Without a doubt, crypto taxes have always been complicated and continue to be among the biggest obstacles to widespread cryptocurrency adoption. Calculating how much you owe in taxes can be a very complicated and tiring process, especially in countries like the UK, where crypto traders and users are subjected to capital gains tax on top of a crypto income tax.

Would you believe, some people do not know that they have to pay crypto tax, whether they gain or lose in trading them?

The HMRC ((Her Majesty’s Revenue and Customs) in the UK offers well-defined guidelines to help users file their cryptocurrency taxes in the UK. Generally, people in the UK are liable to pay two types of taxes on their crypto assets:

- Income tax

- Individual capital gains tax

The crypto income tax would apply when a user receives crypto airdrops, mining income, or receives any crypto assets for services. However, an income of less than £12,570 is considered as tax-free allowance and is not subjected to an income tax.

| Taxable income bracket | Income tax rate |

| Up to £12,570 | 0% |

| Between £12,571 – £50,270 | 20% |

| Between £50,271 – £150,000 | 40% |

| Over £150,000 | 45% |

On the contrary, individual capital gains tax applies every time a user disposes of their cryptocurrency assets in the UK. There are no tax-free thresholds on capital gains because the HMRC sees cryptocurrencies as assets for personal investments. This means that a crypto trader will incur some tax on every profitable trade.

“Disposal” of crypto applies to any activity that involves selling cryptocurrencies for fiat currency, exchanging one currency for another, or sending cryptocurrencies as a gift. Of course, the tax liability is also taken into account. For instance, if users sell crypto assets at a loss, the capital loss can be deducted from the capital gains.

| Income rate band | Capital gains tax rate |

| Between £12,571 – £50,270 | 10% |

| Between £50,271 – £150,000 | 20% |

| More than £150,000 | 20% |

Crypto gifts also count as a capital gain for the person receiving them, unless you give crypto to a civil partner or a spouse. On the other hand, if you donate cryptocurrencies to charity organizations, such donations do not incur any capital gains tax. So much to remember, right?

Problems with payment of crypto taxes

The biggest challenge with the payment of crypto taxes is that calculating your cost basis and hence, the amount you are liable to pay can be incredibly troublesome. After all, full-time traders and investors often make hundreds of trades and cannot maintain a record of all their transactions. This can be crypto trading very stressful.

Furthermore, frequent crypto users often receive cryptocurrencies from multiple sources. Without proper care, this can lead to inaccurate reporting and result in a user becoming legally liable to pay hefty fines. So, you simply cannot avoid paying taxes on crypto. The lack of accountants specializing in filing crypto taxes further makes the process difficult for new users.

To know whether you are liable to pay taxes, you need your cost basis (based on the market value of the assets originally received by the user). Then, you need to check for capital loss. For a single transaction, this can be easy to calculate. But when you stack up multiple transactions over a time frame, the calculation of taxes can become a messy process. Such information can also be difficult to find on exchanges due to a lack of an official reporting mechanism.

Poland’s reputable provider of digital assets tax automation software, Cryptiony becomes indispensable in simplifying digital assets tax calculation and allowing the monitoring of tax liabilities in real-time. Thus, calculating crypto taxes in the UK becomes incredibly easy through their crypto tax automation web application.

How to use Cryptiony

Wouldn’t it be so helpful if you can easily import your transactions from multiple accounts to Cryptiony and get a full picture of all your crypto trading activity? You can do that exactly.

- Create an account using your email address.

- Easily add your exchange accounts via read-only API or CSV files and connect your blockchain wallets using public receiving addresses.

- Generate your tax report.

Cryptiony removes the hassle of having to switch between multiple sources. Instead, you can import data of all your trades directly into Cryptiony along with the original prices of the assets and the transaction commissions on every trade.

Comparative advantages of Cryptiony

The biggest competitive advantage of Cryptiony is that it seamlessly integrates with a wide range of exchanges through APIs or by importing files. This includes Binance, KuCoin, Crypto.com, Zonda, Kraken, Kanga Exchange, Revolut, LocalBitcoins, Bitstamp, Coinbase and Coinbase Pro, and BitFinex.

You can see all your tax liabilities on Cryptiony’s dashboard in real-time as the data synchronizes (the synchronization period depends on the plan you choose). This not only helps with tax calculation but also allows you to track your taxes so that you can optimize them.

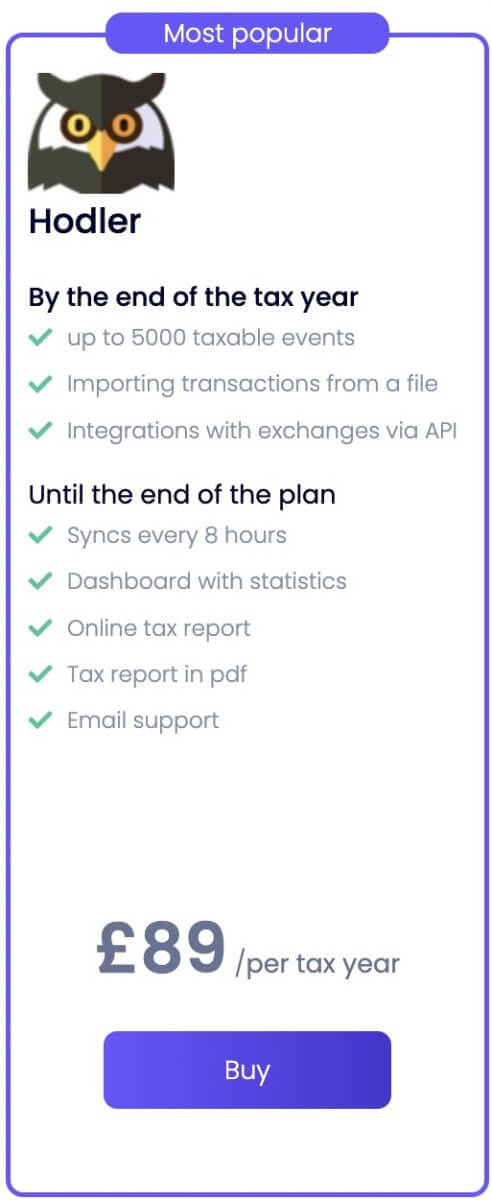

The pricing of Cryptiony in the UK is also extremely competitive. It offers a free package that allows you to report a maximum of 500 tax events and synchronizes after every 24 hours. However, its best-value plan, called Hodler, is still incredibly affordable at only £89/tax year and is suitable for all small to intermediate investors. Whales may want the Pro plan for £169/tax year to enjoy limitless tax events and synchronizations every three hours.

Know more about the innovative features of the Cryptiony app here.

Ready for Web3?

The UK market is approximately 4.2 million cryptocurrency users, and worldwide, there are 295 million crypto users. Those are mindboggling information for entrepreneurs wanting to cash in on the crypto revolution. Here’s some sensible advice from Cryptiony:

Crypto tax software is essential for maintaining good relationships with regulators and the sooner people know about crypto taxes, and use the Cryptiony tax software, the more confident people will be about crypto adoption.

Making it easy to calculate crypto taxes can be a big step towards the widespread adoption of cryptocurrencies, especially in countries like the UK, where users are subjected to capital gain taxes on individual trades/transactions. Cryptiony offers to solve this problem by providing accurate tax reports and transaction data in real-time.

Brands and stakeholders should welcome this chance to integrate with a veteran of crypto tax B2C software, and be on the winning side as they accept the coming challenge: “Web3 will change the tax and accounting industry – and we are ready for this revolution!”