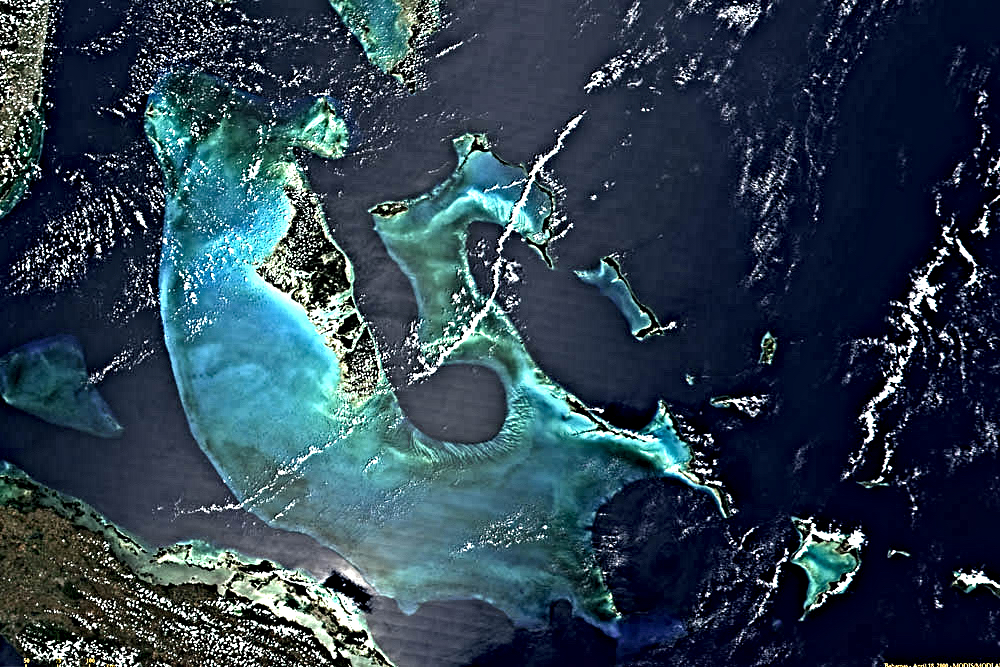

A firm is reportedly preparing to promote solid guidelines for token and crypto sales and ensure making the Bahama a healthier place for decentralized cryptocurrency and blockchain business. The said fir is believed to be experimenting in the digital assets fields within the Bahamas.

While on the other hand, the Securities Commission formally funnelled the draft of a bill a few months ago seeking the regulation of token aids that are not considered confidences.

Conversely, the Bahamas is not the pioneer island state to display concern in the field of cryptocurrency.

Last year, the state of Malta has also passed three laws to enable issuance, exchange, and mainstreaming of virtual currencies, via its Financial Services Authority (MFSA). These currencies included BTC, Eth, and XRP. In addition, Malta has successfully attracted exchanges like Binance to bring its services to Malta.

The legislation is also carried out in Gibraltar seeking to enable the issuance and trade of virtual resources. Bermuda has passed a rule allowing schemes dealing with ICOs to ask for a confirmation from the Bahama’s Finance Ministry.

It’s more probable that specific cryptos symbolizing parity shares should be excused from the national law of security, on the other hand, the laws and regulations for this are still under consideration.

As stated by the bill, various rules and regulations will be valid on all token providers, crypto exchange platforms, wallet operators and providers, and other any parties simplifying ICO. The firms are stimulated to learn that they have enough coverage before initializing the project.

During registration, the company is expected to bring an inclusive financial statement especially including; the issuance of tokens containing the technology of the project, scalability, risks associated to AML & CFT rules and regulations, sovereignty, and authority.

Hence supporting the Bahama’s ombudsmen in evaluating the feasibility of the project. Any firm trying or violating the laws shall pay a fine of around five hundred thousand dollars ($500,000) or serve a maximum of five to ten years of imprisonment.