1inch Price Prediction 2023-2032

- 1inch Price Prediction 2023 – up to $0.43

- 1inch Price Prediction 2026 – up to $1.45

- 1inch Price Prediction 2029 – up to $4.14

- 1inch Price Prediction 2032 – up to $12.33

Aiming to provide the best rates by discovering the most efficient swapping routes across all leading DEXes, 1inch collates and aggregates token prices across a range of decentralized exchanges to seek the best deals for clients. This 1inch Price Prediction will help you know more about the native token and the reasons for considering the coin for your portfolio.

Curious about how #1inch is performing across supported blockchains?

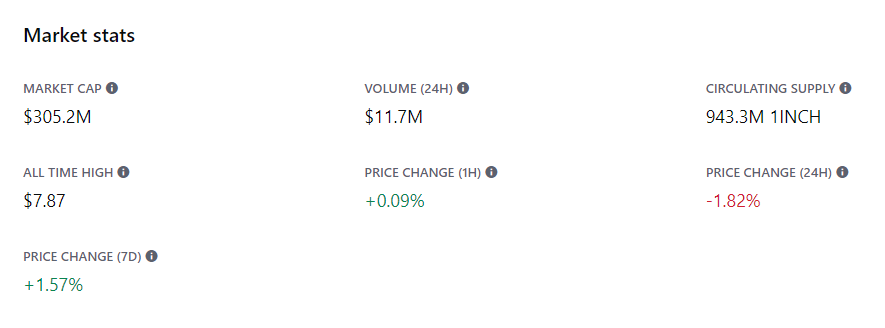

How much is 1INCH worth?

Today’s 1inch Network price is $0.323255 with a 24-hour trading volume of $11,737,236.. 1inch Network is down 1.95% in the last 24 hours. The current CoinMarketCap ranking is #101, with a live market cap of $304,940,500. It has a circulating supply of 943,344,379 1INCH coins and the maximum supply is not available.

1inch price analysis: 1INCH price declines after a bullish rally toward $0.35

TL; DR Breakdown

- 1INCH price experienced a solid recovery rally; however, bulls failed to hold bullish momentum

- Resistance for 1INCH is present at $0.336

- Support for 1INCH/USD is present at $0.312

The 1INCH price analysis confirms that bulls have managed to pull the 1INCH price above multiple Fib channels after the price broke above the consolidation pattern. However, after attaining a high near $0.33, 1INCH price met a correction and is currently on a downward trajectory.

1INCH price analysis 1-day chart: 1INCH/USD fails to hold bullish investors’ confidence

Analyzing the daily price chart of 1inch, 1INCH’s price witnessed a solid recovery rally yesterday. However, bulls failed to hold 1INCH price as it became a victim of intense bearish domination, breaking below the 23.6% Fib channel. The 24-hour volume has declined to $57.95K, showing a constant declining trading activity. 1INCH price is currently trading at $0.32, surging over 1.2% in the last 24 hours.

The RSI-14 (relative strength index) trend line trades just above the midline as it hovers around the 51 level, hinting that bullish power has not faded yet. The SMA-14 level is suggesting upward volatility in the next few hours.

1INCH/USD 4-hour price chart: 1INCH price recovers from EMA20

The 4-hour 1INCH technical analysis suggests that bulls are attempting to trigger an upward correction. The downward correction currently faces a slowdown as the 1INCH price makes a bullish reversal from EMA20 at $0.318.

The BoP indicator is trading in a bullish region at 0.5, bringing confidence among investors.

The MACD trend continues to form bullish candles above the signal line, and the indicator tends to surge to the North, bringing increased buying pressure near lower levels.

What to expect from 1INCH price analysis next?

The hourly price chart confirms that bulls are inducing buying pressure to hold the price above the bearish channel pattern. If 1INCH price holds its momentum above $0.336, it may skyrocket toward $0.379.

If bulls fail to initiate a surge, 1INCH price may drop below the immediate support line at $0.312, which may result in a correction to $0.289.

1INCH Price Predictions 2023-2032

Price Predictions By Cryptopolitan

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2023 | 0.38 | 0.39 | 0.43 |

| 2024 | 0.58 | 0.6 | 0.67 |

| 2025 | 0.83 | 0.86 | 1.01 |

| 2026 | 1.19 | 1.23 | 1.45 |

| 2027 | 1.69 | 1.75 | 2.05 |

| 2028 | 2.41 | 2.5 | 3.02 |

| 2029 | 3.47 | 3.6 | 4.14 |

| 2030 | 5.03 | 5.17 | 6.01 |

| 2031 | 7.12 | 7.37 | 8.87 |

| 2032 | 10.56 | 10.92 | 12.33 |

1inch Network Price Prediction 2023

The 1inch Network is expected to achieve a minimum value of $0.38 in 2023. The price of 1inch Network could potentially reach a maximum of $0.43, with an average price of $0.39 throughout the year.

