Monero Price Prediction 2024-2033

- Monero Price Prediction 2024 – up to $253.50

- Monero Price Prediction 2027 – up to $544.71

- Monero Price Prediction 2030 – up to $2,372.43

- Monero Price Prediction 2033 – up to $7,294.17

This Monero Price Prediction will cover details about Monero, applications, price history, and factors affecting the native currency. There are plenty of things to consider before moving on to the Monero (XMR) price prediction.

How much is Monero worth?

Today’s Monero price is $133.93 USD with a 24-hour trading volume of $45,964,150 USD. We update our XMR to USD price in real-time. Monero is down 0.06% in the last 24 hours. The current CoinMarketCap ranking is #49, with a live market cap of $2,467,342,359 USD. It has a circulating supply of 18,422,268 XMR coins and the max. supply is not available.

Monero price analysis: XMR trades above $130.00 as bulls prepare to push through $145.00 resistance level

The Monero price analysis shows that the XMR price action has started to consolidate around the $138.00 mark as the price action struggles to move beyond the the $137-$143 price level.

The broader cryptocurrency market observed bearish sentiment over the last 24 hours as most major cryptocurrencies recorded negative price movements. Major players include BTC and ETH recording a 0.99 and a 0.83 percent decline respectively.

Monero price analysis: XMR struggles to cross the $144.00 mark

The MACD is currently bullish as expressed in the green colour of the histogram. Moreover, the indicator shows strong momentum as observed in the tall height of the indicator. On the other hand, the lighter shade suggests a decreasing bullish momentum across the charts as the average price struggles to stay above the $145.00 mark.

The EMAs are trading near the mean position as net price movement over the last ten days remains low. Currently, the EMAs are trading at a distance from each other showing strong bearish momentum at press time. However, the converging EMAs suggest a slowly decreasing bearish pressure.

The Relative Strength Index (RSI) has been trading in the neutral region for the past seven days as the net market momentum has remained low. At press time, the indicator trades low in the neutral region at 40.25 index level as the average price suggests strong bullish momentum with the upwards slope suggesting increasing buying pressure at the current price level.

The Bollinger Bands are currently wide as the current monero price observes high volatility across the short-term charts. Moreover, as the XMR price prediction suggests a move back to the $140.0 mark, the bands will continue converging. At press time, the bands’ lower limit provides support at the $138.4 mark while the upper limit presents a resistance level at the $146.8 mark.

XMR price prediction: Technical analyses

Overall, the 4-hour Monero price analysis issues a buy signal at press time with 14 indicators supporting the bulls. On the other hand, only three of the indicators support the bears showing a weak bearish presence. At the same time, nine indicators sit on the fence and support neither side of the market.

The 24-hour Monero price analysis shares this sentiment and issues a buy signal with 14 indicators supporting the bulls against only six supporting the bears. The XMR price prediction shows bearish dominance across the mid-term charts with a low bullish presence at the current price level. Meanwhile, the remaining six indicators remain neutral and do not issue any signals at press time.

What to expect from Monero price analysis: Average price recovers across 4-hour charts

The XMR price chart shows that the Monero market has started another bullish rally after falling to the $100.00 price level. Currently, the bears have broken down to the $145.00 mark but the price continues upward as the buyers fuel the momentum.

According to the Monero coin price prediction and crypto analysts traders should expect XMR to continue its movement above the $140.00 mark as either side struggles to generate momentum. On the other hand, if the price drops below the $135.00 mark, the next support level lies at $130.00 and downward movement below $125 is unlikely.

Is Monero a good investment?

Monero is an attractive investment due to its emphasis on privacy and security, utilizing advanced cryptographic techniques to ensure confidentiality in transactions. Its growing adoption across various use cases, coupled with a decentralized development model, enhances its long-term potential. With a limited supply and increasing investor interest, Monero offers a unique opportunity for those seeking financial autonomy and privacy in the cryptocurrency space. However, investors should remain cautious of regulatory risks and market volatility when considering Monero as part of their portfolio.

Recent XMR News/Opinions

MoneroKon2024 features a hackathon encouraging participants to improve any app/code in the Monero ecosystem for rewards of 5000 EUR. The registration for the hackathon is free but must interest parties must register by May 7.

