Ripple has no mining or miners whatsoever. I’ve known where to buy Ripple and where. So, the question of how to mine Ripple is often astonishing. Instead, transactions are powered through a “centralized” blockchain to make it more reliable and fast. Mining is a core principle of most other cryptocurrencies, and each uses its own system to determine how much power the miners have.

Since you cannot mine Ripple, the only option is to mine other Cryptocurrencies first and then look for exchanges that help you convert your BTC to XRP. In this way, you can lay your hands on XRP directly without having to pay for the Ripple mining process separately. Many people have already started buying XRP owing to its advanced structure and the gradual increase in its price.

Reports are claiming that there are more than a thousand virtual currencies in existence. While Bitcoin leads the pack, others are far behind but still very relevant; one of them is Ripple‘s XRP. At present, Ripple is the seventh-largest crypto asset by market cap.

The current bullish run in the crypto market, which has seen the value of many virtual assets go through the roof, has increased interest in the assets.

Several people are wondering how they too can get into the market. Since crypto mining is a fundamental part of most cryptocurrencies, it is normal to look for ways to mine XRP too.

However, Ripple is unlike the other cryptocurrencies in this respect. It is impossible to mine XRP, and anyone who tells you otherwise is probably trying to scam you. Here, we examine Ripple XRP, why it can’t be mined and how you can own it.

What is Ripple XRP

Ripple is actually a technology company focused on developing online payment solutions. The history of Ripple started back in 2004 with Ripplepay, but it was in 2012 when its ownership changed that it actually started function in line with its goal.

XRP is a crypto asset designed by the company to facilitate financial transactions. Unlike other cryptocurrencies, Ripple XRP seeks to improve the traditional financial system through partnerships instead of providing a complete alternative to it.

This is most of the popularity of Ripple XRP, and its value is tied to its partnership with Banks within and outside the US. Ripple XRP is designed to serve as a bridge currency.

How Ripple XRP is different from other cryptocurrencies

Many crypto enthusiasts have criticized XRP as not being a true crypto, and this is mainly due to its distinctive features. The most relevant one to this article is that it cannot be mined. The creators of the currency created 100 billion units.

Of these units, over 40 billion is currently in circulation. The Ripple company is the only one that can increase the amount in circulation. This means market conditions cannot determine how much of it is in circulation. Closely related to the fact that it can’t be mined is also the fact that it is centralized. The mere mention of cryptocurrency usually brings up images of a decentralized network. But that is not how it works with Ripple XRP.

It is based on the XRP Ledger (ripple consensus ledger) instead of a distributed ledger technology. This is like Blockchain but instead, it is controlled by the company. The centralization of XRP means the Ripple has full control over it. This is why many financial institutions embrace cryptocurrency.

Ripple as a Bridge Currency

XRP, which is Ripple digital currency, serves as a bridge currency for traditional institutions to use in facilitating cross-currency or cross border payments. It is faster and cheaper than the traditional means of doing this through SWIFT.

Thus, XRP is not merely a crypto token; it is a currency with a mission. The mission is not to supplant Fiat currency but to replace the SEPA and SWIFT systems that banks currently use for cross border payment.

XRP services financial and banking institutions, which are those that it is designed for. It eradicates the problems of high cost and slow transactions that these institutions experience with the current technologies for that purpose. By the nature of its design, it can integrate seamlessly with the traditional financial infrastructure.

RippleNet Gateways

Ripple created a digital network known as RippleNet. This network facilitates XRP transactions by incorporating the XRP Ledger. In line with the tradition of Ripple to make its technology as accessible as possible for traditional financial service providers, RippleNet has three services. They are: xRapid, xVia, and xCurrent. These three products serve different purposes that ensure that the Ripple network is truly capable of processing any kind of transaction.

RippleNet gateways payment process

A payment with xRapid follows the trajectory of a financial institution connecting directly to a digital assets exchange in both originating and destination corridors. The originating currency is exchanged into XRP which provides the necessary liquidity to power the final payment, and then in seconds that XRP is exchanged into the destination currency in the second digital asset exchange.

