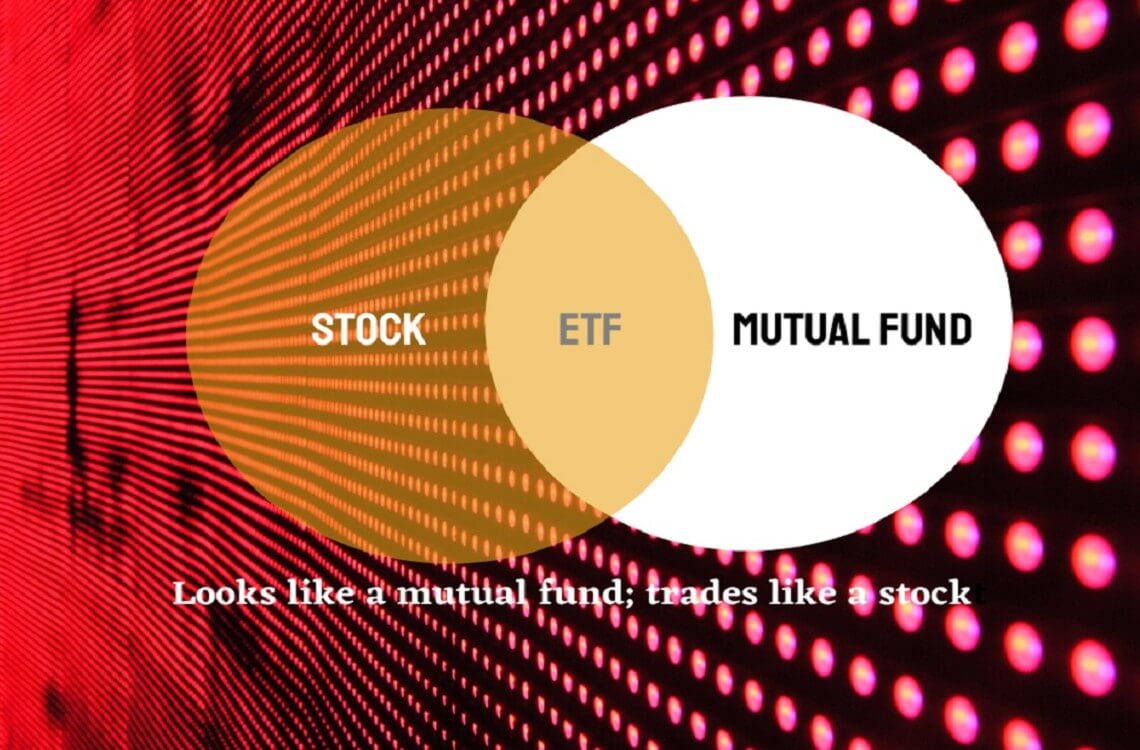

Cryptocurrency ETFs, also known as exchange-traded funds, are investment vehicles that track the price of a specific cryptocurrency or a basket of cryptocurrencies. They are designed to provide investors with exposure to the cryptocurrency market without the need to physically purchase and store the underlying assets. Cryptocurrency ETFs emerged as a way for investors to gain exposure to the cryptocurrency market without the need to physically purchase and store the underlying assets. The first cryptocurrency ETF was launched in 2013, and the number of available ETFs has grown steadily since then. Let’s dive in!

How crypto ETFs work

The purpose of cryptocurrency ETFs is to provide investors with a convenient and accessible way to invest in the cryptocurrency market. They offer the benefits of traditional ETFs, such as diversification and ease of trading, while also providing exposure to the rapidly growing cryptocurrency market. Cryptocurrency ETFs work by tracking the price of a basket of cryptocurrencies. The ETF holds the underlying assets, typically in the form of cryptocurrencies, and issues shares that can be bought and sold on a stock exchange.

When an investor buys shares in a cryptocurrency ETF, they are effectively buying a piece of the underlying assets, in proportion to the number of shares they hold. The value of the shares is tied to the value of the underlying assets, so when the price of the cryptocurrencies in the ETF increases, the value of the shares also increases. Conversely, if the price of the underlying assets decreases, the value of the shares decreases.

The ETF is managed by a professional fund manager, who is responsible for buying and selling the underlying assets to track the price of the basket of cryptocurrencies. The fund manager also takes care of administrative tasks such as record-keeping, tax reporting, and shareholder communications. It is important to note that cryptocurrency ETFs are subject to market risks, and the value of the ETF can fluctuate along with the price of the underlying assets.

Advantages of investing in crypto ETFs

A. Diversification: Investing in a cryptocurrency ETF provides investors with exposure to a basket of cryptocurrencies, which can help to reduce risk and increase returns. By diversifying their portfolio, investors can potentially mitigate the impact of market fluctuations on their investments.

B. Accessibility: Cryptocurrency ETFs make it possible for investors to gain exposure to the cryptocurrency market without the need to physically purchase and store the underlying assets. This makes it easier and more convenient for investors to participate in the market.

C. Simplicity: Investing in a cryptocurrency ETF is a simple process that can be done through a brokerage account. This eliminates the need for investors to manage their own cryptocurrency wallets and eliminates the risk of theft or loss.

