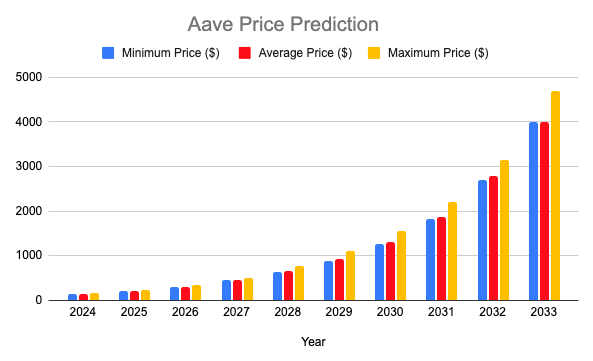

Aave Price Prediction 2024-2033

- Aave Price Prediction 2024 up to $171.07

- Aave Price Prediction 2027 up to $509.13

- Aave Price Prediction 2030 up to $1,546

- Aave Price Prediction 2033 up to $4,690

How Much is Aave Worth Today?

The current live price of Aave (AAVE) stands at $128.84 accompanied by a 24-hour trading volume of $148,713,958. Over the past 24 hours, Aave has experienced market cap increase of 1.08%. In the CoinMarketCap rankings, Aave holds a leading position over the last 24 hours, boasting a live market cap of $1,902,242,346. It has a circulating supply of 14,800,754 AAVE coins and a max Supply of 16,000,000 AAVE coins.

Aave Price Analysis

Aave price analysis: AAVE moves towards $128.87 as Bull Take Control

- Aave technical analysis shows a strong bullish trend.

- AAVE has increased by 1.08% and is trading past its resistance level of 4 hour trade market.

- Trading volume has increased by 69.75% over the last 24 hours.

Aave’s performance shows that the Aave market has exhibited a lateral movement throughout the day’s trading session. The AAVE/USD pairing has fluctuated between $128.87 and $128.04 within the last 24 hours.

The current price of AAVE is $128.87, trading just above its resistance level, indicating an uptrend of 2.52% over the past 24 hours. The day commenced with a bullish tone taking control over the market.

AAVE/USD 1-day price chart: Bullish pressure is present at $128

Aave’s 1-day price chart analysis reflects a bullish trend for the day, with the price surging above its resistance level. A substantial surge in bullish momentum has driven price levels upwards, leading to a value of $128.87.

AAVE/USD 1-day price chart; CoinMarketCap

The technical analysis of Aave (AAVE) reveals an oversold condition, as indicated by the Relative Strength Index (RSI) at 47.94, suggesting a potential need for caution among traders. this suggest a buying spirit by traders

The Bollinger Bands provide additional insights, with a resistance level of $130.73 and support at $128.18. The confluence of an oversold RSI and a resistance level signifies a possible upper limit on the current price movement, possibly leading to downtrend of the market.

Conversely, the support level at $128.18 indicates a critical threshold and a breach below it could signify a momentum shift and the onset of uptrend market. Traders should be attentive to potential breakout or breakdown scenarios, considering the interplay between these technical indicators for well-informed decision-making in the dynamic cryptocurrency market.

Aave Price Analysis 4-hour Price Chart: A Bullish Pattern Forms

The analysis of AAVE’s price chart below reveals that the token is still trading in an descending channel on the 4-hour price chart. This breakout suggests the potential of a term bullish momentum. As of the latest data, the digital asset is presently trading at $127.51.

AAVE/USD 4-hour price chart; CoinMarketCap

On the 4-hour chart, Aave (AAVE) exhibits a neutral stance with a Relative Strength Index (RSI) value of 60.94. This suggests a balance between buying and selling pressures, indicative of a potential consolidation phase or an impending shift in the prevailing trend.

The Bollinger Bands further contribute to the analysis, with a resistance level of $129.04 and support at $120.57. The proximity of the current price to these Bollinger Bands levels implies a range-bound movement, prompting traders to anticipate potential breakouts or breakdowns.

A breakout above the resistance could signal a short-term bullish continuation, while a breach below the support might indicate a shift towards a short-term bearish trend. As the market dynamics unfold, traders should do their own research and closely monitor the interplay between Aave’s price action, RSI dynamics, and Bollinger Bands levels on the 4-hour chart to assess potential trading opportunities and manage risk effectively.

