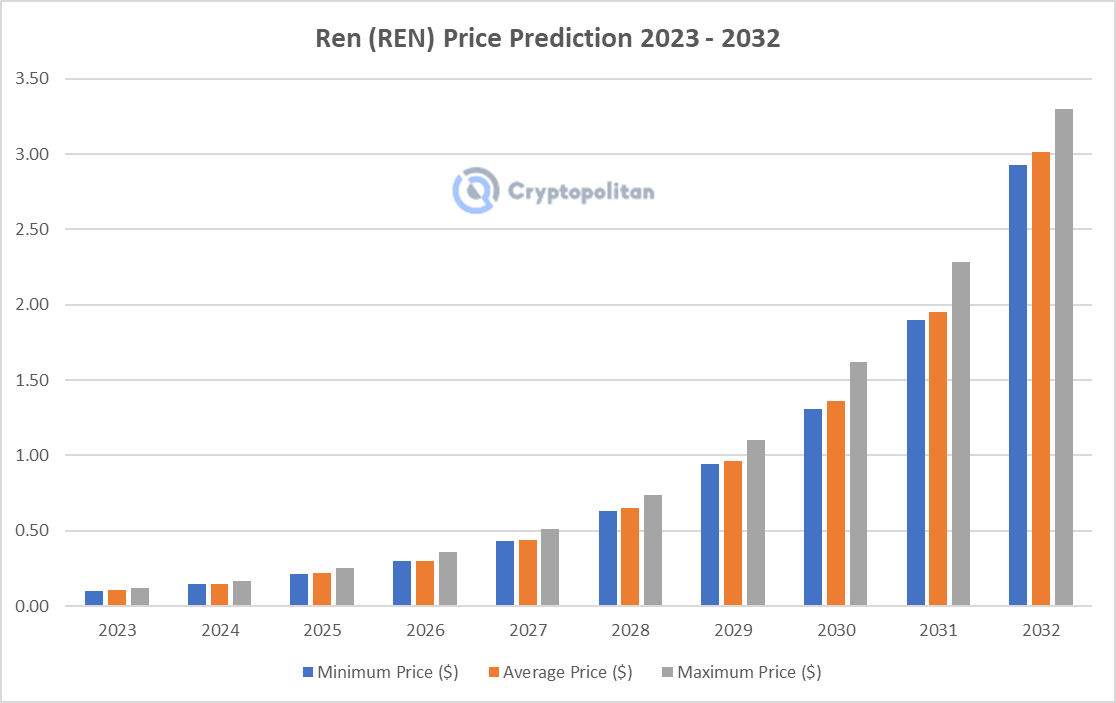

REN Price Predictions 2023-2032

- REN Price Prediction 2023 – up to $0.12

- REN Price Prediction 2026 – up to $0.36

- REN Price Prediction 2029 – up to $1.10

- REN Price Prediction 2032 – up to $3.30

On 20 November 2022, Ren development gave instructions to users on how to move their assets from Alameda to native chains.

1) We recently posted an update regarding how Ren will move forward from Alameda: https://t.co/VFEYHbjZmz

— Ren (@renprotocol) November 20, 2022

On 8 December 2022, the development team announced that they will be shutting down Ren1. 0 at the earliest and announced the next iteration of the platform Ren 2.0. Alameda Research funded Ren Protocol in 2021; the platform now only has a runaway till Q4 2022.

3) Ren will come back stronger and more resilient as Ren 2.0 — enabling novel multichain application development with EVM support.https://t.co/LR7rKpGX4q

— Ren (@renprotocol) December 7, 2022

As the Ren bridge doesn’t require users to submit their email id, social media is the only means through which the team can communicate this update. The community heavily criticized Ren stating that those who are not active on social media are getting “rug-pulled.”

The process was announced on 20 November 2022 and began shortly with mints being disabled, while burns remain enabled for 30 days. This would affect liquidity pools with Ren-assets and possibilities for arbitraging the price of Ren-assets in LPs, even if the underlying asset always can be redeemed.

There was a question back then:

Why are you not stopping the FTX exploiter using your bridge?

— Umbrella (@umbrella_uni) November 21, 2022

How much is REN worth?

Today’s Ren price is $0.081981 with a 24-hour trading volume of $11,046,706. Ren is up 3.66% in the last 24 hours. The current CoinMarketCap ranking is #284, with a live market cap of $81,902,587. It has a circulating supply of 999,037,500 REN coins and a max. supply of 1,000,000,000 REN coins.