Once this transaction takes place, the funds are sent out on the local rails of the destination country for payout. The transaction is tracked end-to-end, and the result is a cross-border payment that is much faster and cheaper than anything before it.

All members of RippleNet are also connected through Ripple’s standardized technology, the already mentioned xCurrent.

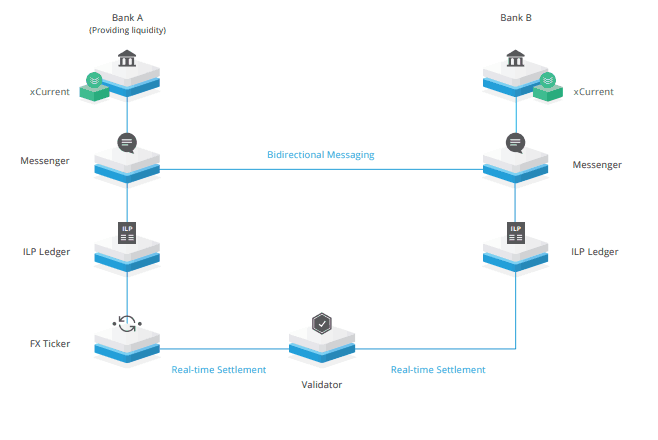

The four components of xCurrent

- Messenger is the API-based bidirectional messaging component that connects to the beneficiary bank’s Messenger instance to exchange KYC and risk information, fees, FX rates (if applicable), payment details and expected time of funds delivery. It packages this information and presents the entire cost structure to the originating bank, providing unprecedented visibility into the total cost of the transaction. Additionally, banks can set fees and the FX rate for payments made with Messenger. FX rates are set in FX Ticker and queried by Messenger during the quoting process.

- Validator is the component which cryptographically confirms the success or failure of a payment. It coordinates the movement of funds across ledgers of transacting parties in a manner eliminating settlement risks and reducing delays. Validator provides a single source of truth for the transacting counterparties while preserving the privacy of banking customers’ identifiable payment information. Banks have the option of running their own Validator, using it for all their transactions, or relying on a Validator run by the transacting counterparty.

- ILP Ledger is a sub-ledger of each transacting bank’s general ledger. This component of xCurrent is utilized to track the credits, debits, and liquidity across the transacting parties. ILP Ledger enables transacting parties to settle funds atomically, which means the entire transaction settles instantly or not at all – no matter how many parties are involved.

- ILP Ledger enables funds settlement in milliseconds. Further, the settlement risk is eliminated because the payment processes entirely or fails upfront. ILP Ledger is designed to provide transacting banks with 24/7, on-demand availability. The combination of these capabilities allows banks to profitably offer low-value, on-demand cross-border payments products and services.

- FX Ticker is the mechanism facilitating the exchange between ILP Ledgers by enabling liquidity providers to post FX rates. This component provides the exchange rate between any pair of ledgers with which it is configured. Additionally, it keeps track of the account, currency and authentication credentials for each configured ILP Ledger.

To enable cross-currency flows via xCurrent, banks can leverage their existing nostro/vostro relationships with other banks and provide liquidity through their FX trading desks, or use external market makers to provide FX liquidity for exotic currency corridors.

This example will refer to that function as the liquidity provider, whether it is the bank’s FX organization or an external market maker. The settlement is an atomic process, meaning that both intra-bank settlement legs of the transaction happen at the same time so as to eliminate the settlement-leg risk.

xCurrent is typically installed on-premises behind the corporate firewall of a bank, with a load balancer handling inbound connections to Messenger and a proxy server handling inbound and outbound connections to all xCurrent components. Banks can deploy multiple instances of the xCurrent behind the load balancer to scale to the volume of payments.

By joining Ripple’s growing, global network, financial institutions can process their customers’ payments anywhere in the world instantly, reliably and cost-effectively.

Banks and payment providers can use the digital asset XRP to further reduce their costs and access new markets.