Is Aave a good investment?

Aave, a leading decentralized finance (DeFi) platform, presents a compelling investment opportunity. With its innovative protocol, Aave offers users the infrastructure necessary to participate in various lending and borrowing activities within the DeFi ecosystem. Boasting a growing user base and a significant transaction volume, Aave has cemented its position as a prominent player in the crypto space. The Aave token serves as a core component of the platform, driving its ecosystem and utility.

Aave’s versatility extends beyond traditional DeFi applications, with the potential for expansion into gaming, non-fungible tokens (NFTs), and decentralized applications (dApps). Many investors and industry insiders view Aave as a solid investment choice, considering its track record of success and ongoing development efforts. Our analysis in the Cryptopolitan Price Prediction section will provide insights into the potential appreciation of the Aave token over the coming years, further solidifying its attractiveness as an investment opportunity.

Recent AAVE News

Aave initiates temperature check vote for integration of rsETH into V3

In a strategic move towards enhancing its decentralized finance (DeFi) ecosystem, Aave has initiated a temperature check vote scheduled for March 1. The proposal, spearheaded by Kelp DAO, aims to integrate its Liquid Restaking token, rsETH, into Aave V3. The snapshot indicates a pivotal community-driven effort seeking support for including rsETH into Aave’s lending and borrowing platform.

Notably, this collaboration is set to broaden the range of assets available on Aave and offers additional incentives. Deposited rsETH will be rewarded with extra Kelp points and EigenLayer points, potentially further incentivizing user engagement and participation in the evolving landscape of decentralized finance. The move underscores Aave’s commitment to community involvement and continuous innovation within the DeFi space.

Aave Price Predictions by Cryptopolitan 2024-2033

| Year | Minimum | Average | Maximum |

| 2024 | $141.23 | $145.48 | $171.07 |

| 2025 | $204.11 | $211.39 | $245.17 |

| 2026 | $295.68 | $304.14 | $349.29 |

| 2027 | $451.68 | $463.84 | $509.13 |

| 2028 | $631.41 | $654.60 | $774.99 |

| 2029 | $891.08 | $923.81 | $1,111 |

| 2030 | $1,267 | $1,304 | $1,546 |

| 2031 | $1,824 | $1,876 | $2,198 |

| 2032 | $2,705 | $2,780 | $3,151 |

| 2033 | $3,860 | $3,999 | $4,690 |

Aave Price Prediction 2024

Our Aave price prediction for 2024 suggests that the cryptocurrency will reach a maximum price of $171.07. We anticipate a minimum price of $141.23 and an average trading price of $145.48.

Aave Price Prediction 2025

Our Aave price prediction for 2025 expects Aave to attain a peak price of $245.17 and a minimum market value of $204.11. Our Aave price prediction for 2025 also indicates the coin will trade around an average price of $211.39, representing a significant profit on the current market price.

Aave Price Prediction 2026

Our Aave price prediction for 2026 anticipates a continued uptrend in the market price of Aave, leading to the coin trading at a maximum value of $349.29. Aave is also expected to have an average price of $304.14 and a minimum price of $295.68.

Aave Price Prediction 2027

Our Aave price prediction for 2027 has a maximum price of $509.13 and an average price of $463.84. The minimum price expected for the year is $451.68.

Aave Price Prediction 2028

For this year, our Aave price prediction 2028 indicates that Aave will record more gains, resulting in a maximum trading price of $774.99 and an average market value of $654.60. The minimum price expected for the coin is $631.41.

Aave Price Prediction 2029

According to our Aave price prediction for 2029, the coin’s market price will reach a maximum value of $1,111. We anticipate that Aave’s price will be between a minimum of $891.08 and an average of $923.81 throughout the year.

Aave Price Forecast 2030

Our Aave price prediction for 2030 is that Aave may attain a maximum value of $1,546 and an average trading price of $1,304. The minimum price is estimated to be $1,267.

Aave (AAVE) Price Prediction 2031

Our Aave price prediction for 2031 anticipates a continued uptrend in the market price of Aave, leading to the coin trading at a maximum value of $2,198. Aave is also expected to have an average price of $1,876 and a minimum price of $1,824.