Ren is 96.11% below the all-time high of $1.83. The current circulating supply is 999,037,500.362 REN. You may buy Ren at the current rate, the top cryptocurrency exchanges for trading in Ren stock are currently Binance, BingX, Deepcoin, Bybit, and OKX.

Let’s take a look at the basics and background of REN and see if it’s worthy of inclusion in your crypto portfolio, minding that Ren 2.0 is the new platform underway,

What Is Ren Crypto?

Ren is an open-source protocol designed to ensure the confidential transfer of values between different public blockchains. Basically, Ren provides financial liquidity to various blockchain platforms. Ren is an ecosystem for building, deploying, and running general-purpose, privacy-preserving applications and moving averages using a secure multiparty computation protocol.

It makes it possible for any application to run in a decentralized protocol, trustless, and fault-tolerant environment similar to blockchains but with the distinguishing feature that all application inputs, outputs, and states remain a secret to the participants running the network.

The Ren Company’s main product is RenVM which enables decentralized financial interoperability. The project’s main goal is to expand existing dApps and create entirely new business cases with support levels within the decentralized world.

Ren (REN) is the internal token of the Ren ecosystem. Ren coin (REN) is the internal token of the Ren ecosystem.

What Ren offers

The Ren team founded Ren blockchain technology in 2017 as the Republic Project before rebranding as Ren in 2019.

Its founders, Tiayang Zhang and Loong Wang were software engineers in the financial markets that wanted to make crypto exchange built on different blockchain networks more liquid and easily traded without going through a centralized exchange.

What makes Ren different?

Instead of buying BTC and ETH separately, the Ren protocol lets you store your Bitcoin in a type of smart contract, in which you will then receive an equivalent quantity of BTC or crypto assets to use how you want. The contract is a type of CFD (Contract For Difference) that pay different investor price based on their investment.

For example, you could buy Ethereum price-based altcoins or lend your ERC20 token out for interest. Meanwhile, your bitcoin remains stored as a type of collateral through the Ren smart contract.

If you want to unlock your funds such as Bitcoin, you have to pay a fee in REN tokens, which is how the Ren network is maintained. Just like how Ether is the coin that fuels the ETH platform, Ren tokens are the coin that makes the Ren platform work.

At the same time, Ren champions itself as a privacy-oriented platform. It lets users collateralize their existing crypto to access other blockchain tokens without leaving a trace on a decentralized finance ledger.

According to the Ren whitepaper, users can store and transfer tokens without revealing the transaction amounts or their wallet balances. Currently, Ren can transfer Bitcoin, Bitcoin Cash, ZCash, BTC, and Dogecoin onto the Ethereum blockchain.

Ren Market Dynamics

This comprehensive Ren price prediction and technical analysis provide a better insight into the current situation and future expectations concerning the price of Ren. It will help readers understand what’s going on in the crypto market right now, adjust the trading strategy accordingly, and make calculated investment and trading decisions in the future. This could be informed if the trader can identify important resistance using the relative strength index, and forecast the price direction using buying or selling pressure in the current crypto market.

Ren is a non-mineable token presently priced at $0.07831 and has a market capitalization of $78,135,802, which puts it in the 289th position in the global cryptocurrency rating. The currently available supply of Ren is 999,037,500 REN.

It is important to grasp the projected changes in the supply of the native token to properly calculate future market cap, hence the future price or forecast of the cryptocurrency under review, thereby enabling you to get a reasonable REN price prediction. Most traders come to the cryptocurrency ecosystem and more particularly, the REN community searching for digital assets that promise high and extremely high returns, which is achieved, among other things, through volatility inherent to this space.

And even though the capability of most cryptocurrencies to showcase tremendous gains has been hampered by recent crises, they remain the point of attraction for those who see this platform as a good current investment alternative to stocks, Forex, and other traditional markets.

The data allows us to assess the overall strength of the trend, which, in turn, provides the means for a more precise REN price forecast and predicts the shifts in supply and demand that play a decisive role in price changes in both the immediate and distant future.

To better understand recent REN market fluctuations and the REN cryptocurrency, we introduce the Ren price projection to clearly depict the present price dynamics and offer some hints at the possible scenarios of future price action.

Volatility and Price Action

Volatility represents an essential aspect of crypto trading. Crypto Rating always proceeds from a range of factors when analyzing the price of Ren and offering short, medium, and long-term price projections using our proprietary algorithm that successfully incorporates artificial intelligence and, specifically, data.

According to the various technical analysis from Ren, the trading volume for the past 24 hours is $12,501,079, which constitutes an increase from the previous day.