Interoperability of xRapid and xCurrent

xRapid and xCurrent are interoperable and made to be used together (Ripple plans on offering one convergence solution) while xVia is a gateway that provides access to RippleNet via a single standardized API. The API enables users to seamlessly send payments globally with transparency into the payment status and with rich information, like invoices, attached.

The attached data to payments eradicates verification and reconciliation issues. xVia enables direct connectivity to receive correspondents and affords bi-directional messaging to confirm FX and fees, submit payout requests and verify payout completion. It requires funding in the local or payout currency.

The XRP token in these settings provides instant liquidity pools for facilitating fast and cheap payments. The first part of the transaction takes just 2-3 seconds and the conversion of XRP through digital asset exchanges and/or local payment processors, the entire transaction takes about 2 minutes in total.

The Financial Conduct Authority in the UK has also gone to categorize XRP as a utility/exchange token alongside Bitcoin and Ethereum. However, its technical purpose and role in the system make it a class of a digital asset that is not recommended as a “regular” investment nor meant to serve a function outside its specific context. It is meant instead to keep money flowing freely (as information) and unhampered by high transaction costs and processing delays.

How is the Circulation of Ripple controlled?

While many have criticized the lack of mining for Ripple, this is not necessarily a bad thing. Coins that require mining to increase their circulation poses an environmental problem.

Mining cryptocurrencies usually require high-level computers that consume a lot of energy. As the effects of climate change and its awareness continue, the energy efficiency of processes such as Bitcoin mining has been criticized too. Ripple offers a more energy-efficient, low cost, more liquid, and more stable alternative.

One may ask that if mining Ripple is impossible, then how is the amount of Ripple in circulation controlled? The answer to this lies in the Ripple escrow.

The Ripple Escrow

Less than half of the 100 billion Ripple units created are in circulation at present. A sizable portion is held directly by the bank, with many financial institutions and payment providers also holding large amounts. However, 55 billion Ripple, which is over half of these total supplies, has been kept in an escrow account.

According to the Ripple company, the decision to put these units in an escrow account is to prevent a situation where there will be excess XRP in the market which will affect those holding XRP negative.

55 escrow contracts were created, each holding 1 billion Ripple. The contracts are set to expire on the first day of each month for the next four and a half years. With each expiration, the Ripple company will have access to 1 billion XRP, which it can sell to institutional investors or use to reward market makers. Any leftover from the 1 billion Ripple supply for that month will be returned to escrow that will expire on the first day of the month after the current 55 contracts expire.

By this estimate, XRP supply in circulation could double in the next eighteen months. However, given that the company uses only around 300 million Ripple averagely in a month according to its reports, it might take between 14 to 18 years before all the 55 billion Ripple in the escrow account is spent.

How to own Ripple

Since Ripple mining is not possible, the simplest way to own it is to buy from a currency exchange platform. While it was not originally created to be an investment vehicle, the increase in its value over time has enabled it to become one.

At present, the Ripple price is around $0.4. The Ripple company sells part of its XRP holdings to cryptocurrency exchanges, and you can easily buy the asset from them.

However, it is worthy of note to mention that the Ripple CEO Brad Garlinghouse and the company itself is currently embroiled in a lawsuit with the SEC. The SEC claims XRP is unregistered security, while Ripple labs claim the coin is a cryptocurrency. The announcement of the lawsuit influenced the price, and the outcome will definitely do the same.

XRP Mining

From everything above, it is clear that ripple cloud mining or any form of cryptocurrency mining is impossible for XRP. However, if you are insistent on getting your XRP token through mining, there is an indirect way of doing it. This is by mining other cryptocurrencies such as Bitcoin, Ethereum, Litecoin, etc., and exchanging any of this digital currency for XRP on cryptocurrency exchange platforms.

Conclusion

Ripple XRP is more than just a digital coin; it is designed to improve the traditional banking system with the Ripple transaction protocol. Rather than supplanting it like other cryptocurrencies, the ripple protocol is built to integrate seamlessly with it. However, the only way you can own the Ripple coin is by buying it or exchanging another altcoin for it, so if anyone comes to you about mining XRP, that is a clear red flag.