Aave Price Prediction 2032

According to our Aave price prediction for 2031, the value of this cryptocurrency is expected to increase to a maximum of $3,151 by that year. Based on our price analysis, Aave’s expected minimum and average price will be $2,705 and $2,780, respectively.

Aave Price Prediction 2033

According to our Aave price prediction for 2033, Aave may grow to a maximum price of $4,690 and a minimum value of $3,860. The coin is expected to stabilize at an average price of $3,999.

Aave Price Prediction By Wallet Investor

In their latest update, WalletInvestor has provided their perspective on Aave’s price prediction. They anticipate that the Aave price could reach $107375 within one year, reflecting a significant increase. Furthermore, WalletInvestor envisions a promising long-term earning potential, projecting a growth of +32.84% over the year. Their 5-year forecast is even more optimistic, suggesting that Aave could reach $145.657. These insights offer investors valuable information to consider when assessing Aave’s prospects in the cryptocurrency market.

Aave Price Prediction By DigitalCoinPrice

In Digitalcoinprice’s latest update on Aave’s price predictions, they foresee significant growth in the cryptocurrency’s value. By the end of 2024, they anticipate Aave reaching $234.12, reflecting a positive outlook for the near future. Their projections show even more substantial gains in the coming years, with Aave’s value expected to increase by 209.23%, reaching $374.99 by the end of 2026.

Looking further ahead, Digitalcoinprice predicts that 2027 Aave will hit a high of $488.30, indicating a continued upward trajectory in the cryptocurrency’s value. These predictions offer insight into their optimistic perspective on Aave’s performance in the cryptocurrency market.

AAVE Price Prediction by Coincodex

Coincodex’s recent analysis of Aave’s price predictions reveals intriguing insights. According to their one-month prediction, Aave is expected to hover around $111.04, showing potential short-term movements. Looking further ahead, their 2025 projection spans from $100.57 to an optimistic high of $793.00, suggesting a potential 625.85% gain if Aave reaches the upper target.

For the long-term vision in 2030, Coincodex envisions a price range between $526.90 and $993.10, implying a substantial 819.00% gain from today’s price if Aave manages to attain the upper limit. These predictions offer a comprehensive perspective on Aave’s potential trajectory and are subject to market dynamics and developments.

Aave Price Prediction By Market Sentiment

In a recent update, Altcoin Doctor, a prominent crypto community figure, shared his intriguing insights regarding Aave’s future price predictions. According to his analysis, Altcoin Doctor anticipates that Aave will make significant strides in the crypto market. By mid-2024, he foresees Aave reaching a substantial price point of $384, reflecting the coin’s potential for growth.

Furthermore, his predictions extend to the end of the year, where he envisions Aave surging even higher, potentially exceeding the $900 mark. These optimistic projections by Altcoin Doctor have certainly caught the attention of crypto enthusiasts, as they eagerly await Aave’s performance in the coming months, all while keeping a close eye on this dynamic market.

AAVE Overview

| Popularity | Market Cap | $1,667,093,136 | |

| Price Change (24 hours) | +2.02% | Trading Volume (24 hours) | $264,500,475 |

| Price change (7 days) | +5.91% | Circulating Supply | 14,750,535 AAVE |

| All-time low (Oct 03, 2020) | – | All-time high (May 19, 2021) | $666.86 |

| From ATL | 51.02% | From ATH | -84.88% |

AAVE’s Price History

ETHLend started in 2017 as a peer-to-peer digital asset lending and borrowing platform. It generated $16.2 million during an initial coin offering (ICO). During the same ICO, 1 billion units of LEND coins were sold, with 300 million reserved for the AAVE team.

ETHLend was given a new name in 2018, AAVE, with ETHLend becoming a subsidiary. Note that AAVE means ghost in Finnish. In January 2020, the protocol officially went live on the Ethereum mainnet. By August of the same year, the AAVE token rose to be the second DeFi protocol to get to $ 1 billion in total value locked, with MakerDao being the first.

In the same month (August), AAVE was awarded an EMI (Electronic Money Institution) license by the FCA, which saw LEND rapidly rise by 30% to a new ATH. Around the same time, a second version of the AAVE protocol was announced and was released on 3 December of the same year. Other features were reported simultaneously: a trading desk, a game studio, and a payment system.