The current tendencies regarding changes in the average trading volume reveal the increasing demand for REN tokens against the backdrop of the decreasing supply of the corresponding cryptocurrency.

At Cryptopolitan, we do our best to provide accurate price predictions that support a wide range of digital coins like REN. Our analysis concludes a plausible maximum supply data, maximum price, average price, and minimum price. In fact, our use of some of the most commonly used indicators ensures we get approximately correct forecasts and enable traders to get reward earnings.

Forecasting Process

We update our predictions daily, working with historical data, opening price, and closing price, and using a combination of linear and polynomial regressions.

However, no one can predict the prices of the cryptocurrency market with total certainty; thus, it is crucial to understand that the following price predictions serve merely as a suggestion of possible price development and are not intended to be used as investment advice.

Ren Technical Analysis

Ren price action in the last 7 days shows REN coin has been trading in a bullish continuation pattern after breaking out of a descending triangle pattern. The trend line on the chart shows that Ren has been trading in an upward-sloping channel and has managed to stay above critical support levels of $0.07137 and $0.065, showing strength in the near term.

Ren coin is trading inside an ascending triangle pattern, which is a bullish continuation pattern. This pattern features upper and lower trend lines that converge at one point, creating a triangle shape on the chart. A break out from this pattern will indicate further upside in Ren price.

However, Ren coin is down by over 30% in the past 3-month timeframe, with the recent price action indicating a rebound. In the near term, REN is expected to move higher if it manages to break above the $0.1048 resistance level. On the downside, critical support lies at $0.07137 and $0.0650 levels respectively. If these support levels are breached, then Ren could face further downside pressure in the next few weeks or months.

Looking at the popular technical indicators, a bullish crossover on the MACD indicator could signal a further upside in the Ren coin price. Moreover, RSI is currently at 50 levels and looks likely to move higher if bulls can gain momentum.

Ren’s price is stumbling to climb above the 50-day moving average and it needs to breach the $0.1048 resistance level before any significant upside can be expected. The coin has had a choppy trading session since mid-January and is currently trading in consolidation mode.

Ren coin’s current price action is bullish, with key resistance levels at $0.1048 and critical support levels at $0.07137 and $0.0650 respectively. If bulls can break above the resistance level of $0.1048, then the Ren coin price could see further upside in the near future. On the other hand, if these support levels are breached, then further downside pressure is likely. Overall, Ren coin looks likely to trade in an upward-sloping channel in the near term, and a break out from the triangle pattern could signal further upside.

Ren Price Predictions by Cryptopolitan

Our Ren Price Prediction for 2023 is a maximum price target of $0.12; in 5 years, $0.74 is the highest price; and by 2032, a maximum value of $3.30 is attainable. Ren has great potential, and its long-term outlook looks very promising. Let’s see the year-on-year price progression of the REN token.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2023 | 0.10 | 0.11 | 0.12 |

| 2024 | 0.15 | 0.15 | 0.17 |

| 2025 | 0.21 | 0.22 | 0.25 |

| 2026 | 0.30 | 0.30 | 0.36 |

| 2027 | 0.43 | 0.44 | 0.51 |

| 2028 | 0.63 | 0.65 | 0.74 |

| 2029 | 0.94 | 0.96 | 1.10 |

| 2030 | 1.31 | 1.36 | 1.62 |

| 2031 | 1.90 | 1.95 | 2.28 |

| 2032 | 2.93 | 3.01 | 3.30 |

Ren Price Prediction 2023

Our Ren Price Prediction for 2023 suggests Ren coin might reach a maximum of $0.12. Ren prices are expected to face a minor pullback to a minimum price of $0.1 and an average price of $0.11.

Ren Price Prediction 2024

Our Ren Price predictions for 2024 suggest that the Ren token prices will increase from their current price and could reach a minimum price of $0.15 with an average price of $0.15 and hit a high of $0.17.

Ren Price Prediction 2025

Our Ren price prediction for 2025 is a maximum of $0.25. The minimum price the coin will have by the end of 2025 is expected to be $0.21, while the average Ren token price is expected to be $0.22.

Ren Price Prediction 2026

Our Ren price prediction for 2026 suggests Ren token might reach a maximum Ren price of $0.36. Ren Price movements are expected to continue in 2026 and a minimum forecast price of $0.3 is expected, with an average price of $0.3.

Ren Price Prediction 2027

Our Ren price prediction for 2027 anticipated the altcoin to skyrocket, reaching a maximum value of $0.51. A minimum price of $0.43 is also possible while the average forecast price might be $0.44 throughout the year.