#MoneroKon2024 features a hackathon this year!

— Monero (XMR) (@monero) February 20, 2024

Scope: build or improve any app/code in the Monero ecosystem.

Register by May 7th and compete IRL from June 7-9th.

Registration is free, and there are 5000 EUR of rewards available (paid in XMR). https://t.co/dqLRn5PsiQ

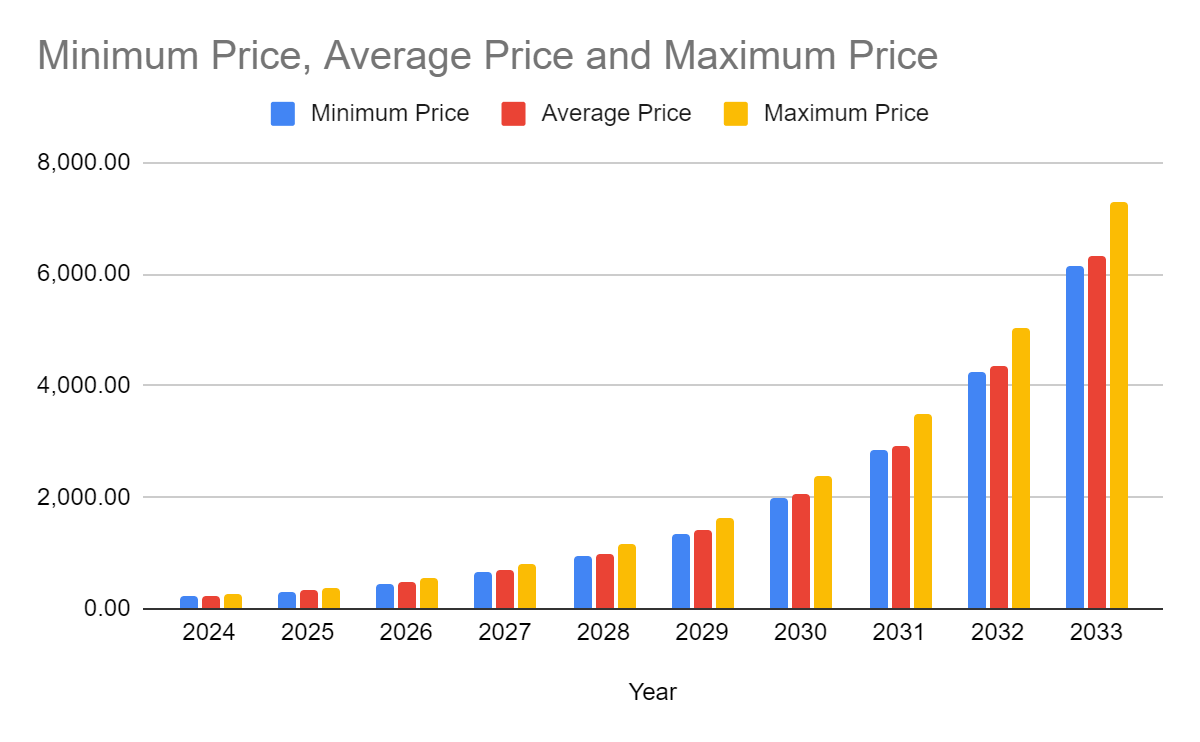

Monero Price Prediction 2024 – 2033

Monero Price Predictions by Cryptopolitan

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2024 | 215.85 | 223.24 | 253.50 |

| 2025 | 315.44 | 324.37 | 370.27 |

| 2026 | 462.92 | 475.90 | 544.71 |

| 2027 | 660.99 | 684.78 | 806.17 |

| 2028 | 950.93 | 985.17 | 1,172.25 |

| 2029 | 1,354.70 | 1,403.95 | 1,624.18 |

| 2030 | 1,989.41 | 2,059.60 | 2,372.43 |

| 2031 | 2,852.46 | 2,934.85 | 3,478.97 |

| 2032 | 4,230.25 | 4,347.64 | 5,035.82 |

| 2033 | 6,142.77 | 6,316.68 | 7,294.17 |

Monero Price Prediction 2024

Our XMR price prediction for 2024 is a minimum value of $215.85 with an average price of $223.24. Based on the XMR price prediction for 2024, the price could reach a maximum of $253.50 during the year.