1inch Network Price Prediction 2024

Based on our extensive technical analysis of past 1INCH crypto market data, the price of 1inch Network is projected to hit a minimum of $0.58 in 2024. The price could potentially reach a maximum of $0.67, with an average trading price of $0.60.

1INCH Price Forecast for 2025

The 1inch Network price is projected to reach a minimum price level of $0.83 in 2025. According to our analysis, the 1INCH price could reach a maximum price level of $1.01 with an average forecast price of $0.86.

1inch Network Price Prediction 2026

The future price points of the 1INCH network are optimistic. The 1inch Network is expected to reach a minimum value of $1.19 in 2026. The 1INCH price could potentially reach a maximum of $1.45, with an average of $1.23 throughout the year.

1inch Network Price Prediction 2027

Based on the forecast price and technical analysis, the price of 1inch Network is projected to hit a minimum of $1.69 in 2027. The price could potentially reach a maximum of $2.05, with an average trading price of $1.75.

1inch Network Price Prediction 2028

The 1inch Network is expected to achieve a minimum value of $2.41 in 2028. The 1inch Network price could potentially reach a maximum of $3.02, with an average of $2.50 throughout the year.

1inch Network Price Prediction 2029

The 1inch Network price is projected to reach the lowest possible level of $3.47 in 2029. According to our analysis, the 1INCH price could reach the maximum possible level of $4.14 with an average forecast price of $3.60.

1inch Network Price Forecast 2030

Based on the forecast and technical analysis, the price of 1inch Network is expected to hit a minimum of $5.03 in 2030. The price could potentially reach a maximum of $6.01, with an average value of $5.17.

1inch Network Price Prediction 2031

Based on our extensive technical analysis of past 1INCH data, the price of 1inch Network is projected to be around a minimum of $7.12 in 2031. The 1inch Network price could potentially reach a maximum of $8.87, with an average trading value of $7.37.

1inch Network Price Prediction 2032

The 1inch Network is expected to achieve a minimum value of $10.56 in 2032. The 1inch Network price could potentially reach a maximum of $12.33, with an average of $10.92 throughout the year.

1inch Price Prediction By Coincodex

Coincodex’s 1inch price prediction forecasts a decrease in its value by -10.42%, reaching $0.288438 by July 7, 2023. Coincodex’s technical indicators suggest a Bearish sentiment, with the Fear & Greed Index displaying a score of 63, indicating Greed. Over the past 30 days, the 1inch Network Token has seen 17 out of 30 green days (57%) with a price volatility of 10.53%. Based on Coincodex’s forecast for the 1inch Network Token, they advise that it’s currently not a favorable time to purchase the token.

In the most optimistic scenario, if 1INCH follows the growth pattern of Facebook, its price could reach $19.68 by the year 2026. However, if 1inch Network Token mirrors the growth of the Internet, its predicted value for 2026 would be $2.26.

1inch Price Prediction By DigitalCoinPrice

DigitalCoinPrice gives a bullish analysis of the 1inch price prediction. The website expects 1inch token to trade above the level of $0.72 in 2024. By the end of the year, 1inch Network is predicted to reach a minimum value of $0.68. In addition, the 1INCH price may attain a maximum level of $0.74.

In 2032, the 1inch network is predicted to surpass the level of $6.06. By the end of the year, 1inch Network is projected to reach a minimum value of $6.01. In addition, the 1INCH price may secure a maximum level of $6.08.

1inch Network Price Prediction By CryptoPredictions.com

Cryptopredictions.com’s 1inch price forecast states that the token may begin trading in August with a price of approximately $0.527 and conclude at a remarkable $0.413. Throughout the month, the 1INCH token is projected to reach a peak price of $0.6, while its lowest value is anticipated to be around $0.4.

1inch Price Prediction By Market Sentiment

The potential future success of 1inch is contingent on its capacity to evolve and broaden its services to meet the dynamic needs of the DeFi ecosystem. As the market sees an influx of innovative DEXs, the necessity for effective exchange aggregation will only intensify, further cementing 1inch’s role in the industry. The token had already hit significant milestones, with 1inch announcing a notable achievement of amassing 1.5 million users on the Polygon network, which strengthened the token’s value.