Ren Price Prediction 2028

Our Ren price prediction for 2028 suggests REN coin might trade at $0.74 as the highest price. The minimum price of the coin by 2028 is expected to be $0.63 while the average trading price is forecasted to be $0.65.

Ren Price Prediction 2029

Our Ren price prediction for 2029 expects the Ren coin to reach a maximum of $1.1. Additionally, the altcoin is expected to retrace to a minimum trading price of $0.94 and an average price of $0.96.

Ren Price Prediction 2030

Our Ren price prediction for 2030 is a maximum price of $1.62 as the altcoin is expected to continue on a bullish note. According to our forecasts, the price of the Ren coin will remain constant during the year, fluctuating between a minimum of $1.31 and an average of $1.36 per coin.

Ren Price Prediction 2031

Our Ren price prediction for 2031 is a maximum price of $2.28. The coin’s lowest price is expected to be $1.9, while the expected average trading price is $1.95.

Ren Price Prediction 2032

Our Ren price prediction for 2032 anticipates Ren coin to hit its minimum price value of $2.93. According to our deep technical analysis and past performance of the Ren cryptocurrency, Ren coin might potentially attain a maximum price of $3.3 while the average price is expected to be around $3.01.

Ren Price Prediction by Technewsleader

According to Technewsleader, the price of Ren currency might trade between $0.22 and $0.26 in 2025, which is a relatively optimistic projection. The website predicts that during the course of the following five years, the value of the Ren might increase to a maximum price of $0.50. Technewsleader considers Ren to be one of the best coins to invest in and forecasts that it might eventually reach $0.70 to $0.84 in the next five years and trade at $3.16 to $3.60 by 2032.

Ren Price Prediction by Wallet Investor

Wallet Investor states that REN could be a successful investment choice if you’re looking for digital currencies that have a high rate of return. If you purchase Ren today for $100, you will receive a total of 1277.812 REN. According to the website’s projections, long-term growth is anticipated; the price outlook for January 15, 2028, is $0.150. The revenue with a 5-year investment is anticipated to be roughly +91.57%. Your $100 investment today might be worth up to $191.57 in 2028.

Ren Price Prediction by DigitalCoinPrice

DigitalCoinPrice has an optimistic Ren coin price prediction for 2023 and beyond suggesting that the Ren cryptocurrency might trade at a minimum price of $0.31, an average price of $0.33, and a maximum value of $0.37 by the end of 2026. Their long-term predictions are also bullish as the Ren coin might reach a value of $0.60 by the end of 2028.DigitalCoinPrice also suggests by 2031 Ren cryptocurrency might potentially attain a maximum price of $1.15 while in 2032 and beyond it might be able to reach a maximum price of $1.56 and a minimum value of $1.50.

Ren Price Predictions by Market Experts

Market analysts are bullish on the Ren price and have given their Ren price predictions for the future. Meanwhile, Crypto Vault, a YouTube-based market expert is very bullish on Ren’s future price.

The analyst suggests Ren has the potential to surge by 9000 percent and has given fundamental reasons for the same. The digital asset has a very low circulating supply, is supported by leading organizations and projects in the space, and has a very active community.

Conclusion

Starting the year strong, cryptocurrency markets achieved record-breaking heights in a short span of time. However, like Bitcoin, many altcoins have dipped below their all-time highs in recent days – likely due to an expected market correction. Nevertheless, this presents a lucrative opportunity for long-term investors to purchase coins at lower prices and cash in on great returns.

With the Ren Project’s software, over $115 million of assets have been produced across all chains. The REN token covers many functions from trading to network fees and interacting with DeFi protocols. In a world requiring increased interconnectivity, Ren could be one of the most sought-after cryptocurrencies in its field.

Overall, the Ren Project’s technology and growing user base present a promising outlook for the REN token price. Although market corrections could have an effect on its current value, rising adoption of the protocol and improved investor sentiment could drive up prices. Therefore, the long-term potential of REN looks positive, making it a great asset for investors waiting to capitalize on the next bull run.

With the Alameda exposure, the Ren development team has transitioned to Ren 2.0 resulting in a pullback in prices for 2023. According to our projections, REN will be green in 2031 and surpass its all-time high with a $2.28 maximum price.

With more developments coming out of the Ren Project, REN could be one of the most promising altcoins in 2023. However, as with all investments, proper risk management should be practiced when investing to ensure optimal returns and you should always do your own research before investing.