Following the demise of FTX, Genesis Global took a similar route and filed for Chapter 11 bankruptcy protection in New York on January 19th. This sudden news caused an uproar among the crypto community, with people turning their attention to other companies that had financial connections with this lending firm.

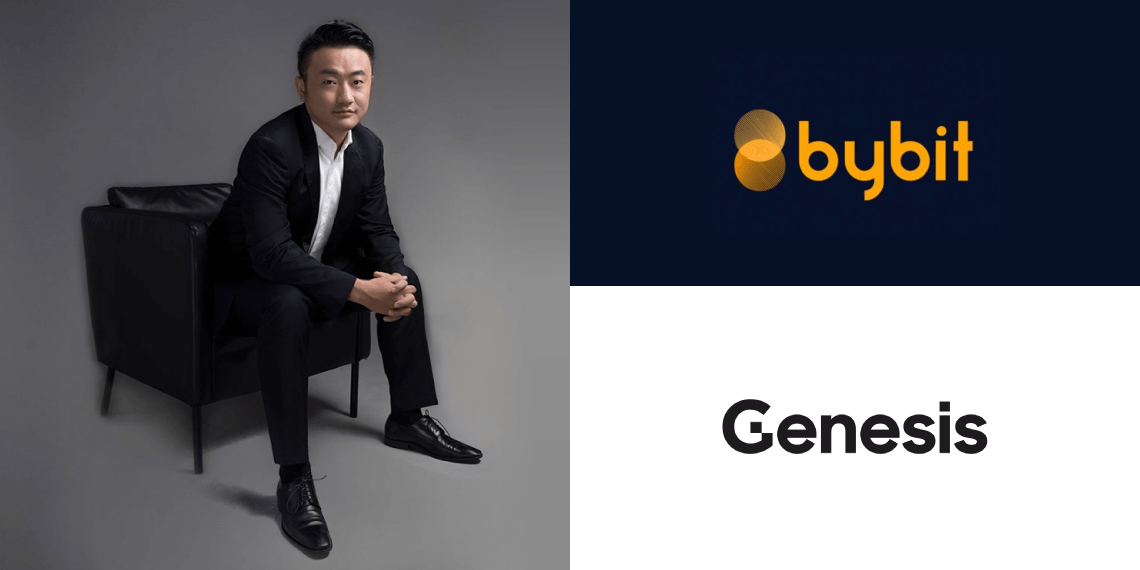

A recent report indicated that nine crypto companies had financial ties to Genesis, with the leading entities being Gemini, Bybit, VanEck, and Decentraland. Ben Zhou–CEO of Bybit–quickly responded to these reports by confirming an exposure of $150 million through its venture fund Mirana. This news highlights just how serious this case is for those involved as it continues to cause a stir within the industry.

Furthermore, Zhou commented that Mirana had authority over only a small portion of Bybit’s assets. The publicized $151 million exposure consisted of collateralized positions worth around $120 million—which have since been liquidated. He also confirmed that client funds are kept divisively distinct from one another, ensuring none of Bybit’s Earn products use Mirana as their source.

Full disclosure:

— Ben Zhou (@benbybit) January 20, 2023

1. Mirana is the investment arm of bybit.

2. Mirana only manage some bybit company asset. Client fund is separated snd bybit earn product doesn’t use mirana.

3. The reported 151m has abt 120m of collateralized positions which mirana had already liquidated. https://t.co/kqVPpAMGky

Though the co-founder’s quick explanation was appreciated by many, numerous others had additional queries about it, especially concerning the company’s earn products.

One user asked for complete transparency regarding the Earn products and how they are produced. Another individual questioned their association with Mirana to ascertain whether their strategies were similar to FTX/Alameda’s.

The surprising timing of the news left many scratching their heads, as Genesis’s troubles have been in plain sight for a couple of months, and major creditors such as Gemini are even pushing Digital Currency Group to take action against its own daughter company. One user tweeted: “Tweeting ‘full disclosure’ only when caught with your pants down automatically refutes your claim. If this were ‘full disclosure,’ ByBit would have said it months ago.”

While others called for a demonstration of transactions between Bybit and Marina, they reminded Zhou that FTX executives had previously voiced these statements, too.

Thanks for being quick to respond to this. Just know everyone is still on edge regardless. The more proof/evidence you can provide, the better people will feel 💯

— CryptoData (@TheCryptoData) January 20, 2023