TL;DR Breakdown:

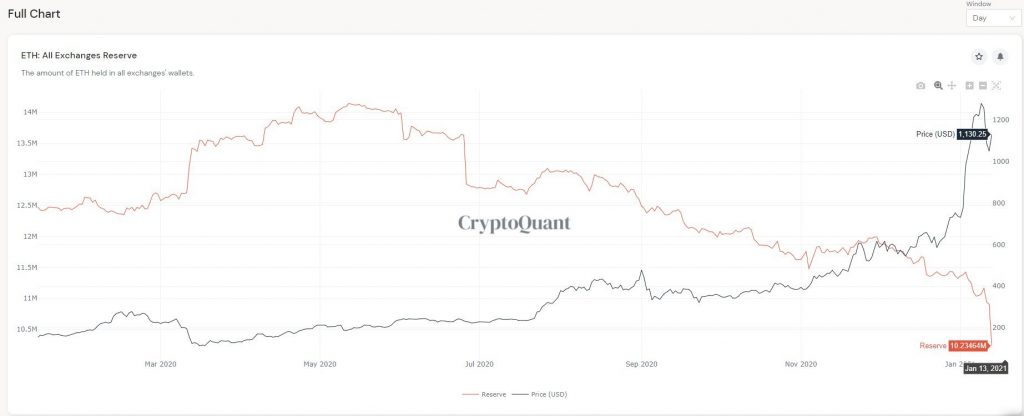

- Crypto exchanges have been losing ETH reserves for the past few days.

- This creates a scarcity of ETH and should be bullish for the crypto in the long term.

The second-largest cryptocurrency, Ethereum (ETH), is seeing an exponential growth in demand, with crypto exchanges failing to meet up. Over the past few days, a significant amount of ETH was moved off exchanges, causing a heavy drop in ETH reserves on cryptocurrency exchanges, according to data shared from Crypto Quant, an on-chain crypto analytics platform. Following the economics with scarcity, the price of the cryptocurrency is likely to jump.

ETH reserves on crypto exchanges are drying up

The founder of the Australia Nuggets News, Alex Saunders, alerted on the dropping ETH reserves. Following the Crypto Quant chart shared, crypto exchanges started to see a notable drop in the cryptocurrency’s reserves. This coincided with the recent correction in the crypto market, which saw ETH trading below $1,000. The exact reason for the development remains unknown.

However, it’s agreeable to note that these moved ETH may be leaving to DeFi decentralized exchanges, the Ethereum 2.0 deposit contract, or hard wallets for self-custody.

Whatever the reasons may be, they are draining the ETH from exchanges rapidly. This is evident as the number of ETH on crypto exchanges dropped to 10.23 million as of January 13. At that time, Saunders predicted that more Ethereum would leave exchanges in the coming days – which is likely correct, as the ETH reserve dropped further during the next day.

ETH is becoming scarce

On January 14, the ETH reserve on exchanges dropped further by about 20 percent, from the previous 10 million ETH reserve to 8 million. Noteworthily, this is happening when the demand for cryptocurrency is rising, thereby causing scarcity. “Exchanges could be out of $ETH within 48 hours”, the founder of Nuggets News added. In the long term, this trend is quite bullish and might push up the price of the cryptocurrency above its all-time high (ATH).

Exchanges could be out of $ETH within 48 hours. Demand has sky rocketed. Exchange reserves fell 20% from 10M to 8M in the last few hours. With targets of $5k, $10k & $20k long term, I doubt many HODLers will sell their ETH in the $1-2k range. 🌐🖥️👽 #ETH2 #DeFi #NFTs #Gaming #DAO pic.twitter.com/rYPOch2u7p

— Alex Saunders 🇦🇺👨🔬 (@AlexSaundersAU) January 14, 2021

Currently, ETH is trading at $1,208 on Coinmarketcap, with a market capitalization of $138 billion.