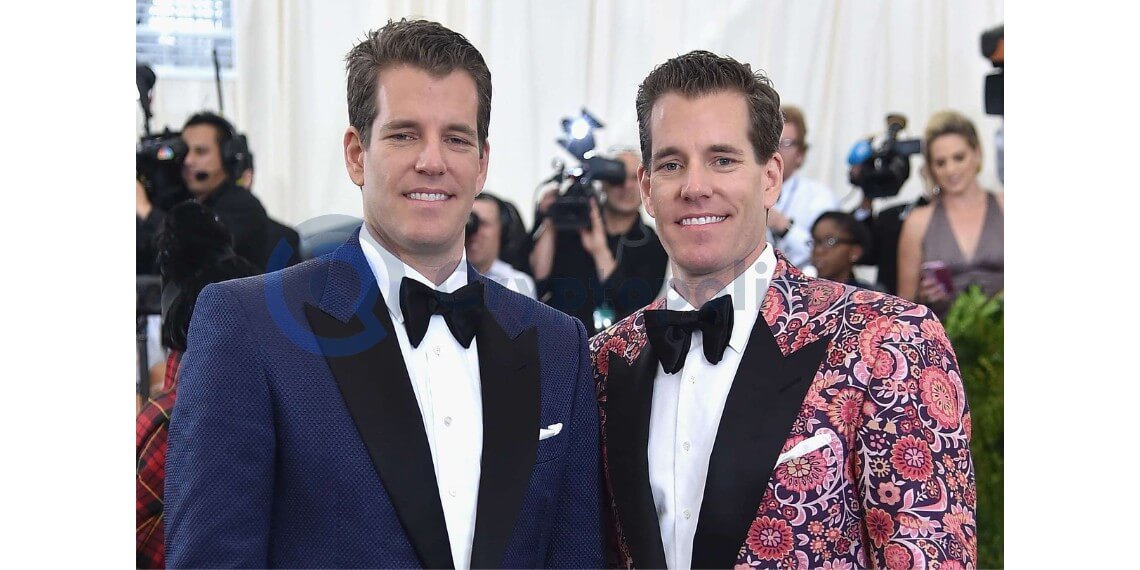

This controversial financial misstep has intensified the turmoil between Gemini, headed by CEO Cameron Winklevoss, and DCG led by CEO Barry Silbert, creating an uncertain atmosphere within the digital currency realm.

DCG’s missed payment comes amidst the backdrop of Genesis filing for Chapter 11 bankruptcy. The severity of the situation has escalated due to allegations of unregistered securities sales through the ‘Earn’ program and allegations of mixed funds.

This development has led to the U.S. Securities and Exchange Commission (SEC) calling both firms to account.

Mounting tensions and ongoing negotiations

Gemini has openly expressed frustration with the ongoing impasse. Winklevoss, in a display of exasperation, has publicly accused Silbert of utilizing “bad faith stall tactics” that are hampering negotiations.

As these two cryptocurrency heavyweights face off, the looming threat of a lawsuit from Winklevoss towards DCG and Silbert persists.

In a countermove, Gemini, alongside other parties, is considering an alternative route to resolve the issue. They are proposing an amended reorganization plan to Genesis that doesn’t rely on DCG’s approval, according to an update on Gemini’s website.

This is seen as an effort to expedite a resolution that seems stalled by the ongoing disputes.

Gemini’s plan for digital asset recovery

Despite the mire of conflict, Gemini has not lost sight of its responsibilities to its users. The company has been hard at work preparing a claim to recoup over $1.1 billion in digital assets from Genesis.

These assets are on behalf of the more than 200,000 users of their Earn program who were left in a lurch when Genesis went under.

As negotiations with DCG continue to falter, the importance of this claim for Gemini and its users becomes ever more clear. The company’s legal representatives are exploring all possible avenues to ensure users’ funds are not lost in the shuffle.

Lawyers for Genesis have recently petitioned the Bankruptcy Court of the Southern District of New York, requesting an extension to the time allocated for filing a Chapter 11 plan and soliciting acceptances. If approved, the deadline to file a plan would be August 27, with Gemini given until October 26 to accept it.

While the tug of war continues, the end game remains the same for Gemini: ensuring the safe return of their users’ digital assets and maintaining the faith and trust that users have placed in the platform.

As this situation unfolds, it serves as a stark reminder of the volatile nature of the cryptocurrency industry. It further highlights the necessity for increased regulatory oversight and stringent financial responsibility to prevent future instances that could put user funds at risk.