Monero Price Prediction 2025

Our Monero price prediction for 2025 anticipates a potential increase in Monero adoption, resulting in a maximum price of $370.27. Based on our analysis, investors can expect an average price of $324.37, while the minimum price could be around $315.44.

Monero Price Prediction 2026

Our XMR price forecast for 2026 Monero price is anticipated to reach a minimum of $462.92in 2026. The potential maximum XRM price could be $544.71, with an average price of $628.67.

Monero Price Prediction 2027

Our XMR price prediction for 2027 will continue rising and exhibit minimum and maximum prices of $660.99 and $806.17 as well as a short-term average price of $684.78.

Monero Price Prediction 2028

Our Monero price prediction for 2028 Monero price is expected to reach a minimum of $950.93 in 2028. The maximum expected XMR price is $1,172.25, with an average price of $985.17.

Monero Price Prediction 2029

Our XMR price prediction for 2029 expects the price of XRM to reach a minimum of $1,354.70. The XRM price can reach a maximum level of $1,624.18, with an average price of $1,403.95throughout 2029.

Monero Price Prediction 2030

Our Monero price prediction for 2030 is predicted to hit a minimum price of $1,989.41and an average price of $2,059.60 throughout the year 2030. The maximum forecasted Monero price is set at $2,372.43.

Monero Price Prediction 2031

Our Monero price prediction for 2031 the coin’s price is expected to continue its rise in 2028, with the digital coin price expected to see a minimum price of $2,852.46and an average trading price of $2,934.85, and the maximum value could be as high as $3,478.97.

Monero Price Prediction 2032

Our Monero price prediction for 2032, prices are estimated to attain a minimum price of $4,230.25, an average forecast price of $4,347.64, and a maximum price of $5,035.82 as the bullish momentum is expected to continue.

Monero Price Prediction 2033

Our Monero price prediction for 2032, prices are estimated to attain a minimum price of $6,142.77, an average forecast price of 6,316.68, and a maximum price of $7,294.17 as the bullish momentum is expected to continue.

Monero Price Prediction by Coincodex

Coincodex’s most recent price predictions for Monero suggest that it will rise and reach $ 222.54 by December 31, 2024. Coincodex’s technical indicators indicate that the present mood is bearish, while the Fear & Greed Index reading is 46 (Fear). Over the past 30 days, Monero has experienced 1.53% price volatility and 18/30 (or 60%) green days. Considering Coincodex’s Monero forecast, this is not the ideal time to purchase Monero.

The best-case scenario for the price of XMR in 2027 is $421.64 if it grows at the same rate as Facebook. In the event that Monero followed the expansion of the Internet, the forecast for 2026 would be $440.09.

Monero Price Prediction by DigitalCoinPrice

DigitalCoinPrice’s most recent Monero price forecast suggests Monero’s value will increase by 238.19%, reaching $531.58 by end of 2025. All technical indicators indicate that the current sentiment is Bearish, while the Fear & Greed Index is reading 14.67, which means extreme fear

The 200-day SMA will drop soon, and the price will hit $153.42 by the end of December. By December 2023, 2024, Monero’s short-term 50-Day SMA shows a $146.56.

Monero Overview

| MARKET CAP | VOLUME 24H | CURRENT SUPPLY | PRICE CHANGE (24H) | ALL-TIME HIGH |

| $3.0B | $58.8M | 18.4M XMR | +0.06% | $517.62 |

Monero Price History

Monero’s market value has changed dramatically since its launch in 2014, going from being worth less than $1 to over $475.

May 2021 marked the highest point in Monero’s history. Monero’s price projections brought the security of the coin to light. They provide investors with optimism that they will be freed from the persecution of some authorities simply by buying or selling Monero.

Across 2023, Monero’s price rose by 11.49%. The highest price of XMR last year was $278.56, and the lowest price was $114.16.

