TL;DR Breakdown:

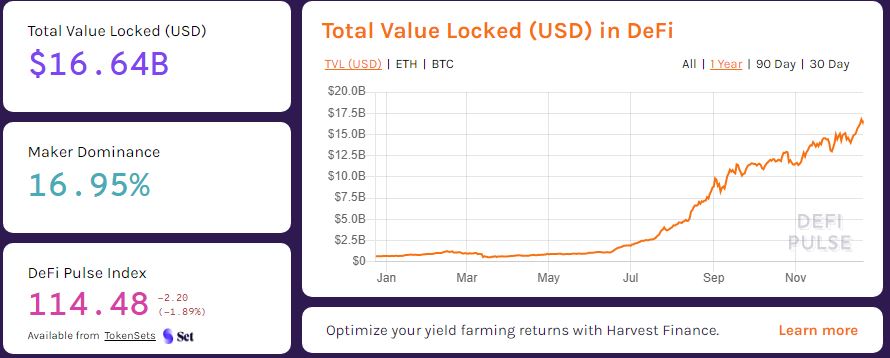

- The assets locked in the DeFi market are currently worth more than $16.6 billion, according to DeFi Pulse.

- With the growth of the crypto market, and more adoption in DeFi, the industry is likely to grow even further.

Without any doubt, it’s safe to say that 2020 is a stellar year for the Decentralized Finance (DeFi) industry. DeFi gained the most traction this year, especially during the yield farming times, which caused a massive inflow of assets in related protocols for a better-earning opportunity. This and many more reasons skyrocketed the valuation of the DeFi market from $675 million to almost $17 billion, according to the current information of DeFi Pulse.

What category is lending the DeFi market growth?

The total value of assets locked in decentralized finance protocols is currently worth $16.64 billion, led by the Maker protocol with a dominance rate of 16.95 percent. Grouping the different protocols in the DeFi market gives a clear view of what category is performing better. Judging by this, the lending protocols lead the decentralized market with about $7.01 billion in assets locked.

The top protocols in the lending category include Maker ($2.82 billion), Compound ($1.92 billion), and Aave ($1.80 billion). The second-largest market in DeFi is the DEXes or decentralized exchanges, with a total valuation of $4.42 billion. This category is led by Uniswap ($1.50 billion), SushiSwap ($1.17 billion), and Curve Finance ($931.1 million). Other leading categories in the DeFi market include assets ($3.87 billion), derivatives ($1.17 billion), and payment ($177.7 million), per DeFi Pulse.

Will DeFi surpass $17 billion?

First, it’s worth mentioning that the DeFi market has grown by more than 2,300 percent on a year-to-date count. Precisely, the market growth shot up around July, with more adoption, the inflow of assets, hypes, new protocols, and more factors. Compared to these times, the current rate at which DeFi TVL grows has somewhat dropped, as the hypes around high interest-earning opportunities have calmed down.

The growing value of the DeFi assets relates to the growing price of cryptos, especially Bitcoin (BTC), and Ether (ETH), which are among the most-locked coins. So, it’s safe to say that the TVL is likely to grow further as the crypto market rallies, followed by more participation in the DeFi industry.