TL;DR Breakdown:

- 3iQ Bitcoin fund AUM has surpassed another milestone level.

- The growing demand for 3iQ Bitcoin fund and other related products show a rising interest in the leading crypto.

The growing market valuation of several Bitcoin (BTC) investment products indicates a steadily increasing level of interest and demand for the leading cryptocurrency among investors, especially institutions. This is evident as many institutional-grade crypto investment companies are seeing more assets under management in BTC funds and other related products.

Bitcoin attracted lots of attention since it began rising in December 2020. The cryptocurrency made headlines in several popular new outlets after breaking the previous years-long all-high time (ATH) to over $40,000.

3iQ Bitcoin fund AUM skyrockets

In an update on Friday, the Canadian investment fund manager, 3iQ, informed that its Bitcoin fund had surpassed a milestone record of CAD$1 billion (US$789.9 million) in assets under management. The Bitcoin fund was launched in April 2020 and trades on the Toronto stock exchange under the ticker “QBTC.” The record today shows a strong demand for the Bitcoin product among investors in Canada, especially.

TSX:QBTC has one BILLION dollars of 🇨🇦 #bitcoin pic.twitter.com/YNeCwocaBF

— 3iQ Digital Asset Management (@3iq_corp) January 15, 2021

For the record, the 3iQ Bitcoin fund is the world’s first regulated and exchange-traded bitcoin fund. Aside from Bitcoin, the Canadian investment company also manages other products, including the Ether fund “QETH” and the 3iQ Global CryptoAsset Fund, which tracks popularly-traded coins like in Bitcoin, Ether, and Litecoin. Overall, 3iQ sees more than CAD$1.2 billion (US$947.9 million) in AUM, ranking the company as the largest digital asset investment fund manager in Canada.

Other institutions are close to the 3iQ bitcoin fund

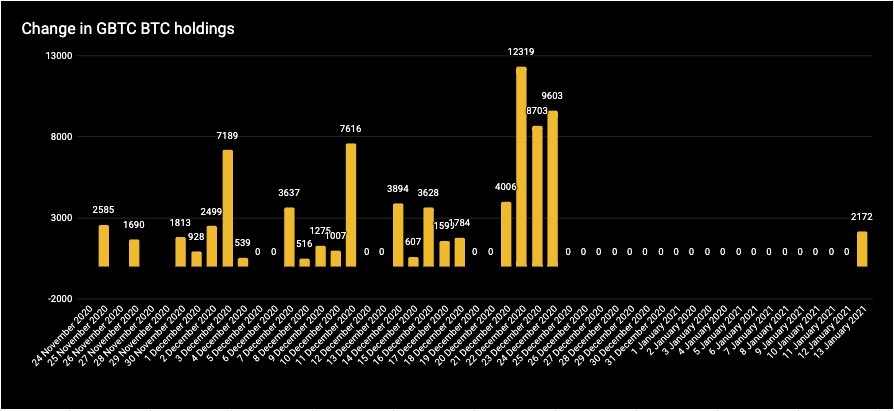

3iQ isn’t the only investment company seeing this massive demand in Bitcoin. Grayscale also reported a substantial amount of growth in its Bitcoin Trust product. More interestingly, the company stacked up an additional 2,172 Bitcoin after it reopened its Bitcoin Trust for investments on January 13. Grayscale suspended new investments in the Bitcoin product since December 24.

Judging by BTC’s performance last year, the crypto is likely to see more institutional investors this year, as it continues to get more awareness and an attractive trend in price.