D. Increased Accessibility: Investing in a cryptocurrency ETF makes it easier for individuals to invest in the cryptocurrency market, as it eliminates the need for them to purchase and store the underlying assets. This can be especially beneficial for investors who are not comfortable with the technical aspects of buying and holding cryptocurrencies, or for those who live in countries where it may be difficult to purchase digital assets directly.

E. Liquidity: Cryptocurrency ETFs are traded on stock exchanges, making them highly liquid. This means that investors can easily buy and sell shares in the ETF, providing them with greater flexibility and control over their investments.

Risks

A. Market Volatility: The cryptocurrency market is highly volatile, and the value of cryptocurrencies can fluctuate rapidly. This means that the price of a cryptocurrency ETF can also be highly volatile, and investors may experience significant losses.

B. Lack of Regulation: Cryptocurrencies are not widely regulated, and the regulatory environment for cryptocurrency ETFs is still evolving. This lack of regulation can increase the risk of fraud and market manipulation, and it may also make it more difficult for investors to recover their investments in the event of a loss.

C. Liquidity Risks: Although cryptocurrency ETFs are highly liquid, the liquidity of the underlying cryptocurrencies can be limited. This means that it may be difficult for investors to sell their shares in the ETF, particularly in the event of a market downturn.

Bitcoin ETFs

Bitcoin exchange-traded funds (ETFs) have gained popularity in recent years as investors look for ways to gain exposure to the cryptocurrency market. The popularity of bitcoin ETFs has increased as the price of bitcoin has risen, attracting a wider range of investors who are interested in the potential for high returns. Additionally, the introduction of regulated and reputable platforms for trading bitcoin ETFs has made it easier and more secure for investors to gain exposure to the cryptocurrency market.

However, despite the growing popularity of bitcoin ETFs, they are still a relatively new investment product and not yet widely adopted. Some investors remain hesitant to invest in bitcoin ETFs due to concerns about the high volatility of the cryptocurrency market, the lack of regulation, and the risk of security breaches.

Whether or not they become more widely popular will depend on a variety of factors, including the regulatory environment, the performance of the underlying asset, and the level of investor confidence in the product.

Some Bitcoin ETFs are

- Grayscale Bitcoin Trust (GBTC): GBTC is one of the largest and oldest Bitcoin ETFs, established in 2013. It holds physically settled Bitcoins and is traded on the OTCQX market.

- Purpose Bitcoin ETF (BTCC): BTCC is a Canadian-listed ETF that provides exposure to the price movement of Bitcoin. The fund is physically backed by Bitcoin and aims to provide an easy way for investors to gain exposure to the cryptocurrency.

- Evolve Bitcoin ETF (EBIT): EBIT is another Canadian-listed ETF that provides exposure to the price of Bitcoin. The ETF is designed to track the performance of the price of Bitcoin and is traded on the Toronto Stock Exchange.

- First Trust Bitcoin ETF (FBTD): FBTD is a US-listed ETF that provides exposure to Bitcoin. The ETF is designed to track the performance of the price of Bitcoin and is traded on the NYSE Arca exchange.

- VanEck Vectors Bitcoin ETF (BBTC): BBTC is a US-listed ETF that provides exposure to Bitcoin. The ETF is designed to track the performance of the price of Bitcoin and is traded on the NYSE Arca exchange.

- 3iQ Bitcoin Fund (QBTC): QBTC is a Canadian-listed ETF that provides exposure to Bitcoin. The ETF is designed to track the performance of the price of Bitcoin and is traded on the Toronto Stock Exchange.

- ETC Group Bitcoin Exchange Traded Crypto (BTCE): BTCE is a London-listed ETF that provides exposure to Bitcoin. The ETF is designed to track the performance of the price of Bitcoin and is traded on the London Stock Exchange.

- Amun Bitcoin ETF (ABTC): ABTC is a Swiss-listed ETF that provides exposure to Bitcoin. The ETF is designed to track the performance of the price of Bitcoin and is traded on the SIX Swiss Exchange.

- 21Shares Bitcoin ETF (ABTC): ABTC is a German-listed ETF that provides exposure to Bitcoin. The ETF is designed to track the performance of the price of Bitcoin and is traded on the Frankfurt Stock Exchange.

- BMO Bitcoin ETF (ZBTC): ZBTC is a Canadian-listed ETF that provides exposure to Bitcoin. The ETF is designed to track the performance of the price of Bitcoin and is traded on the Toronto Stock Exchange.

Bottomline

Cryptocurrency ETFs are a new and exciting investment opportunity for those looking to invest in the cryptocurrency market. They offer several benefits such as lower risk, easier access, and greater liquidity compared to traditional cryptocurrency investments. However, as with any investment, it’s important to conduct thorough research and understand the potential risks involved. It’s also recommended to consult with a financial advisor to determine if a cryptocurrency ETF is the right investment choice for you. With the growing popularity of cryptocurrencies, it’s clear that cryptocurrency ETFs are set to become an increasingly important player in the investment world.