TL;DR Breakdown:

- ETH staked on Ethereum 2.0 has surpassed $2.6 billion in valuation

- This is creating scarcity and should be favorable to ETH in the long term.

Ever since the deposit contract for Ethereum 2.0 (Serenity) was deployed last year, the number of Ethereum coins staked on the network has been rising steadily. This suggests that Ethereum users are very confident in the potential progress of Serenity when it’s finally completed. Meanwhile, as more Ether (ETH) are staked in the deposit contract, it creates scarcity for the cryptocurrency, which should be a healthy sign for ETH price in the future.

Over $2.6 billion ETH now staked in Ethereum 2.0

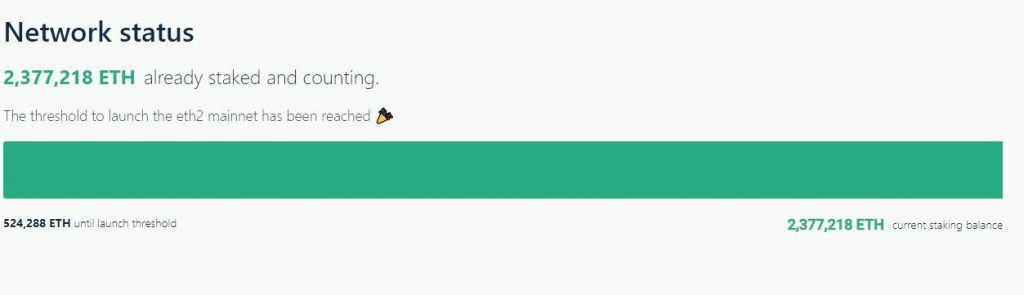

As of January 6, about 2.25 million ETH was staked on Ethereum 2.0 deposit contract, amounting to $2.3 billion following the price of the cryptocurrency then at around $1,022. Fast forward to the present, the number of coins staked on the network has increased by at least 100,000 ETH within five days. According to the Eth2 Launchpad webpage, there are currently 2,377,218 ETH staked.

With the current price of cryptocurrency at $1,094 on Coinmarketcap, the total staked coins worth $2.6 billion. Additionally, ETH has a market capitalization of over $123 billion, from a circulating supply of 114.2 million. So, about 2.08 percent of the circulating ETH supply has been staked on Ethereum 2.0.

Is ETH benefiting from Eth2 staking?

Notably, the Ethereum 2.0 staking is pushing off more Ether from exchanges. Glassnode, an on-chain analytics platform, reported today that $5.7 billion in ETH flowed into exchanges over the past week. However, a higher amount of ETH worth $6.7 billion was moved off from cryptocurrency exchanges within the same period. This resulted in a net flow of -$1.0 billion. Likewise, the previous week saw a net flow of -$223.0 million.

🚨 Weekly On-Chain Exchange Flow 🚨#Bitcoin $BTC

— glassnode alerts (@glassnodealerts) January 11, 2021

➡️ $15.8B in

⬅️ $15.8B out

📈 Net flow: +$5.7M#Ethereum $ETH

➡️ $5.7B in

⬅️ $6.7B out

📉 Net flow: -$1.0B#Tether (ERC20) $USDT

➡️ $6.1B in

⬅️ $6.2B out

📉 Net flow: -$79.2Mhttps://t.co/dk2HbGwhVw

Aside from staking, these coins may be leaving crypto exchanges for some other reasons that include trading in decentralized exchanges (DEX), staking contract, or self custody. Whatever be the reason, it should favor the price of ETH in the long-run following the economics of scarcity.