TL;DR Breakdown:

- Indian crypto exchanges experience massive crypto sell-off.

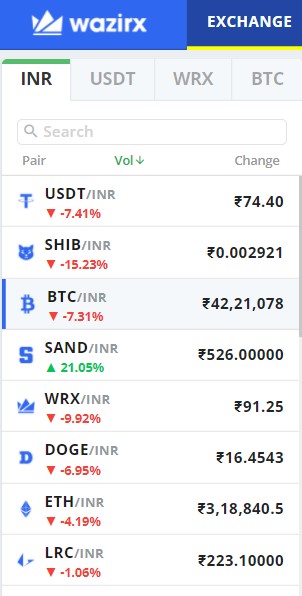

- Panic selling causes major coin prices to dip 20% in local currency.

- WazirX platform crashes after too many sell requests.

Indian crypto exchanges witnessed massive crypto sell-offs overnight after reports of a potential India crypto ban emerged yesterday. According to the agenda brief of the Indian parliament’s winter session, a crypto regulation bill will be presented which aims to ban all private cryptocurrency usage, transactions, promotions, and investments in the country. The government will only allow the usage of a centralized digital asset which will be developed by the Reserve Bank of India.

This potential crypto ban created massive FUD among the local crypto holders. This led to a surge of overnight panic sell-offs on popular Indian crypto exchanges like WazirX and CoinDCX. The CEO of WazirX, which is one of the largest crypto exchanges in India, reported that their website and app crashed overnight due to ‘too many’ sell requests. The platform was restored soon after.

The selling prices of Bitcoin, Ethereum, and other major altcoins dropped 20% in Indian Currency (INR) compared to the global market prices. Bitcoin prices increased 2% globally in the last 24 hours, but it actually dropped over 16% on WazirX. Similarly, Ethereum prices increased 5% in the global markets but plunged over 10% on Indian crypto exchanges.

India crypto ban can disrupt the yearly progress made in the industry

Just a year ago, the global cryptocurrency market cap was below $500 billion, which is now $2.7 trillion. 2021 has been a positive year for crypto. Even though there were regulatory pressures from major countries like China, there was also industry-wide adoption.

El Salvador became the first country to make Bitcoin their national currency. Major businesses around the world have started to accept crypto payments. The US also launched the first-ever Bitcoin-based ETF on the NY Stock Exchange. Major financial advisors and investment sharks have praised Bitcoin to replace gold as an inflation hedge.

Altcoins like Cardano and Binance created ways for new investors and traders to come into the industry with effective security and blockchain knowledge. There’s also been wider adoption of NFTs and crypto-gaming.

However, an India crypto ban can cause massive disruption to this progress. India is one of the largest economies in the world and the center of major trade activities in South Asia. India’s strict regulation of crypto can lead other countries in the region to follow the same path.

This might cause a large number of crypto traders and investors to step out of the industry. Although the new bill still remains to be passed in the parliament, the Indian government’s continuous scepticism of cryptocurrency indicates that a crypto ban might be imminent in India.