Based on its price history and current performance, market analysts have varying predictions for the 1inch token, with Alt Sherpa forecasting a surge to $5 this year due to its strong fundamentals, while others anticipate a bearish trend leading to a value of $0.01 by the end of 2023.

1inch Overview

The price of 1inch has risen by 1.57% in the past 7 days. The price declined by 1.82% in the last 24 hours. In just the past hour, the price grew by 0.09%. The current price is $0.32 per 1INCH. 1inch is 95.89% below the all-time high of $7.87.

1inch Price History

The 1inch DEX aggregator searches through several decentralized cryptocurrency exchanges to allow both experienced and inexperienced DeFi users to find the most advantageous exchange for their tokens. The network’s name is a monicker from Bruce Lee’s legendary “one-inch punch” martial arts technique, a model of efficiency, to establish the crypto project’s efficient structure in optimizing searches, results, and, ultimately, profits

In 2021, two years after its inception, 1inch Network had already exceeded a cumulative trading volume of $85.8 billion. It expanded to four new networks and integrated over 120 decentralized exchanges, thus creating the most significant liquidity in DeFi.

In April, the 1inch iOS wallet was released. It’s an all-in-one mobile platform with a user-friendly interface that includes secure storage, transaction, and even staking functions. It provides the same functions as the desktop version.

By the end of 2021, the number of wallets interacting with 1inch Network on Ethereum had already hit one million, and over 600,000 between Polygon and Binance Smart Chain, for a total of $134 billion in volume. One of the main challenges the crypto space will have to resolve is the Ethereum gas price. 1inch Network co-founder Sergej Kunz revealed to Cointelegraph that they expect a fix to the issue with “layer-2 solutions and people moving to other solutions like the Binance Smart Chain, for example.”

In December, 1inch concluded a series B investment round led by crypto-finance company Amber Group for $175 million to expand the network utility and allow liquidity access to the decentralized finance market.

In 2021, 1inch Network also introduced the 1inch Network DAO Treasury, a decentralized organization that governs the network parameters enabling 1inch holders to vote for key protocol and collect governance rewards

At the beginning of 2022, the 1inch network hit 1.6 million total users, 11.7 million trades, and five supported networks, including Ethereum, Binance Smart Chain, Polygon, Optimistic Ethereum, and Arbitrum. $120 billion in total trading volume was recorded on the Ethereum Network, placing 1inch Network among the top 10 decentralized exchanges in terms of volume.

Observers expect Anton to focus on growing DeFi crypto assets and expand into Web3 tools such as GameFi, NFTs, play-to-earn and the metaverse, starting with the DeFi Racer game. To further expand its presence in DeFi, the company has launched the 1inch Aggregation Protocol and the 1inch Limit Order Protocol on Avalanche and Gnosis Chain, formerly known as the xDai Chain.

Recent News on 1inch

@SchorNatalia, Community and Grants at 1inch, participated in Online #Web3 Startup Pitch Roast by @humanfromweb3_ on June 29

Achievements

- 1inch reached 17M in total swap count on #BNBChain

- The number of unique monthly wallets that use #1inch crossed the 1M mark

- 1inch joined @Crypto_Dep‘s top of 10 #dApps by 30d volume with a result of $5.11

More on the 1inch Network

What is 1inch?

1inch is the utility token for the 1inch network. 1inch is a DEX aggregator. 1inch exchange is developed to ease and convenience for DeFi users to obtain better services within the DeFi space.

An aggregator like 1inch derives its liquidity from several other DEXs and pools them into one platform. The pooling allows the DEX aggregator to offer its users the best swapping rates possible, beating all the individual DEX platforms like Uniswap and Sushiswap due to its vast liquidity provider pool.

Additionally, 1inch has undergone tremendous changes in its core over the years, and today, the platform embraces the Decentralized Autonomous Organization model.

The DAO model allows 1inch users to be more involved in shaping up the future direction 1inch, giving investors a significant level of control that isn’t available on other platforms.

1inch was launched in 2020 and has since realized impressive gains. It serves as the utility token for the 1inch platform, and holders use it to vote within the DAO model.

The liquidity pools created by the aggregation model ensure that 1inch stays ahead of other regular DEX platforms indicating that the future is bright, and investors are beginning to consider it as a good investment.

Who owns 1 inch crypto?