Aave’s proposal to upgrade its protocol was passed unanimously by its community. Following Aave v3’s mainnet launch on 16 March, the AAVE token surged as much as 114% to a nearly three-month high of $261.29 on 1 April 2022.

More about the AAVE Network

What’s AAVE?

Aave is an Ethereum-based money market where users can borrow and lend various digital assets, from stablecoins to altcoins. Aave (AAVE) is also the native cryptocurrency of the Aave platform: a decentralized finance (DeFi) platform where users can borrow a range of cryptocurrencies and lend assets in exchange for interest payments, all without needing an intermediary.

Decentralized lending system

Users of AAVE now require a traditional financial institution to manage their money. They must trust the code used to write the program and won’t be disappointed. If you’re wondering about AAVE, it’s an acronym for African American Vernacular English. No matter among several emerging DeFi cryptocurrencies, Aave is a decentralized lending system that allows users to lend, borrow, and earn interest on crypto assets without intermediaries.

The AAVE software allows a lending pool capable of lending or borrowing up to 17 different crypto coins, some of which include ETH, BAT, and MANA. And just like other DeFi systems, you must first deposit collateral if you want to borrow AAVE. The equivalent of whatever you post will be given to you as a loan. The borrower then collects the funds as a unique token called aToken. The aToken is assigned the worth of another asset and then encoded so lenders receive interest when depositing.

5th highest TVL

Aave, along with Uniswap (UNI), Compound (COMP), and Curve, is considered one of Ethereum’s blue-chip DeFi protocols. Aave is also deployed on layer-1 network Avalanche (AVAX) and Ethereum’s layer 2 protocol Polygon (MATIC).

According to DeFi total value locked (TVL) aggregator DefiiLlama, the Aave protocol has the fifth highest TVL across all blockchains at $14.3bn as of 4 April. The aave protocol is currently the top DeFi platform for TVL on Avalanche and Polygon.

AAVE Founder

AAVE was developed by Stani Kulechov in 2017. Stani hails from Finland, and he is a programmer and an entrepreneur. He started the AAVE cryptocurrency. He is majorly into cryptocurrency, blockchain, and fintech.

He graduated with a Law Master’s degree in 2018. He graduated from the University of Helsinki. While at the university, he worked as a Trainee at a Law Firm named Castrén and Snellman between January and May 2017. He was still a trainee at Bird and Bird between August and November of the same year. He then became a Member of the Legal Aid Committee of the Law Students Association of Pykäläry.

While at the university for his Master’s, finance interested him, becoming involved with FinTech. The concepts of smart contracts and the Ethereum blockchain became appealing to him, and he was motivated to develop a decentralized financial system.

Where to buy AAVE?

Steps to Buy Aave

Step 1 – Open an Online Account. The 1st step to buying Aave begins with opening an account with an exchange that supports Aave.

Step 2 – Buy a Wallet (Optional). After deciding where to purchase Aave and opening your account, you can open a wallet to store your tokens safely.

Step 3 – Make Your Purchase.

Crypto.com App users can now purchase AAVE at true cost with USD, EUR, GBP, and 20+ fiat currencies and spend it at over 60M merchants globally using the Crypto.com Visa Card.

Coinbase customers can now buy, sell, convert, send, receive, or store AAVE in all Coinbase-supported regions except New York State. Same steps as on top.

Conclusion

Aave’s price analysis reflects a strong bullish trend, with the token trading below its resistance level of $130.47 in 1 day trade market. Despite exhibiting lateral movement within the past 24 hours, Aave’s performance hints at potential upward momentum.

The 1-day price chart displays bullish pressure, supported by a surge in price above the resistance level. Technical indicators like the Relative Strength Index (RSI) and Bollinger Bands suggest moderately overbought conditions and delineate crucial price levels for traders to monitor.

Meanwhile, on the 4-hour chart, Aave appears to break out from an ascending channel, signaling a potential bearish reversal. However, the RSI indicates slightly overbought territory, implying continued bullish momentum.

Amidst this, Aave’s integration with the Binance Smart Chain (BSC) presents promising opportunities for BNB Chain users and Aave enthusiasts, aligning with BSC’s ambitious 2024 goals for mass adoption and efficiency improvements in the DeFi ecosystem.