Monero has amazing potential over the next few years as acceptance of the cryptocurrency increases. Our market forecast indicates that by 2025, XMR could reach a new all-time high of $638.64.

More About the Monero Network

What is Monero?

The don’t know about RandomX (extremely important imo), tail-emission, PoW (as opposed to all the PoS shitcoins), P2P pool, great wallet options (such as Cake and the desktop wallet), true fungibility, decentralization, no pre-mining or company behind it, adjustable block size, fast block time, 10 block fund lock to prevent fork issues, etc.

Monero $XMR is one of those cryptocurrencies that has held up for the most part, compared to many top cryptos last year. The growth ceiling for #XMR isn’t talked about enough. It’s a highly undervalued asset but leads the pack of the best cryptos to buy now despite the decline of most cryptos in the short term, as the public’s trust in the crypto space continues to wane.

A couple of months ago, Monero (XMR) was one of the worst-performing crypto asset. Pushing below key support levels amid a strong drop level, XMR suffered even a bigger loss following an announcement that Bittrex would be pulling out its support for the cryptocurrency and a few others that were put into the same bucket as Monero.

Secure, private, untraceable, unlinkable, and fungible digital currency – these features distinguish Monero. While Bitcoin and other cryptocurrencies can also be considered fungible assets, Monero further obscures the transaction history of all XMR, making all tokens equally indistinguishable. Not only do the wallet addresses and transactions between users limit traceability, but those features are maintained within the XMR token itself, as Monero included fungibility as a feature of its token.

The privacy-focused cryptocurrencies aim to make the world easy to use and stress-free, while it is coupled with its privacy scheme attached to its anonymity. It assures users that all trading is untraceable, cementing traders’ privacy and shielding holders from external forces.

Reliable and confidential transactions

One of the most favorable options for traders and investors is trading any digital asset which guarantees privacy. Monero (XMR) cryptocurrency is based on the open-source crypto design that uses stealth addresses for extra privacy. These randomly created addresses align with each project execution mainly scheduled for the receiver. Using those addresses ensures the specific address the coin is being sent to remains hidden, preventing the receiver’s identification.

This then means that any individual can trade without anyone knowing the source, amount, or destination. Thus, the XMR is a secure asset because Moneró traders’ portfolio is safe even if governments around the globe decide to launch a crackdown on cryptocurrency.

Monero will undoubtedly succeed with its anonymous nature, so many investors could not take their eyes off trading the cryptocurrency or purchasing Monero to hold. The Monero blockchain is pretty efficient with a good performance. Monero ring signatures are composed of the actual signer, who is then combined with non-signers to form a ring. The group of ring signatures can be used to validate confidential transactions by implementing confidential ring transactions quickly.

The digital currency automates privacy transactions with the assistance of stealth addresses regardless of the strength attached to any of the trusted platforms wherein the storage is created.

Security of Monero coin

The security of the Monero digital coin was brought to the limelight by Monero’s price predictions. It gives confident hope to investors who want to be saved from the oppressions of certain authorities just for engaging in cryptocurrency when they buy or sell Monero.

Being a recap: Crypto is diving into a new world with secured sources, of which the Monero blockchain network has continued to maintain an apex seat for a long time.

Records have equally shown that crypto-mining malware is less effective as the security wall of the Monero network is seated on the rock, and hence chances of holders losing money rapidly are low and make the asset a good investment decision.

The major factors defining Monero’s security are:

- Monero’s security relies on advanced cryptography.

- Ring signatures mix transactions for enhanced privacy.

- Stealth addresses create unique, one-time transaction addresses.

- Confidential transactions encrypt amounts for verifiability and privacy.

- Decentralization minimizes the risk of a single point of failure.

- An open-source model fosters community collaboration in addressing vulnerabilities.

- Regular updates demonstrate Monero’s commitment to proactive security.

- Monero leads in providing a secure, private financial ecosystem to meet the growing demand for digital privacy.

There are so many rich-in-content platforms and currencies compared to scarce powerful anonymity-developed marketing platforms that are safe havens against oppressions, intimidations, unnecessary and rivalry threats of whichever type that tend to limit the operational tasks of such person. Getting along with those limited platforms is no longer unachievable. Monero cryptocurrency and others have paid the sacrifices for that.