Anton Bukov is an experienced software developer and entrepreneur who co-founded 1inch Network in 2019 after becoming passionate about blockchain and cryptocurrencies. He has a degree in cryptography and developed a TCP/IP OS stack equivalent and a C-style language compiler. He co-founded 1inch Network in 2019 with Sergej Kunz, another software engineer. During a New York City hackathon, they had developed a prototype of a decentralized exchange aggregator that became the foundation of 1inch Network.

Applications of 1inch

The 1inch network uses multiple protocols, and the synergy of these protocols ensures fast and protected operations in the DeFi space.

- Aggregation Protocol: This protocol sources liquidity from various exchanges and splits a single trade across multiple exchanges to offer the best rates. The core of this protocol is the V3 smart contract, which performs runtime verification of transactions. The aggregation protocol uses the pathfinder algorithm for finding the best paths across multiple markets in less than a second. The pathfinder algorithm finds routes across over 60 Ethereum liquidity sources, more than 30 Binance liquidity sources, and 30+ polygon and optimistic Ethereum liquidity sources.

- Liquidity Protocol: This is an automated market maker (AMM) that allows users to automatically trade their assets using liquidity pools. The liquidity protocol provides liquidity to the pools and enables users to participate in liquidity mining programs to earn rewards.

- Limit Order Protocol: This protocol facilitates an innovative and flexible limit order functionality. The protocol features no fees, dynamic pricing based on demand and supply, conditional execution of orders, and multichain support and fulfills requests for quotations. Furthermore, the protocol implements stop-loss orders, trailing stop orders, and auctions, making the protocol very flexible.

According to the website, 1INCH is the native token of the network. 1INCH is an Ethereum token that serves as a governance token and a utility token. The token is used in the governance modules of the aggregation protocol and the liquidity protocol. 1inch DAO is the decentralized organization that governs the network parameters and enables the 1Inch token holders to vote for protocol parameters and collect rewards. Besides, the 1INCH token is the network’s cryptocurrency and can be traded on many exchanges like Coinbase.

Is 1inch safe?

1inch Network maintains a strict focus on the prevention of security issues, ensuring all users’ funds and transactions are safe. 1inch smart contracts have been audited by leading audit teams in the industry such as OpenZeppelin, Consensys diligence, SlowMist, Haechi Labs, Coinfabrik, Certik, Hacken, Scott Bigelow, Mix Bytes and Chainsulting.

See the full list of all 1inch Network protocol audits here.

In addition to protocol audits, 1inch Network is also 100% non-custodial, meaning that the user’s funds are not held by the protocol or platform.

Conclusion

The 1inch roadmap includes several feature upgrades as it continues to gain popularity. Some somewhat convincing arguments for holding the 1inch token at this time are shown by an initial deep dive into the network’s innovation. According to the 1inch prediction, these coins will reach their all-time high in 2031.

Since its inception, the 1inch ecosystem has attracted investors thanks to a thriving community and the arbitrage opportunities it offers to investors. Since the token has a low price relative to the total quantity in circulation, traders may purchase a big 1inch with a relatively modest investment.

Remember that your decision should be based on your comfort level with losing money, risk tolerance, market knowledge, portfolio spread, and other factors. Never forget that investing in cryptocurrencies may be quite risky, and past success is no guarantee of future results. Defi initiatives like 1inch are also vulnerable to assaults from malicious actors that exploit system flaws. 1inch’s cryptocurrency research and forecast do not constitute investment advice. Never risk more money than you can afford to lose on anything, and do your own research.

The 1inch ecosystem has continued to draw investors since its launch with a growing community and the arbitrage opportunities it provides to investors. Traders can acquire a large 1inch with a relatively small investment, given that the token has a small price from the total circulating supply.

1inch token is likely to continue soaring in the future with collaboration from other DeFi protocols. As the DeFi industry matures, 1inch is expected to play a leading role and could be worth over $27.12 by 2032. The staking program will also attract more investors in the coming years.

Remember that your pick should depend on your risk tolerance, market expertise, portfolio spread, and how comfortable you are with losing money. Always keep in mind that cryptocurrencies are very volatile investments, and previous performance is no guarantee of future outcomes. Never put more money into something than you can afford to lose.

Defi projects like 1inch are also prone to attacks by bad actors who take advantage of vulnerabilities in the system. 1inch crypto analysis and prediction are not investment advice.

Also Read:

- 1Inch Price Analysis: 1INCH falls below support at $2.95, a bearish retracement to follow?

- 1inch debuts on Avalanche and xDai Chain

- Best crypto exchanges for US residents: How to choose the best