However, conducting your own research and own due diligence is advisable as it represents the perfect path for getting self-satisfactory information about the crypto market.

Implications of Monero Price Forecasts

Positive Implications

People should always acknowledge that Monero has proven to be one of the cryptocurrencies that run personally. The strength of these characteristics uses stealth addresses as a security pattern for investors’ cryptos against external or internal invasion.

The pros that are in favor of Monero are listed below.

- Linkage of any transaction in Monero to any individual is impossible.

- The non-static surging in Monero ensures fees would not end up being exorbitant regardless of how the usage increases. Zero limits are in operation by blockchain.

- It allows the possibility of selecting the person who sees or accesses your transaction. It is quite unaffordable for any authority to monitor one’s operation.

Based on past performance, positive things can be said, which makes it a good investment.

Negative Implications

Here are the negative aspects of Monero. Right from inception, much E-billfold is yet undeveloped. Jaxx or many other solution platforms do not exist.

- The pattern of securing Monero such that the cryptocurrency is accurately tied is much more cumbersome than other cryptocurrencies across the globe.

- This is presumed to be the sole cause of its inability to be more widely accepted by the community. It appears very hard to secure.

- Recall that Monero doesn’t rely on the operational level of Bitcoin to exist. Yeah, this might be a valid reason why developing an application that works with its blockchain seems unfeasible.

Monero Past Developments

Monero (XMR) uses cutting-edge encryption to offer its users a high level of privacy and security. The cryptocurrency’s salient features include. Private transactions are allowed on the Monero and other protocols thanks to proofs with zero knowledge. When the money being sent has been encrypted, the transaction is regarded as secret.

Any group member can create ring signatures, which are digital signatures. Due to ring signatures, it is difficult to pinpoint the origin of a Monero transaction because it cannot be tracked. A hard fork was used to implement the update; this irreversible alteration to the blockchain is not backward compatible; thus, nodes must either accept it or diverge onto a different network.

The connection between transactions and node IP addresses is hidden because of Monero’s Dandelion++ functionality. Thus, transaction secrecy is enhanced.

In addition to other privacy-protecting cryptocurrencies, Monero was delisted from several important exchanges, including Bittrex and Kraken, in the UK. Some exchanges, including Coinbase, won’t even list Monero (COIN).

This is because it’s challenging to conduct know-your-customer and anti-money laundering (AML) checks on Monero users (XMR).

Ledger and Trezor, two well-known hardware wallets, both support XMR; therefore, Monero is still growing strong. The well-known Cake wallet, which previously solely supported Monero, now takes Litecoin (LTC), Bitcoin (BTC), and Haven (XHV).

Several intriguing improvements have been included as part of the update, including

- Fee adjustments that will increase overall network security and reduce charge volatility. The multi-signature technique will be improved, and crucial security fixes will be implemented.

- Bulletproofs+ has taken the place of the current Bulletproofs algorithm. Bulletproofs+ increases transaction size and transaction speed. Overall performance is expected to improve by 5%–7%.

- The number of signers needed for a ring signature will rise from 11 to 16 for each transaction.

- A new technique called view tags will speed up wallet synchronization by 30% to 40%.

- More than 300 developers from around the world have backed Monero. 71 developers collaborated on the most recent upgrade, highlighting the power of the Monero developer community.

Conclusion

As users increasingly seek financial privacy and security in the digital realm, Monero stands as a reliable choice, offering a robust platform that prioritizes anonymity and ensures transactions remain confidential. While no system can claim absolute invulnerability, Monero’s commitment to privacy and security positions it as a leader in the realm of private cryptocurrencies, providing users with a reliable and secure means of conducting confidential transactions in the evolving landscape of digital finance.

Monero $XMR is one of those cryptocurrencies that has held up for the most part, compared to many top cryptos last year. The growth ceiling for #XMR isn’t talked about enough. It’s a highly undervalued asset, but leads the pack of the best cryptos the buy now, despite the decline of most cryptos in the short term, as the public’s trust in the crypto space continues to wane.